You’re our first priority.

Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

Smart Money Podcast: Buy Now, Pay Later Loans and How to Start Building Wealth

Senior Writer | Personal finance, credit scores, economics

Senior Writer | Personal finance, debt

Lead Assigning Editor | Personal finance, credit scoring, debt and money management

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Visit your My NerdWallet Settings page to see all the writers you're following.

Welcome to NerdWallet’s Smart Money podcast, where we answer your real-world money questions.

This week’s episode starts with a discussion about buy now, pay later loans. These offers are common when shopping online, but they aren’t always a good option.

Then we pivot to this week’s question from Patricia, who left us a voicemail:

“Hi, my name is Patricia. I’m 23 years old. I’m about to graduate in a month and a half, so this semester, and I’m trying to figure out how to get my finances together. I don’t have that much money as of now ... and I want to know how do I go about building wealth. What steps do I have to take to then be financially stable without having to work like a dog?”

Check out this episode on any of these platforms:

Our take

Buy now, pay later loans can be a convenient way to break up an expensive purchase into more manageable payments. But be mindful of interest and late fees, which can make these a worse deal than they’re marketed to be. Sometimes saving up for a big purchase is the best route. That said, these offers can be useful in a pinch, such as if you need to buy an expensive flight on short notice and don’t want to or can't put it on a credit card.

As far as building wealth, the best way is to start with a strong foundation. Create a budget to know where your money is going. Then give each dollar a job. Make specific and actionable goals for your money, such as setting some aside for emergencies or saving for vacations and retirement.

Realize that building wealth takes time. Consider setting up automatic monthly transfers into various savings or investing accounts to maintain gradual, steady growth. And save aggressively to avoid working like a dog. If you’re making enough money to live comfortably, you can likely afford to save more money than you are right now.

Expect to make some mistakes along the way. Try not to beat yourself up over them. Instead, find the lesson in each setback.

Our tips

Start with the basics. Know where your money is going and how to make it work for you.

Get started investing as soon as you can. A long time horizon will mean greater gains over time.

Learn from your mistakes. While missteps and setbacks are inevitable, they’re also opportunities to acquire knowledge.

More about building wealth on NerdWallet:

Have a money question? Text or call us at 901-730-6373. Or you can email us at [email protected]. To hear previous episodes, go to the podcast homepage.

Sean Pyles: Welcome to the NerdWallet Smart Money podcast, where we answer your personal finance questions and help you feel a little smarter about what you do with your money. I'm Sean Pyles.

Liz Weston: And I'm Liz Weston. To contact the nerds, call or text us on the NerdHotline at 901-730-6373, that's 901-730-NERD. Or email us at [email protected].

Sean: And hit that subscribe button to get new episodes delivered to your devices every Monday. And one last plug before we get the episode going: We want to hear from you, our listeners. So we put together a super quick two-question survey.

Liz: You can find the link in the episode description. So please take a few seconds to fill it out. We're always working to improve the show for our listeners, and this is your chance to help.

Sean: On this episode of the podcast, Liz and I answer a listener's question about how to get started building wealth as a recent college graduate. First though, in our This Week in Your Money segment we are talking with personal loans Nerd Annie Millerbernd about buy now, pay later loans.

Liz: Hey, Annie, welcome back to the podcast.

Annie Millerbernd: Thanks for having me.

Sean: So Annie, I see these loans all around the internet when I'm shopping for things. And I'm wondering if you can give us a breakdown of what these loans are and how they work.

Annie: So these loans are basically a way to break up a large payment into smaller, often bi-weekly payments. Typically, you'll see them in about four payments. So if you get $200 worth of product at Sephora, for example, you would be able to break it up into four bi-weekly payments of $50, assuming you didn't have to pay interest.

Sean: And it's not just limited to things like retail, they're also in travel and flights, things like that.

Annie: They're most well-known right now for being on a lot of retailer's websites, but they're also available through airlines, you can see them at travel agencies, you'll see them for hotel services. They are very expansive.

Sean: And I'm seeing these pretty much anywhere shopping online nowadays. I'm seeing a bunch of drag queens that I follow on “RuPaul's Drag Race” shilling these things and getting some money for that, I guess. And I'm just kind of skeptical of the entire product. They seem too good to be true. Is there a catch here? What's going on behind the scenes?

Annie: I think you're not alone in wondering what's the catch with some of these things. There can be some pros and cons. I don't know that there's necessarily one hard catch. Some of them might pull your credit to decide whether or not to charge you interest or how much. A lot of the times you'll see a zero interest offer at checkout, "You could get payments as low as this for zero interest," but you might end up getting an interest rate. So that's one of the cons I guess, how much interest are you willing to pay on this purchase, whatever it might be.

And then the other thing to consider is that you're basically signing up to make payments on an item. And then if you don't make those payments, if you don't take that initiative to make sure you're getting those payments in on time, you could get a late fee, and the late fees can be anywhere from no late fees to $7 or $8, which doesn't sound like a lot of money. But when you're talking about one bi-weekly payment of $50, hitting an $8 late fee for that, that's a lot of money, especially if you get it more than once.

Sean: And that seems like one of the cons for me is that with something like putting a pair of jeans on a credit card, you know that you're going to pay your credit card off at the end of the month, or hopefully you'll be doing that. With something like one of these loans is from a retailer, it adds yet another account that you have to manage, which I'm sure could be easy to forget it if you're not used to doing this.

Annie: Yeah. And some of them have a policy of emailing you or notifying you that, "Hey, you're going to need to make this payment soon. Don't forget." But if you're not checking your email, or if you're not really proactive about doing that yourself, it can be easy to forget that you've added essentially an extra bill payment to each pay cycle.

Liz: Annie, I've just been ignoring these. Are they ever a good option?

Annie: I think they're a good option if you are going to make a big purchase and you get no interest. Say, you're going to purchase a $2,000 Peloton bike, the real offer you get is a zero interest, 12 monthly payments of $160 or whatever it may be. That's not going to harm you. It's not going to help you build credit, for example, a lot of these services won't help you build credit. But it is a way to say, "I'm not going to take all this money in a lump sum out of my bank account. Instead, I'm going to commit to doing it over bi-weekly or monthly payments."

Liz: The payments come out of your checking account automatically or do I have to remember to make those monthly payments or bi-weekly payments?

Annie: You can set up auto pay with them. I don't think it's always right out of the gate you're in an auto pay. I think you have to go do that yourself.

Sean: When I think about buying something as expensive as a Peloton or other furniture and breaking it up into monthly payments, to me, it seems like the natural tool for this would be a zero APR credit card. These are cards that have a zero interest period for somewhere between 12 or sometimes even 18 months. And it seems like that's the better way to do it, in my opinion, because you're building credit for on-time payments with that. And as you mentioned, typically, folks aren't getting any sort of credit boosts from this because these payments are not being reported to the credit bureaus. So that's where I'm kind of thinking, "Why go this route? Is it really that you don't have credit to get approved for one of those cards?" What do you think?

Annie: I think these services, these buy now, pay later services, used to be seen as the option for people who can't qualify for a credit card, and the credit cards you're talking about, the zero-interest promotional periods, those tend to have really high bars for people to qualify for them. So if you can't qualify for them, this is sort of your alternative. If you're going to make a big purchase that you maybe haven't planned out, maybe you don't want to wait however long it would take for you to qualify for a credit card and get that credit card in the mail, you just want to make this purchase. This is really just kind of a debit alternative to that kind of credit card, especially if you do get a zero interest rate.

Sean: So when do you think this should be avoided?

Annie: I think they should be avoided if you get a high APR. Some of them can have interest rates as high as 30%, which is a lot, whether you're paying for a pair of jeans or a television, that's a lot of extra money to pay for that purchase. That might be one of those times when it's better to just hold off and save up.

