Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

With the total amount of outstanding student debt approaching $1 trillion, the plight of debt-straddled college students is more pressing than ever.

In the past 30 years, not only has the number of high school graduates enrolled in four-year universities increased by 11%, but college tuition has soared over 200%. As more students attend college at a cost higher than ever before, millennials have increasingly turned to loans to help finance their education. While much of the college debt dialogue concerns immediate issues like employment and repayment, there is another glaring challenge for graduates: retirement.

When will students be able to retire, given that many are spending the first 10 or more years of their careers paying off loans? NerdWallet conducted a study that examined the financial profile of a typical college graduate. We found that while retirement is certainly not impossible, for most millennials it will have to wait until their early- to mid-70s — more than a decade beyond the current average retirement age of 61.

Key takeaways

Most of today’s college grads won’t be able to retire until 73 due to high debt load — 12 years later than the current average retirement age.

Given a life expectancy of 84, today's grads will only have about 11 years to enjoy retirement.

The median debt load of $23,300 will cost students over $115,000 (in today’s dollars) by the time they retire.

Employer 401(k) matches are crucial, and will make up 50% of retirement savings.

Quick facts on students and debt

Here are some quick facts to give context on what students are grappling with.

Median debt for a student upon graduation: $23,300

Percentage of students who are unemployed at graduation: 18%

The median starting salary for those who do have jobs: $45,327

Standard loan repayment plan: 10 years

Average yearly loan repayment: $2,858

Number of college graduates currently estimated to be in default: over 7 million

$23,300 in loans costs $115,096 by retirement

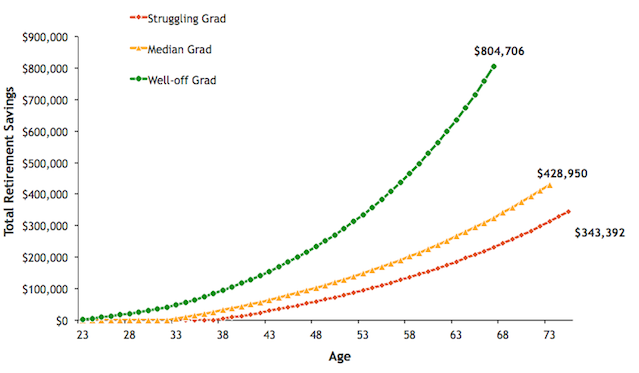

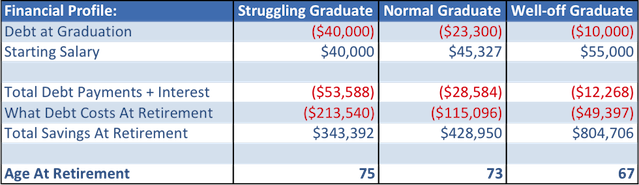

The goal of the NerdWallet study was to make realistic retirement projections that applied to a broad range of students. The study compared three different financial profiles: the median graduate, with median debt and salary; the struggling graduate, with high debt and a below-average salary; and well-off graduate, with low debt and an above-average salary.

Graduate Retirement Outcomes

Student debt has a clear impact on retirement outcomes. Currently, the average retirement age is 61. But for most of today’s college grads, a realistic retirement age will be closer to the mid-70s. Given an average life expectancy of 84, this will leave only 10 to 12 years to spend in retirement.

A key factor: Although the median college graduate leaves school with a seemingly manageable $23,300 debt load, 7% of a student’s earnings go toward yearly loan payments of $2,858 for the first 10 years of his or her career. This precludes any meaningful contributions toward retirement. In fact, by the age of 33, when the typical college grad has finally paid off a standard 10-year loan, he or she can only be expected to have saved $2,466 for retirement — some $30,000 less than if the student had graduated debt-free. Even worse, the missed savings carry a serious opportunity cost, as this money would have been earning a compounded rate of return every year until retirement. At the projected retirement age of 73, the lost savings directly attributable to student debt is $115,096, nearly 28% of total retirement savings.

Surprisingly, the projected retirement outcome isn’t dramatically different for the struggling grad. Despite having nearly twice as much debt and starting with 10% less pay, the expected retirement age is 75, just two years later than the median case. The main reason for this is Social Security, whose viability by the time millennials retire has been the subject of much debate. Social Security benefits are factored conservatively into the study at $11,070 (75% of current average) per year beginning at age 67. That said, a substantial reduction in benefits or the disappearance of the program altogether would significantly alter the retirement equation. If the current Social Security payouts were to remain unchanged for the next 50 years, the benefits would provide future retirees a significant boost by accounting for nearly 15% of their required yearly income in retirement.

