Net Worth Defined and Calculated: What Is My Net Worth?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Net worth defined

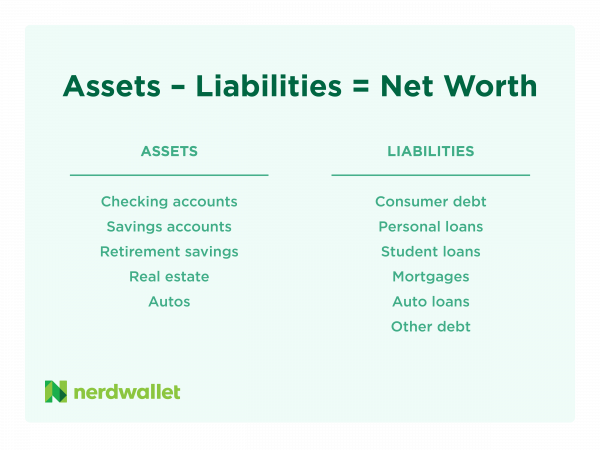

Net worth is assets minus liabilities. Or, you can think of net worth as everything you own less all that you owe. Find your net worth by using our net worth calculator.

Get a custom financial plan and unlimited access to a Certified Financial Planner™

NerdWallet Advisory LLC

What is my net worth?

To calculate your net worth, take inventory of what you own, as well as your outstanding debt. And when we say own, we include assets that you may still be paying for, such as a car or a house.

For example, if you have a mortgage on a house with a market value of $200,000 and the balance on your loan is $150,000, you can add $50,000 to your net worth.

Basically, the formula is:

ASSETS minus LIABILITIES equals NET WORTH

Calculating net worth: What are assets and liabilities?

If you’re not sure what assets and liabilities are, here are some guidelines:

Assets: Assets include cash — such as in your checking, savings and retirement accounts — and certain investments, such as stocks and bonds, that you could sell for cash. These are often referred to as liquid assets.

Some fixed assets can count toward your net worth calculation, too, provided you can or would sell them if needed. For example, your home would count toward your net worth if you’re willing to use it for a home equity line of credit or sell it should the need arise.

Liabilities: Any money you owe to another person or entity falls under this category. That includes revolving consumer debts — such as credit card balances — as well as personal, auto, payday and title loan balances. If you’re using your home as an asset, its mortgage counts as a liability as well.

Do you include a 401(k) in a net worth calculation?

All of your retirement accounts are included as assets in your net worth calculation. That includes 401(k)s, IRAs and taxable savings accounts.

Net worth calculator

See more financial calculators from NerdWallet and consult our personal finance guide.

Compare your net worth

The Federal Reserve releases its Survey of Consumer Finances every three years — the most recent report was issued in September 2020 with data from a survey fielded in 2019. Here’s how net worth stacks up by income, age, family size and education, and how it has changed since 2016.

Net worth of U.S. families by income

Income tier | 2016 | 2019 | Change 2016-2019 | |

|---|---|---|---|---|

Less than $20,000 | $7,100 | $9,800 | 37% | |

$20,000 to $39,900 | $31,500 | $44,000 | 40% | |

$40,000 to $59,900 | $94,200 | $92,900 | -1% | |

$60,000 to $79,900 | $181,500 | $199,100 | 10% | |

$80,000 to $89,900 | $421,700 | $382,300 | -9% | |

$90,000 to $100,000 | $1,732,300 | $1,589,300 | -8% | |

All families | $103,500 | $121,700 | 18% | |

Net worth of U.S. families by age

Age tier | 2016 | 2019 | Change 2016-2019 |

|---|---|---|---|

Less than 35 | $11,700 | $13,900 | 19% |

35–44 | $63,600 | $91,300 | 44% |

45–54 | $132,100 | $168,600 | 28% |

55–64 | $199,200 | $212,500 | 7% |

65–74 | $237,600 | $266,400 | 12% |

75 or more | $281,600 | $254,800 | -10% |

All families | $103,500 | $121,700 | 18% |

Net worth of U.S. families by race or ethnicity

Race or ethnicity | 2016 | 2019 | Change 2016-2019 | |

|---|---|---|---|---|

White non-Hispanic | $181,900 | $188,200 | 3% | |

Black or African American non-Hispanic | $18,200 | $24,100 | 33% | |

Hispanic or Latino | $21,900 | $36,200 | 65% | |

Other or multiple race | $68,800 | $74,500 | 8% | |

All families | $103,500 | $121,700 | 18% | |

Net worth of U.S. families by education

Education | 2016 | 2019 | Change 2016-2019 | |

|---|---|---|---|---|

No high school diploma | $24,300 | $20,500 | -16% | |

High school diploma | $71,300 | $74,000 | 4% | |

Some college | $70,200 | $88,800 | 26% | |

College degree | $310,700 | $308,200 | -1% | |

All families | $103,500 | $121,700 | 18% | |

Track your money with NerdWallet. Skip the bank apps and see all your accounts in one place. Create my free account.