I think another time that they could be avoided is, not sure of money coming into and money going out of your account every month. And this is really the biggest one. So if you are noticing that your account balance gets near zero each month, and you're not totally confident that you would have that money to take it out and pay for this every pay period or every month, then this is something that you're just kind of adding into the mix. It's going to add a layer of complexity and it might just not be the right time to do it.

Sean: Well, Annie, as we mentioned earlier, it seems like these offers are everywhere. And I'm wondering if there are new products or if they've been around for a while?

Annie: These products are definitely having a moment. A lot of the bigger-name ones have been around since 2014, 2012, or even earlier. So they're not necessarily a new thing. They're just a popular thing. And I think you're going to start seeing them more often at checkout. And you might even start to see multiples competing for your eyeballs at checkout. So it's really important to do your research and understand what each type of service has to offer. Each of these has a little different nuance. So some of them might charge a higher late fee. Some of them might have a policy of never charging interest.

Liz: I feel like I have to mention it's really a good idea to save up in advance when you're buying something. You don't always have to rely on credit or spreading payments out.

Sean: That's the thing is, I think that the services rely on you to be maybe doing some impulse shopping, and you know that maybe you can't afford whatever it is that day. So it's easier to break it up over a few weeks or months. It seems like a risk sometimes.

Annie: Another time I think it would be a good option is if you are taking a flight that maybe you didn't have time to save up for. So if you have to go somewhere quite quickly, if you're in an emergency, obviously the best situation would be that you had savings to use for that. But if you don't, you can turn to this as an alternative to using your credit card. Obviously, it would be great to compare rates with a credit card if you have it, but if you don't have a credit card and you're in an emergency, this is one way to avoid having to put that extra weight of a huge lump sum toward a plane ticket.

Sean: Well, Annie, thank you so much for chatting with us.

Annie: Thank you for having me.

Liz: And with that, let's get on to the money question. This episode's money question comes from Patricia. Here's the question:

Patricia: Hi. My name is Patricia. I'm 23 years old. I'm about to graduate in a month and a half, so this semester. I'm trying to figure out how to get my finances together. I don't have that much money as of now. My parents have put a lot of money into my retirement and stuff. I personally don't have that much money, and I want to know how do I go about building wealth, I guess? What steps do I have to take to then be financially stable without having to work like a dog, I guess? If that makes sense. That's what I want to know. If y'all can answer me, that'd be great. Thank you for your time and your services and your podcast.

Liz: To help us answer Patricia's question, on this episode of the podcast we're once again joined by personal finance Nerd Sara Rathner.

Sean: Hey Sara, welcome back to the podcast.

Sara Rathner: Thank you. Always a pleasure.

Sean: Our listener, Patricia, is new to this whole managing money thing and just looking for some advice. And let's talk first about where to start. What do you think is a good first step?

Sara: Honestly, it can really feel like money just slips through your fingers. So a really powerful exercise is to find out where your money actually goes. Because the answer might surprise you.

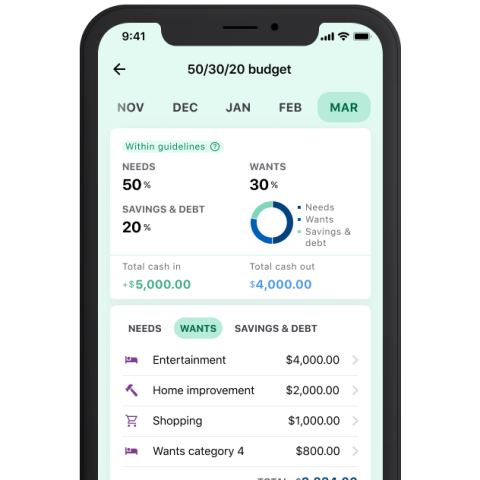

Sean: We are big advocates for the 50-30-20 budget. So you can put your money into these buckets of needs, and wants, and savings and debt payments. And that way you can account for every bit of your spending.

Sara: And what's nice about a budget system like that is you also budget for fun.

Sean: Yes.