Well-Off Grads Retire Seven Years Earlier

The retirement prospects for the well-off grad are significantly better than for the others, as illustrated in the graph above. By graduating with a reduced debt load and landing a job that pays 22% more, the well-off grad can expect to retire at age 67. This demonstrates the importance of contributing to a retirement plan early in one’s career. Compared to the median grad, the extra $40,406 that the well-off graduate is able to contribute during the first 10 years of his or her career results in a $446,452 difference in retirement savings by age 73.

So how do you beat the odds?

Given these circumstances, should students resign themselves to an eternity of work with little to look forward to in their later years? Not necessarily. Though a rising retirement age does appear to be an inevitable economic reality, being conscious of this problem and tailoring financial and career planning accordingly can go a long way toward achieving retirement objectives. There are many factors that influence the age at which people are able to retire, but there are a few variables that have a particularly large impact. Making above-average yearly contributions to a retirement account, working for an organization with a decent 401(k) match and investing in index-tracking mutual funds are three ways to help add years to retirement.

Make above-average contributions to retirement accounts

While working for a generous employer can do wonders for retirement, not everyone can be so selective about whom to work for. Another important component of retirement planning is the yearly contribution rate. Making above-average contributions can significantly improve retirement outcomes. Though the study projects a 6% annual post-tax contribution (the average personal savings rate for Americans), increasing that number to 10% lowers the expected age of retirement from 73 to 69.

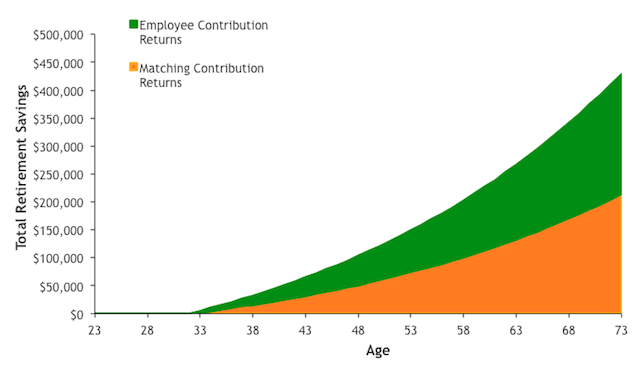

Employer 401(k) match is crucial

As fewer and fewer companies offer defined benefit plans, millennials will have to depend upon employer 401(k) plans to save for retirement. According to a recent Fidelity survey, the current median yearly matching contribution is $3,420. As shown below, these employer contributions are expected to make up roughly 50% of the retirement equation for millennials. By working for a company that offers a yearly matching contribution of $4,420 — $1,000 more than the median — potential retirees can lower their expected retirement age by up to three years.

401(k) Match Makes Up Half of Retirement Savings

Invest in index funds

Contributing money toward retirement won’t be helpful if the money just sits in a savings account or CD. To earn a return, millennials must be willing to take some risk and construct an equity-oriented portfolio. This may be difficult for today’s grads, who have seen the stock market seemingly implode every five years; but retirement will be impossible if funds are invested too conservatively. The study assumed a 6% yearly return on retirement savings, a conservative figure given the historical performance of the market. That said, it is a rate of return that can’t be achieved without some equity exposure. The best way for an individual to overcome this problem is by investing in index-tracking mutual funds, which will offer a market return and low fees.

Retirement isn’t hopeless, but it will be difficult

Far more than their parents, millennials will have to rely upon proactive financial management to achieve retirement goals. Each generation has its own distinctive financial challenges, but the burden of college debt is unique thus far to millennials. The decline of pension plans, the uncertainty surrounding Social Security and the college debt epidemic have placed the onus on graduates to make conscious, forward-thinking decisions about retirement.

on Capitalize's website

Methodology

Future retirement statistics were projected by profiling three potential types of retireed: the median graduate, with median student debt and median starting salary; the struggling graduate, with a high debt load and a below-average salary; and the well-off graduate, with a low debt load and an above-average salary. The study factored in a range of other relevant variables to create the projections, including average 2012 Social Security benefit, average 2012 401(k) match, 30-year average national salary growth rate, 30-year average inflation rate, 30-year annualized S&P 500 returns, life expectancy, 30-year average personal savings rate, 2012 Stafford loan interest rates and standard loan repayment terms.

All projected figures are inflation-adjusted and discounted back to 2013 dollar-terms.

Data sources:

Bureau of Economic Analysis Bureau of Labor Statistics Fidelity Investments National Association of Colleges and Employers New York Federal Reserve Pew Research Center Social Security Administration World Bank Consumer Financial Protection Bureau

More From NerdWallet: