5 Ways to Brace Your Budget for Any Big Disruption

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Whether it’s a nationwide recession, worldwide crisis or a personal event, it can feel like tough times are never far away.

It’s a good idea to start thinking about how to stabilize your finances now so they can be a safety net in your time of need.

How to make your budget resilient

You can’t always control how much time you have to prepare for a financial crisis. The key is to work strategically with the time and resources you have to safeguard your budget as best you can.

Here are some tips for how to brace your budget for a major financial disruption.

1. Make or fine-tune your budget

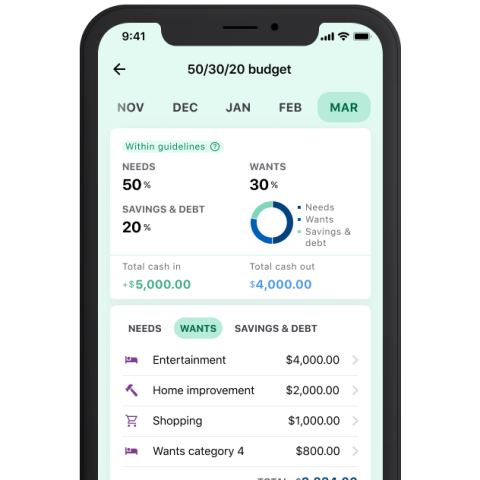

To prepare for an emergency, isolate your necessary expenses so you know what your bare minimum budget should be. A 50/30/20 budget framework is a good way to start thinking about what’s necessary and what you can cut if needed.

“When it comes to expenses, we usually don’t go back far enough,” says Kia McCallister-Young, the director of America Saves, a nonprofit organization and an initiative of the Consumer Federation of America. Only looking at your last few statements can cause you to leave out annual expenses. McCallister-Young recommends going back a full year and examining all your statements, including those from your bank and other bill pay apps.

If you’re in a crisis now: Make a list of expenses you can cut — things like cable or streaming subscriptions, meal services, eating out and shopping. Contact these providers to cancel immediately.

2. Create or bulk up your emergency fund

Ideally, you should have or be working toward an emergency fund that holds three to six months of necessary expenses. However, “three to six months in expenses is very overwhelming, and for some people unattainable as well, especially if you’re not earning a living wage,” says McCallister-Young.

She recommends starting with an attainable goal and automating your savings, either through direct deposit or through your bank. Even $10 a week is a good starting point. “Saving is a habit, not a destination,” says McCallister-Young.

Storing your emergency fund in a high-yield savings account is a good idea because it’s easy to access and also will be earning interest with each passing month, helping you reach your goal faster.

If you’re in a crisis now: It can feel scary to pull money from your emergency fund, but don’t be afraid. “You don’t have to feel bad about the fact that you are using the savings that you have created,” says McCallister-Young. “It’s supposed to be there to help you.” If you don’t have an emergency fund, though, reach out to your community resources.

3. Research assistance in your area

Knowing where to turn in a financial crisis can be a challenge because you might be feeling panic or shame. McCallister-Young recommends finding a “community of support that can lift you up and can tell you where you should go” in a time of need.

Plugging into these community resources ahead of an emergency can be helpful. Consider joining online neighborhood groups, following the social media pages of local nonprofits and identifying food banks in your area.

If you’re in a crisis now: Start your internet search with 211.org for confidential help from experts on everything from finding food to mental health assistance. From there, reach out to your community of support to find local food banks or identify community groups or nonprofits that can help pay your bills.

4. Pay down your debt

One of the ways you can set yourself up to survive a financial crisis is to have as little debt as possible. Big disruptions are likely to make it harder to pay your bills, and accruing interest will only make digging out of your circumstance harder.

To prepare for an emergency, start paying down credit card and other debt now. If it’s a recession you’re worried about, focus on paying down debt with the highest interest rates.

If you’re in a crisis now: Contact lenders to discuss payment options. For example, a lender might be able to put you on a payment plan to spread out costs into more manageable chunks or temporarily lower your interest rate.

5. Bolster your credit score

The best way to protect your credit during a financial disruption is to make on-time payments and keep your credit utilization as low as possible. However, this might be difficult, especially if you’re operating off of a reduced income and need your credit cards to supplement your monthly expenses.

You have some options when it comes to handling your debts, explains Melinda Opperman, chief external affairs officer at Credit.org. If you have time to prepare, “call your lender to ask if they offer a concession like a lower interest rate or a deferred payment,” she says. The only risk, according to Opperman, is that your lender might lower your credit limit, causing your credit utilization ratio to increase. This could harm your score until you are able to pay down the balance.

You also might consider using a balance transfer or 0% APR credit card to take some of the pressure off. Just pay attention to the fine print, especially when it comes to transfer fees and repayment terms, which are typically around 18 months, says Opperman.

If you're in a crisis now: One way to weather a financial storm is to make on-time payments, but consider only paying the minimum balance, says Opperman. While it will temporarily increase your debt load, especially if you’re used to paying your balance in full each month, paying the minimum for a short time can help you get through a tough time while recording on-time payments, which is a huge factor in calculating your credit score.

The thing to note about your credit score is that it’s not typically directly impacted by a recession or personal financial crisis.

“A credit score doesn’t reflect your income, wealth or current financial situation,” says Opperman. “It’s a measure of how you handle your debts.”

on Capitalize's website