Sara: So it's not about depriving yourself, it's just about planning your spending.

Sean: I think that's a really important part of it because when people think of money management, sometimes they can think, "Oh, this is going to be the worst kind of homework and I'm going to hear nothing but no from my finances." When, in fact, there's a lot of opportunity that comes from doing a budgeting exercise like this, because as you said, you factor in things like going out to eat, and now we're looking more toward traveling and getting together with friends and family, and you can budget for all of that, which creates a lot of potential in the future.

Sara: One thing I tend to recommend is, just for one or two months, do like the money diaries thing. You see those articles about money diaries that track people spending for a week. Do that yourself. Write down how much money do you take home in your paycheck or paychecks, if you have more than one job. So how much money do you bring in every month? And then what do you spend every dollar on? And don't judge yourself. Just write down where your money is going. And at the end of that period, look back on where your money went and you might be able to identify some places where you could save money. Maybe your cell phone bill is really high and you can consider switching over to a different plan, for example. Sometimes these switches don't really change your day-to-day life, but they do free up some cash.

Sean: I think it's really important when people are doing an exercise like this to be their authentic selves. If you know that you have a habit of at 10 p.m. on a Saturday night, you're sitting at home maybe after a glass of wine or two doing some impulse shopping, something I know a lot of people do.

Sara: Are you projecting a little bit?

Sean: Maybe. But don't try to curb your spending just to make it appear better for this exercise. You want an accurate picture of where your money is going.

Sara: Yeah. And nobody else is going to see this, so you don't have to do this to impress anybody. The important thing really is to not judge yourself and not get angry at yourself. The money's already spent. It's just, how can you do differently in the future?

Liz: A lot of people during the pandemic picked up some good spending habits and good savings habits because they weren't able to do a lot of the things they did before. But I think we've also got some expenses we need to take another look at. Like we loaded up on streaming subscriptions. We have a ridiculous number at this point. And I think it's worthwhile to kind of go through and look at what you've got and think, "What do I really need going forward?"

Sara: Definitely a lot of spending on athleisure and fancy pajamas you might not be wearing as much when you actually leave the house to go to work once again.

Sean: Another aspect of understanding where your money is going and money management is giving every dollar a job. Sara, can you explain how that works?

Sara: Every dollar has the potential to work for you. Harness the power of your money, essentially. And that can play out in a couple of different ways. First is goal setting. Setting specific, actionable goals for your money. You know how much you want to save for your next home repair project. You know how much you want to save to go on vacation, maybe your first vacation post vaccination. By setting specific goals, you know how hard it is you need to work and save now to be able to afford these things in the future. So that's one aspect of putting your money to work for you.

Patricia asks about building wealth. A big part of building wealth is also putting your money to work for you in a different way. And that's through saving, investing, paying down debt.

Sean: It's important to note for Patricia, and anyone else that's interested in getting started building wealth, is that it doesn't happen overnight. In fact, it can happen pretty slowly in the beginning, which I think can be hard for people to grapple with. Instant gratification is much preferable in some ways to delayed gratification, but understanding that it's going to be several years possibly until you do have that actual wealth, I think can help you going into this process.

Sara: It's not like winning the lottery. Nobody shows up at your door with a novelty check.

Sean: I wish.

Sara: For most of us, it's years of effort of putting money aside into specific accounts and not touching it.

Liz: Something that can really help people is to track your net worth as well, track the growth of your investments and how you're paying down debt over time. Anything that we monitor, anything that we track, we tend to put more energy into. So we have an app at NerdWallet that can help you with that. Not just watching the money going out, but actually watching your wealth build up can be really satisfying.

Sara: Especially if you're paying down debt, maybe you have negative net worth. The day you hit zero is like this incredible day, because from there on out, you're going to be in the positive.

Liz: And it does sound like Patricia is getting help from her parents. She's already got retirement funds. So that's a big step up.

Sean: Well, on the topic of building wealth, what helped me in the beginning with investing was setting up monthly contributions to a robo-advisor account. And I think that can be a pretty easy way for some people who are interested in getting started, but don't really know what to do. Just making a regular contribution as you would your student loan payment.

