Cash App: What It Is and How It Works

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Table of Contents

- What is Cash App?

- How does Cash App work?

- How to add money to Cash App

- How to send money with Cash App

- How to receive or deposit money with Cash App

- How to withdraw money from Cash App

- Cash App debit card

- Cash App fees

- Cash App limits

- Cash App benefits: What makes it different from other P2P apps

- Cash App drawbacks: What to know

ALSO CONSIDER: PayPal || Venmo || Zelle || Apple Pay Cash || Top P2P payment apps

As more people embrace the convenience of cashlessness and contactless payment, tech companies have made it easier to send and receive money instantaneously from a smartphone. Cash App, one of these services, offers some unique functions compared with other money transfer options, including options for savings and investing.

Read on to learn more about Cash App and its features, benefits and possible drawbacks.

» COMPARE: See NerdWallet's top peer-to-peer payment apps

What is Cash App?

Cash App is a financial services platform. Cash App offers peer-to-peer money transfer service from Block Inc. that allows users to send and receive money. This service can help you send your share of utilities to your roommates, pay friends back for coffee, split the cost of a trip or any other money-sending task you want to accomplish with other Cash App users.

Cash App has branched out from just money transfers. It now also offers:

The ability for users ages 13 and up to invest money in stocks through Cash App Investing.

The option to buy and sell Bitcoin.

Free tax filing with Cash App Taxes.

A savings feature — Cash App Savings.

» Skip ahead to read more about Cash App Investing, Cash App Taxes or Cash App Savings.

How does Cash App work?

Cash App works on your smartphone (though you can do some functions through a web browser). To use Cash app, you need to sign up for an account. You can do that through a browser or by downloading the app to your smartphone. Once you have an account, connect a funding source (such as a bank account or debit card) and you’re ready to send and receive money with people you know and trust, and explore the app’s other services.

How to add money to Cash App

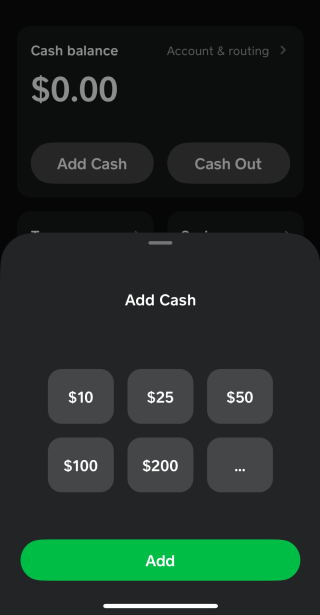

To use Cash App to send payments, you need a bank account, debit card, credit card or prepaid card. You load money on Cash App by tapping the Money tab in the app’s home screen, tapping “Add Cash” and inputting how much cash you’d like to add from your linked account.

You’ll then need to confirm the transaction by entering your PIN for the app or by using a biometric ID.

How to send money with Cash App

You’ll be able to use your linked bank account, debit card or other funding source to send money to other Cash App users, as well as to transfer money from your Cash App account into your bank account. This function is similar to services like Venmo and PayPal, which also allow you to link a bank account to send money; you can also hold any received funds in the app until you’re ready to withdraw them.

» Want a great checking account? Consider NerdWallet's Best Online Checking Accounts

To send a payment:

Open the Cash App mobile app.

Enter the amount you want to send.

Tap “Pay.”

Enter the email address, phone number or “$Cashtag” (another person’s username in the app).

Enter what you are sending the payment for.

Tap “Pay.”

You should send money only to people you know and trust. Before using money transfer apps, learn other tips to avoid P2P scams.

How to receive or deposit money with Cash App

To view the details of a received payment, tap the “Activity” button. You’ll also see the total amount of your Cash App balance at the bottom left of the app home screen.

You can also fill out a form to get your paycheck directly deposited into your Cash App account and deposit physical cash into your account at participating retailers for a fee.

» ALSO CONSIDER: NerdWallet's review of Zelle money transfer

How to withdraw money from Cash App

If you have the Cash App debit card, you can use it to make withdrawals at an ATM. Withdrawals are free at in-network ATMs and $2.50 each (plus ATM operator fees) at out-of-network machines. You can earn one instant out-of-network ATM fee reimbursement every 31 days by having paycheck direct deposits totaling at least $300 in the calendar month.

You can also cash out your app balance and have the funds transferred to a bank or debit card linked to your Cash App account.

Cash App debit card

Optional free debit card. The “Cash Card” allows users to make transactions. The card is issued by Sutton Bank and is unique to a user’s Cash App account. It isn’t connected to a personal bank account or another debit card.

