What Is a Good Credit Score and How Do I Get One?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

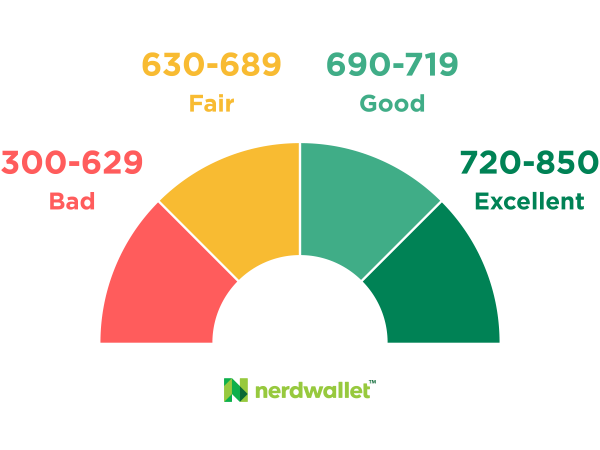

NerdWallet’s credit score bands, used for general guidance

Generally speaking, a good credit score is 690 to 719 in the commonly used 300-850 credit score range.

Scores 720 and above are considered excellent, while scores 630 to 689 are considered fair. Scores below 630 fall into the bad credit range.

Lenders, such as credit card issuers and mortgage providers, may set their own standards on what "good credit" means as they decide whether to extend credit to you and at what interest rate.

In practice, though, a good credit score is the one that helps you get what you need or want, whether that's access to new credit in a pinch or lower mortgage rates.

What’s a good credit score with FICO vs. VantageScore

FICO, the most widely known credit scoring system, and its competitor VantageScore both use the 300-850 range. However, the two systems group good credit scores slightly differently from each other.

What is a good FICO score?

A good FICO score is 670 to 739, according to the company's website. According to FICO's most recently available data for October 2023, the average credit score was 717, which falls in the good range.

FICO says scores of 580 to 669 are considered "fair" and 740 to 799 are considered "very good." Anything at 800 or above is considered "exceptional." NerdWallet’s credit score bands, used for general guidance, are pictured above.

FICO comes from Fair Isaac Corp., the company that first developed a credit scoring system. It uses data about consumers from the three major credit reporting bureaus: TransUnion, Equifax and Experian.

What is a good VantageScore?

A good VantageScore is 661 to 780, which the company calls a "prime" credit tier. The average VantageScore 3.0 as of October 2023 was 700.

VantageScores 781 to 850 are considered "superprime," while 601 to 660 are "near prime." VantageScores 600 and below are considered "subprime." These ranges are for VantageScore 3.0.

VantageScore produces a similar score to competitor FICO using the same credit report data from the three bureaus.

NerdWallet offers you a free credit score using VantageScore and your TransUnion credit report.

What a good credit score can get you

Having good credit matters because it determines whether you can borrow money and how much you'll pay in interest to do so. Having a good credit score is also helpful whether you plan to apply for credit or not.

Here are some things a good credit score can help you get:

An unsecured credit card with a decent interest rate, or even a balance-transfer card.

A desirable car loan or lease. If your credit score is around 700 or below, prepare for questions about negative items on your credit record when shopping for a car. People with major blemishes on their credit are routinely approved for car loans, but you may not qualify for a low rate.

A mortgage with a favorable interest rate. You don’t need flawless credit to get a mortgage. In some cases, credit scores can be in the 500s. But credit scores estimate the risk that you won’t repay as agreed, so lenders do reward higher scores with lower interest rates.

An upper hand in the rental application process. Landlords or property managers generally aren't looking for immaculate scores. They are interested in your credit record. Learn more about what landlords look for in a credit check.

The ability to open new credit. This flexibility can help you cover expenses in a crisis or grant access to specialty rewards and travel cards. No matter the reason, being able to open a new line of credit when needed is a real benefit of having a good score.

A good credit score helps in other ways, too. In many states, people with higher credit-based insurance scores pay less for car insurance. In addition, some landlords use credit scores to screen tenants.

What affects your credit score?

On the list of what affects your credit score, two factors have the biggest influence: payment history, which is whether you pay on time, and credit utilization, or how much of your available credit you are using.

Other factors matter but carry a little less weight: how long you've had credit, whether you have a mix of credit types, and how frequently and recently you've applied for credit.

How to get a good credit score

Good credit habits, practiced consistently, will build your score. Here’s what you need to do:

Pay bills on time

Payment history has the largest impact of all the factors in your score. A missed or late payment can do tremendous damage to a credit score and it can stay on your credit report for up to seven years.

Keep credit utilization below 30%

Keeping your credit card balances well below your credit limits is a great financial habit. You should aim for credit utilization under 30%, but lower is better. High utilization dings your score, but the damage will fade when you're able to reduce your balances and the lower utilization shows up on your credit reports. You also may be able to lower utilization by getting a higher credit limit or becoming an authorized user on a lightly used card with a large limit.

Keep credit accounts open

Keeping older accounts open helps your average age of accounts, which has a small influence on your score. Closing an account cuts into your overall credit limit, driving up your credit utilization. However, there are some compelling reasons to close an account, including high fees or poor service.

Space out credit applications

Avoid making several credit applications in a short time frame. Credit checks for the purpose of credit decisions can cause a small, temporary dip in your score, and several in a short time can add up. That's why it's important to research credit cards before you apply.

Monitor your credit reports

Monitor your credit reports and dispute information you believe is incorrect or too old to be included (most negative information falls off after seven years). Errors could lower your scores.

Want to see what powers your credit? Check your free credit score and get personalized insights. Weekly updates let you track your progress. Sign up, it's free.

What is the highest credit score, and how many people have it?

The highest score you can have on the most widely used scales is 850. According to data from FICO, about 1.7% of all FICO scores were at the coveted 850 as of April 2023. And even if you do get there, the fluctuating nature of credit scores means you’re unlikely to keep it month after month. FICO and VantageScore's average credit scores by age reveal where most people's scores actually land.

How do you get a perfect credit score?

According to FICO, those who achieve 850 scores pay on time, use credit lightly, have a long credit history and rarely open a new account. Here’s what they tend to have in common:

A credit history of about 30 years.

Uses only 4.1% of credit limit.

No late payments on credit reports (meaning any late payments were more than seven years ago).

You don't need a perfect credit score to get the best deals. A score of 720 or higher is generally considered excellent. And scoring 800 or above qualifies you for the best terms offered.