Sara: For a lot of people saving for retirement is really the first time they begin investing. If you have a retirement plan that's run by your employer, that money is automatically deducted from every paycheck. It's almost like tricking your way into retirement savings. You never see the money land in your bank account, so you can't spend it.

Liz: It's amazing how powerful that can be.

Sean: And Patricia is 23. They have a great time horizon with which to build all of this wealth and take advantage of that compound interest. But one thing that really stood out to me that made me kind of chuckle and get enjoyment out of listening to Patricia's question was that they're interested in being financially stable so they don't have to work like a dog, which I love. How do you think someone can go about accomplishing that?

Sara: Well, I don't know if you've ever met my dog, he hasn't worked a day in his life. My dog was born retired. He sits on the couch all day and then he gets walked and fed like a prince. So maybe the lesson out of this is we should aim to be more like our dogs and less like human beings.

So there's definitely the trend of the FIRE movement, which is “financial independence, retire early.” There's a lot of talk around different techniques for saving and investing early on, reducing spending or being very strategic about spending so you can retire earlier than the typical retirement age, which for younger workers is around 67.

You work really hard and you want to enjoy your retirement, you want to enjoy it while you're still young enough to be active and travel and do all the things that you want to do. One of the things that it requires is saving pretty aggressively, because you're cutting down the amount of time that you're in the workforce. So instead of working for 45 years, you might be working for 30 years. So that's cutting 15 earning years off of that time horizon.

Sean: And unless you're making a lot of money, you practically have to live a bare-bones lifestyle in order to save as much as it requires to accomplish that early retirement.

Sara: And you kind of have to be the millionaire next door, which means that you might earn a very comfortable living, but you're not going to look outwardly like you earn a very comfortable living. You might live in a smaller home, drive an older car or even not have a car at all if you live in a walkable or bikeable area. So there are sacrifices in the short and medium term that some people are willing to make and some people aren't.

Sean: I could never do this personally, because my personal motto is “live for today, plan for tomorrow.” I like a little bit of a middle ground. I want to be able to enjoy my present while knowing that I'm saving for retirement. We have to take advantage and enjoy each day that we do have because tomorrow is not guaranteed.

Sara: That's true. You can work your whole life to retire and retire well, then you don't get the retirement that you thought you could have, maybe it's because of healthcare issues, or financial issues or family issues. Sometimes it's not your choice to leave work when you leave work.

And I like your philosophy. Mine is sort of a little bit of lifestyle inflation isn't such a bad thing because you do work for that. As your income grows and as your financial situation becomes more stable, in my mind, it's OK to bring a little bit of extra convenience into your life or luxury, just in a sustainable way.

Sean: It reminds me of the part of Alanis Morissette song, “Ironic” about Mr. Play It Safe was afraid to fly. He waited his whole life to take a flight, and then he died on the flight. It's things like that that makes me not want to stow away every penny I have for some sort of idea of retirement that may not come to fruition.

Sara: We live in the time of the gig economy, and there are so many people that have two, three, maybe even four jobs at once. And that is hard. There also is this idea of not working like a dog, maybe your primary source of income pays you well enough that you don't have to have extra side work. You can focus on one job and then actually have more free time available to you. That could be a way to work for 40 plus years in a way that feels like you're not burning yourself out all the time.

Sean: And going back to the idea of the modern dog, which is not working at all, I think it might be worth looking into something like how to generate passive income so that way you have money coming in, but you're not working like a human has to.

Sara: And that's where investing could be a helpful tool because you have that compound interest. It grows over time, hopefully. That could be a way to let your money grow while you're kind of doing other things.

Sean: So Patricia is still in their early 20s and I think that this is a period of time for a lot of people when you're learning a lot, in part because you're making a lot of mistakes. And I know that I was in that situation in my early 20s, making a number of financial mistakes. So I would love to hear from you guys about one mistake that you guys made in your early 20s with your finances and what you learned.

