UltraFICO vs. Experian Boost: Tools to Jump-Start Your Credit

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

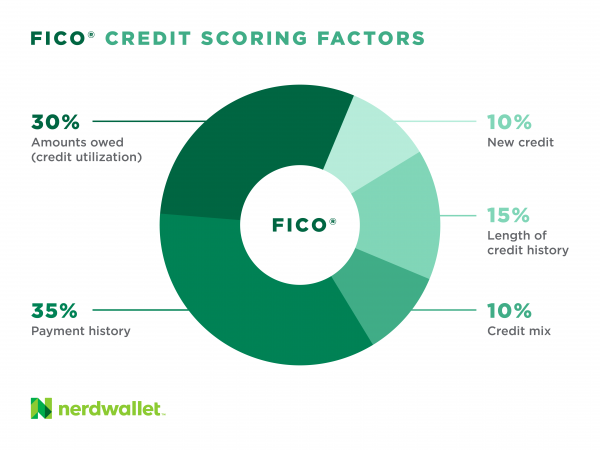

The rules for achieving a decent credit score haven’t changed much since credit scoring was invented: Pay all your bills on time, don’t use too much of your available credit and build a long history of responsible behavior.

But credit novices and those looking to rebuild after missteps have two other tools they can use: Experian Boost and UltraFICO. Both reward good financial habits that go unrecognized by some credit scoring models.

Credit bureau Experian and analytics company FICO, most commonly known for the FICO credit score, say they created Boost and UltraFICO to help people starting out with credit or those who want to build it anew. They are likeliest to help those with credit scores in the 500s and 600s, the companies say.

Boost launched in March 2019 and is available to consumers on Experian’s website. UltraFICO, launched in 2018, is an opt-in service that consumers may use so that savings and checking account balances and payments can be used to help evaluate financial habits.

Both products have quirks you need to understand. Boost and UltraFICO work only with credit scores based on data in your Experian report. Here’s the lowdown on Boost and UltraFICO and how to decide whether to use them:

How Boost and UltraFICO work

Boost

This free service lets you add points to your existing credit score. Here’s how:

Sign up on Experian’s website and connect your bank account information, allowing Boost to scan your transactions for utility and cellphone payments. In September 2022, Boost added the ability to report rent payments as well.

Select the bills you want added to your Experian credit report and, if applicable, decide if adding rent is a good option. Choose only the bills you know you paid on time. Since scores are calculated from the information in your reports, adding those positive payment records can help your score.

If adding rent payments, be sure to read the fine print. Rent payments must be over a qualifying amount and made online to eligible property management companies and landlords using rent payment platforms (rather than cash, personal check or PayPal, Venmo or Zelle). To qualify, you must make at least three rent payments within a six-month time frame, with one rental payment occurring in the previous three months. You can check to see if your rental payments are eligible for reporting on the Experian Boost website.

Check your progress. Signing up for Boost also gives you free access to your FICO score, so you can see the immediate effects of using it.

What to know:

Experian says Boost can benefit the most common versions of FICO and VantageScore. But the effect shows only when a lender uses your Experian credit report with those scoring models. If a lender looks at scores based on your TransUnion or Equifax credit reports, it will not see the change.

If you have an Experian credit freeze in place, you can still use Boost.

After signing up for Boost, monitor your Experian FICO score. Only positive payments are reported, but if you find that using Boost is negatively impacting your score you can remove those specific accounts.

UltraFICO

This type of FICO score is free to use, but you must opt in. It works in two steps:

You sign up on FICO’s website and link your bank accounts, allowing it to scan your transactions. The scoring algorithm checks whether you consistently have cash on hand, how long your accounts have been open, how active they are and how often you have a negative balance.

Before applying for a credit card or loan, ask the lender if it uses UltraFICO. Apply as normal. If the lender finds that your credit is not good enough to qualify, you can ask it to check your UltraFICO to see if you have a second shot. Your credit is pulled only once during the whole process, says Gregory Wright, chief product officer at Experian Consumer Information Services.

What to know: Unlike with Boost, you cannot check your UltraFICO score to see the effect. The only time you may see it is if you are turned down after the lender’s second look; it will send you a notice in the mail explaining why, says David Shellenberger, FICO's vice president of product management for FICO scores. As with Boost, you can opt out at any time.

Deciding whether to use Boost or UltraFICO

If you know you manage money responsibly and your score doesn’t reflect that, Boost and UltraFICO may be worth exploring. However, you need to be comfortable sharing your bank account information.

Experian says the majority of consumers who’ve signed up since Boost’s launch added points to their score, with an average FICO 8 jump of more than 13 points.

Using these traditional methods to build credit, while slower to show results, is more likely to help all versions of your credit score:

You could apply for a secured credit card.

You could take out a credit-builder loan from a lender that reports to all three credit bureaus.

You could also ask to be added as an authorized user on the credit card account of someone who has a good payment history. Again, verify that the card issuer reports authorized user information to the three bureaus.