Most Americans Have a Monthly Budget, but Many Still Overspend

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

According to a new survey from NerdWallet, 84% of Americans with a monthly budget say they've sometimes exceeded their budget. The survey, conducted online by The Harris Poll on March 31-April 4, 2023, among more than 2,000 U.S. adults ages 18 and older, found that around three-quarters (74%) of Americans have a monthly budget.

Key findings

Most Americans overspend, and many use credit cards to cover it. The survey found that 83% of Americans say they overspend, and a similar proportion who have a monthly budget (84%) say they exceed it. Of those who’ve ever gone over their monthly budget, 44% say they usually use a credit card to pay for the additional purchases they make when going over budget.

Youngest U.S. adults are more likely to say their generation has it worse. Nearly 1 in 5 Americans (18%) think their generation is bad at managing money and nearly 3 in 5 Americans (57%) think their generation has had a harder time making ends meet than any other generation, the survey finds. Younger Americans are more likely to make each of these assertions.

Emergency savings is a financial priority for many. Close to half of Americans (48%) say they want to prioritize emergency savings, according to the survey. Other popular financial priorities for Americans are investments (36%) and retirement planning (35%).

“Savings accounts offer a buffer against life’s unexpected twists, from job loss to unplanned expenses,” says Kimberly Palmer, a personal finance expert at NerdWallet. “Funding one can make the difference between relative financial stability or being unable to pay for everyday essentials.”

An emergency fund is a top priority for nearly half of Americans

Most Americans (92%) have one or more financial areas they want to prioritize. The most common of these priorities is emergency savings (48%), followed by investments (36%) and retirement planning (35%).

Millennials (ages 27-42) and Generation Xers (ages 43-58) are the most likely to say they want to prioritize emergency savings, with 56% and 52%, respectively, saying it is a desired area of focus. That's compared with 38% of Generation Zers (ages 18-26) and 44% of baby boomers (ages 59-77).

Many Americans have very little emergency savings socked away. According to 2022 Consumer Financial Protection Bureau data, 24% of Americans have no emergency savings, and an additional 39% have less than one month's income saved.

After emergency savings, investments (36%), retirement planning (35%), budgeting (34%) and travel savings (34%) rounded out the top five financial priorities. Americans with an annual household income of $100,000 or more want to prioritize investments (48%) and retirement planning (47%) at a much higher rate.

For parents of children under 18, priorities vary, perhaps to account for their children. For instance, holiday savings is a focus for 37% of those parents, compared with 18% of those without children under 18. Similar differences appeared for saving for a home (38% versus 17%) and saving for education expenses (29% versus 8%).

Many common educational savings plans can help savers by giving them some tax advantage. Parents and grandparents can make their educational dollars go further by taking advantage of these plans.

Millennials (36%) and Gen Xers (37%) are more likely to say they want to prioritize paying off credit card debt. Just 29% of boomers and 22% of Gen Zers want to prioritize credit card payments.

What you can do: Set a financial goal or priority if you haven’t yet

If you're in the 8% of Americans who don’t have a financial area they want to prioritize, now is the time to set your financial goals. Think of it as a spring cleaning for your finances and a way to get yourself set up not just for the rest of the year, but also for the rest of your life.

“Setting clear financial goals makes it easier to determine the small action steps we need to take in order to make them a reality. That could include opening up a new savings account or contributing more to retirement,” Palmer says.

Overspending is common, despite monthly budgeting

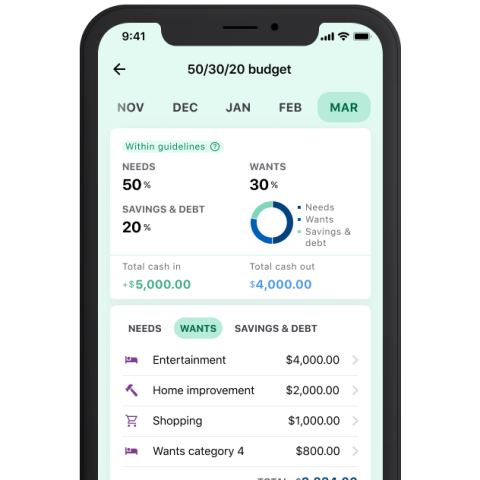

Nearly three-quarters of Americans (74%) have a monthly budget. Millennials are most likely to say this — 83%, versus 76% of Gen Zers, 74% of Gen Xers and 67% of baby boomers.

Some Americans are willing to go without a budget. Just 23% of Americans say they feel like they need a budget to get by every month. Boomers are the least likely to need that support. Only 13% feel they need a budget to get by compared with 32% of Gen Zers, 29% of millennials, and 26% of Gen Xers.

A budget isn’t necessarily the solution to overspending. While close to a third of Americans (32%) say they review their budget and spending on a regular basis, 16% say they often spend more than they budget for each month. And when the money isn’t in the budget, it still has to come from somewhere.

Going over budget is nearly universal

According to the survey, of Americans who have a monthly budget, 84% say they’ve gone over budget at some point. More than 2 in 5 of those who have gone over budget (44%) say they usually pay for additional purchases they make with a credit card.