Sara: So when I was 22 and I was graduating from college, I was desperate for some sort of reward after I graduated. And I took an internship offer for a paid role, but I didn't do enough research. And it actually didn't pay enough to support myself in the city where the job was located. After doing the math, I actually would have spent $400 to work this job. I was fortunate to receive another internship offer that had better terms, better pay in a different area where I actually had family. I really went back and forth about whether or not to back out of the job. I really thought that it was going to hurt me professionally for the rest of my career. I spoke with my parents and I spoke with a career counselor at my college. And I decided to go ahead and do it.

And it was one of the best decisions I ever made in my life. The guy who was supposed to be my boss later got fired from another job for sexually harassing the young women he managed. So really I dodged so many bullets in so many ways.

It taught me two big things that I still carry with me to this day. First of all, you can back out of stuff: jobs, roommate arrangements, relationships, friendships, volunteering organizations. You need to walk away from situations that are not in your favor. You owe it to yourself and you will look back on the experience and be so thankful that you did. When it comes to backing out of bad situations, that's where emergency savings becomes really important.

So that's another lesson I would tell anybody who's in their early 20s or really at any age, you need to have money that can sustain you when you just need to run away from something that you're in that's toxic. It's really important because it can get you out of a bind and into a much better life situation.

Sean: All right. So, Liz, what's your story?

Liz: Well, I think I've told you this before I bought retirement property in my 20s in Alaska 80 miles from the nearest road. And it made a lot of sense at the time. It makes absolutely no sense now.

So the lesson there is don't necessarily think that you know what the future you is going to want. And I think that's where I get with all the talk about FIRE, the financial independence, retire early, is you're making decisions for your future self and your future self may want something different. So just to understand, you change so much in your 20s, 30s, 40s, so on. What you want is going to change. How about you, Sean? What was your mistake?

Sean: Well, I also think that maybe I've mentioned this in the past, and the lesson is basically two: One, don't bury your head in the sand and two, pay your taxes. This is my first substantial job after college when I wasn't working retail. I was a contractor and I was making an OK amount. And I was living in San Francisco and the world was my oyster. In fact, I had never purchased so many oysters in my entire life. They’re delicious. And I basically just ignored my checking account until I got a bill come tax season for all the money that I owed and had not allocated for. And then I spent the next two years paying off that balance. So that's pretty much it. Don't ignore your money. Don't ignore the IRS.

All right. Well, Sara, do you have any final thoughts for Patricia or anyone else that's just getting started building wealth?

Sara: Yeah, just to re-emphasize that building wealth is a slow long process that is very rewarding along the way. So keep doing those things that make it possible to save money, whether that's setting up automatic contributions or budgeting and figuring out what cash you can free up to put toward longer-term goals, prioritizing saving for retirement, because the sooner you start doing these things, the easier it is for you to reach your goals and the less you'll have to play catch up later.

Sean: Well, thank you so much for talking with us.

Sara: Thank you for having me.

Sean: Now, with that let's get onto our takeaway tips. Liz, do you want to kick us off?

Liz: Sure. First start with the basics, know where your money is going and how to make it work for you.

Sean: Next up, get started investing as soon as you can. A long time horizon will mean greater gains over time.

Liz: Finally, learn from your mistakes. While missteps and setbacks are inevitable, they’re also opportunities to grow and rethink how you manage your money.

Do you have a money question of your own? Turn to the nerds and call or text us your questions at 901-730-6373, that's 901-730-NERD. You can also email us at [email protected]. Also visit nerdwallet.com/podcasts for more information on this episode and remember to subscribe, rate and review us wherever you're getting this podcast.

Sean: And here is our brief disclaimer, thoughtfully crafted by NerdWallet's legal team. Your questions are answered by knowledgeable and talented financial writers, but we are not financial or investment advisors.

This nerdy info is provided for general educational and entertainment purposes, and may not apply to your specific circumstances.

Liz: And with that said, until next time, turn to the Nerds.