Free ATM withdrawals with direct deposit. If you set up your account to receive direct deposits, ATM withdrawals won’t cost you a fee. Otherwise the fee is $2.50 to use an ATM to make a withdrawal with a Cash Card. (Note: You can’t deposit cash at an ATM with your Cash Card; cash deposits can only be made at participating retailers.)

Money-saving offers when using the debit card. Users who have the Cash Card can choose offers in their account that allow them to save money on a purchase with a particular vendor (for example, a certain amount off your total bill at a restaurant). Only one offer is allowed to be active at a time, but you can swap offers as often as you want.

Cash App fees

No fees on basic services. Cash App doesn’t charge monthly fees, fees to send or receive money (unless you’re sending from a credit card), inactivity fees or foreign transaction fees.

Fee for using a credit card. Cash App charges 3% of the transaction to send money via a linked credit card. This is a fairly standard fee compared with other money transfer apps; Venmo, for example, also charges 3% to send money with a linked credit card. To avoid this fee altogether, use your linked bank account or the funds in your Cash App account to send money.

Fee for instant deposits of Cash App funds to your bank account. You’ll pay 0.50% to 1.75% of your total transfer to have your funds transferred immediately. There’s no fee to deposit your Cash App funds to your linked account with a standard transfer, which takes one to three business days.

Cash App limits

Cash Card spending limits. The maximum that can be spent on your Cash Card is $7,000 per transaction and per day and $10,000 per week. The maximum that can be spent per month is $25,000.

Cash Card withdrawal limits. The maximum amount that can be withdrawn at an ATM or store register cash-back transaction is $1,000 per transaction, $1,000 per day and $1,000 per week.

Cash App age limits. People 13 years and older can use the app. Cash App users 17 and younger must have an adult sponsor their account to use some features.

Cash App benefits: What makes it different from other P2P apps

Cash App Savings. The new Cash App savings feature doesn’t charge a fee. You must have a Cash Card and an opening deposit of at least $1 (though if you use the roundup feature to open your account, you can open a savings account less). The account offers a competitive interest rate of 4.50% as long as you meet a few other requirements: In addition to having a Cash Card, you must be at least 18 years old and have at least $300 in direct deposits each month. If the requirements aren’t met, the account earns 1.50%.

» Learn more about Cash App’s high-yield savings account

Cash bonus when friends join by using your referral code. If you send a referral code to your friends and they sign up for Cash App using your link, then you receive a cash bonus per friend who signs up.

Cash App Investing. Cash App offers the ability to invest. The app allows users to buy stock in specific companies with as little or as much money as they want to invest. Stocks can be purchased with the funds in your Cash App account; if you don’t have enough funds in the app, then the remaining amount will be taken from your linked bank account.

Cash App Taxes. The app offers a free tax-filing service that it guarantees to be completely accurate. If you choose to have your refund deposited to your Cash App account, you could receive your return up to five days faster than you would with a bank account deposit. (Refer to the FDIC insurance information for Cash App funds.)

» Prepping for April 15? See NerdWallet’s guide to how to file taxes

Bitcoin compatible. Cash App users can buy and sell Bitcoin, but Cash App might charge a fee, which you’ll see before you complete the transaction. Depending on how quickly you choose to receive deposits of Bitcoin you withdraw, you may be charged a fee for withdrawals, too.

» ALSO SEE: Our guide to Bitcoin for beginners

Cash App drawbacks: What to know

.Your funds aren’t automatically FDIC-insured. You must have a Cash Card or a sponsored account to get Federal Deposit Insurance Corp. insurance coverage. If you don’t have either of those, the money in your cash app balance is not insured and it’s a good idea to transfer your funds to your FDIC-insured bank.

Fees may apply. Cash App charges 3% of the transaction amount when you send money using a linked credit card, which is similar to what other money transfer apps charge. Immediate transfers to your bank account also cost a fee. (Refer to the Cash App fees information above for more details.)

⏰ Limited-time offer

SoFi Checking and Savings

NerdWallet rating

4.5

/5

Bonus

$400

Limited-time offer

at SoFi Bank, N.A., Member FDIC

Don’t miss out on a bigger bonus

Get a NerdWallet-exclusive bonus of up to $400 when you open an account and hit $5,000 in direct deposits within 25 days after your first one. That’s $100 more than SoFi’s normal $300 bonus! Select "Learn More" to get started. Expires 4/22/24. Terms apply.

On a similar note...

⏰ Limited-time offer

4.60%

With $0 min. balance for APY

$400

Limited-time offer

Up to $300 cash and $100 in rewards points. Terms apply.