A majority of Americans (83%) say they overspend, at least sometimes. Food is a major reason for overspending — nearly half of Americans (47%) say groceries are among the spending categories they find themselves overspending on most often each month, while 34% say the same about dining out.

Inflation is likely a contributing factor. Over the past year, the cost of food at home has increased by 8.4% and food away from home has increased by 8.8%, as of March 2023, according to the U.S. Bureau of Labor Statistics.

Holding on to the budgetary reins

About 1 in 6 Americans (17%) say they don’t overspend on any products or services each month. Baby boomers are most likely to make this assertion — 31%, versus 14% of Gen Xers and 7% each of millennials and Gen Zers. Interestingly, baby boomers (67%) are least likely to have a monthly budget, and millennials (83%), who are in their peak earning years, are the most likely to have a budget (compared with 76% of Gen Zers and 74% of Gen Xers).

There's also a subset of Americans who plan to overspend and set savings aside for it. One in 5 Americans (20%) who have gone over their monthly budget say they've dipped into savings specifically earmarked for overspending to pay for additional expenses.

What you can do: Take steps to avoid overspending

There are expenses where many could find themselves with no choice but to overspend, such as for medical costs, food when prices jump, or any number of necessities when a breadwinner gets laid off or switches jobs.

That just means it's even more important to plan for the things you can control. Almost 1 in 4 Americans (24%) say they've often overspent on entertainment streaming services. There are plenty of ways to resist the urge to overspend on those products and services, which will hopefully leave more in the bank for unavoidable events.

Generational beliefs about finances differ

Every generation has its challenges, but not every generation agrees on what those challenges are. Just over half of Americans (57%) say their generation has had a harder time making ends meet compared with any other. Millennials (72%) and Gen Zers (68%) are more likely to agree with that sentiment compared with Gen Xers (56%) and boomers (39%).

About a third of Gen Zers (36%) also say their generation is bad at managing money (compared with 25% of millennials, 14% of Gen Xers and 10% of boomers). Education may play a role in that outlook. Roughly 1 in 5 Gen Zers (21%) think they learned all they needed to know about budgeting when they were a kid. (Millennials, at 18%, feel similarly.)

Baby boomers keep income details to themselves

Overall, 69% of Americans say it's rude for a person to talk about how much money they make. Baby boomers are the most likely to agree with that sentiment. About 8 in 10 (81%) are put off by the idea of talking about income. Just about half of Gen Zers (47%) think talking about income is rude, and 65% of millennials and 71% of Gen Xers feel the same.

Boomers are also less likely to say they feel societal pressure to spend money. Just about 1 in 5 boomers (18%) say they often spend more than they budget for because of societal pressure from, for example, family, friends or social media. Conversely, 57% of Gen Zers and half of millennials (50%) say the same thing. Gen Xers fall between the poles at 35%.

Thoughts on tipping and fees

About a third of Americans (32%) say sellers' fees have gone up in the past year. These are the fees companies or individuals add to a purchase that often aren't reflected in the base price. Fuel surcharges at the airport, airport fees for a ride-sharing app and order processing fees from ticketing companies are examples.

When it comes to tipping, the generations are in agreement. Overall, about a third of Americans (34%) say tipping, when the option is present, is mandatory (35% of Gen Z, 35% of millennials, 31% of Gen X and 35% of baby boomers). About the same proportion of Americans (29%) feel like the pressure to tip more has increased for them over the past year.

Boomers are most likely to want the option to tip as opposed to facing increased fixed costs. About 2 in 5 boomers (41%) say, when dining out, they would prefer to tip versus seeing restaurants increase menu prices so tipping isn’t required (compared with 25% of Gen Zers, 31% of millennials, and 29% of Gen Xers).

Baby boomers (4%) are also the least likely to say they judge their friends based on how much they tip. Gen Zers (11%), millennials (15%) and Gen Xers (7%) are all more likely to be judgmental of friends when it comes to tipping.

Baby boomers feeling pinched

Boomers may be more likely to feel the pinch of inflation. Just 5% of baby boomers say their dollar goes farther now than it did a year ago. About 1 in 5 Gen Zers (19%) say the same thing, followed by 16% of millennials and 10% of Gen Xers.

Baby boomers and Gen Xers are also more likely to say portions at restaurants are getting smaller (42% and 39%, respectively) compared with Gen Zers (29%) and millennials (33%).

Part of that may be boomers having a better understanding of the realities of inflation. When we asked Americans if the annual U.S. inflation rate was above 10% (at the time it was 5%), 44% of boomers correctly identified that it wasn't. Just about 1 in 5 Gen Zers (19%) and millennials (18%), and roughly 1 in 4 Gen Xers (24%), got it right.

What you can do: Find ways to save, even when times are tight

Managing your money is much more difficult when you don't have a buffer. Finding a way to save, no matter what generation you belong to, can help you cope when prices increase or attitudes toward costs shift.

“Cutting back on recurring costs such as subscriptions, shopping around when insurance and phone contracts come up for renewal, and timing necessary big-ticket purchases to sales can all help free up money for additional savings,” Palmer says.

You can also take a look at your tipping to better understand what you can and should control. Tipping often feels mandatory because some people rely on tips for a living wage. Knowing what you're providing and what it means to opt out can help you make better-informed decisions, and can have a positive impact on your spending.