How to Buy and Sell Crypto With Venmo

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

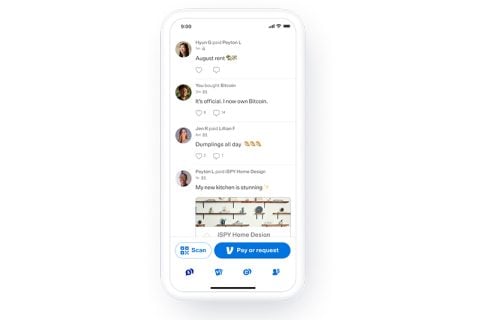

Peer-to-peer money transfer app Venmo allows you to buy, sell and hold cryptocurrencies in its app. The feature launched in April 2021, following a similar move by its parent company PayPal.

While it’s a convenient way to buy and sell crypto, especially in small amounts, it lacks the functionality other major crypto exchanges offer. For example, users can’t transfer crypto from the app into their own crypto wallets. You also can’t trade coins with other users or use your crypto assets to make payments on the app. This makes it a so-so choice compared to more feature-rich exchanges.

Like PayPal, Venmo allows purchases of four different currencies: Bitcoin, Ethereum, Litecoin and Bitcoin Cash. Its pricing structure is similar, too: Fees amount to $2.49 on a $200 purchase, plus an estimated 0.5% trading cost based on the coin’s exchange rate, a moderately expensive rate when compared with other platforms.

Here’s what to know about buying and selling cryptocurrency with the Venmo app.

Buying crypto with Venmo

You’ll need to use a verified Venmo profile to buy and sell crypto through the app. There are two major exceptions: Venmo doesn’t support crypto transactions in Hawaii, and business accounts can’t participate.

If you’re using a personal account in the 49 other U.S. states, here are the steps:

Go to the “Crypto” tab, which can be found at the bottom of the app’s home screen with this icon:

(Image courtesy of PayPal Newsroom)

2. On the Crypto page, you can view the market prices of Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC) and Bitcoin Cash (BCH). You can tap on your desired currency to view a price graph and see the “Buy” button.

3. Make sure your identity is verified. If you need help, this support page outlines the steps. You may need to accept Venmo’s cryptocurrency terms and conditions before you continue, and you’ll likely have to submit a few identification documents to confirm your home address, name, date of birth and Social Security number.

4. Enter the dollar amount of your purchase and select “Review.” You’ll get the chance to double-check how much crypto you’re purchasing, plus any fees that will be added.

The maximum limit for crypto purchases is $20,000 per week and $50,000 in a 12-month period. You can purchase as little as $1.

5. Choose your payment method. You can use a debit card, linked bank account or funds in your Venmo balance.

6. Select “Buy” to confirm. Venmo updates the market value of all four currencies every few seconds, so the value you see right when you tap “Buy” is the amount you’ll receive.

Fees

The fees Venmo charges for cryptocurrency purchases are calculated based on the margin between the market price and the exchange rate between the currency and the U.S. dollar. This difference, called the “spread,” is around 0.5% and depends on market conditions.

On top of the spread, Venmo charges the following transaction fees based on the purchase amount:

Purchase amount | Fee |

|---|---|

$1.00 - $4.99 | $0.49. |

$5.00 - $24.99 | $0.99. |

$25.00 - $74.99 | $1.99. |

$75.00 - $200.00 | $2.49. |

$200.01 - $1,000.00 | 1.80%. |

>$1,000.00 | 1.50%. |

Holding crypto

There are no fees for holding crypto on Venmo. You can view the amount of crypto you hold, and its current market value, in the same tab you used to purchase.

You’ll also be able to see your previous transactions by currency, plus your “Total Return,” which is the difference between your purchase price and the current value for all of your combined crypto assets on Venmo.

If you’re looking to hold a significant amount of crypto, a wallet is a more secure option.

» Ready for a wallet? Here are our top picks

NerdWallet rating 4.8 /5 | NerdWallet rating 3.9 /5 | NerdWallet rating 3.5 /5 |

Fees 0% - 3.99% varies by type of transaction; other fees may apply | Fees $0 per trade | Fees 1% spread |

Account minimum $0 | Account minimum $0 | Account minimum $0 |

Promotion Get $200 in crypto when you sign up. Terms Apply. | Promotion None no promotion available at this time | Promotion None no promotion available at this time |

Selling crypto

Once you have crypto assets on the app, you’ll be able to view the current price and sell through the same tab. The fees for selling are the same as the fees to purchase: a per-transaction fee, plus the 0.5% market spread.

Proceeds from the sale will go to your Venmo account, where you can use the funds to make payments or transfer them to your bank account.

Currently, Venmo does not support payments or purchases with crypto, peer-to-peer trades or transferring crypto to other accounts on or off the app, including your own wallet.

Earning cash back

If you have Venmo’s cobranded credit card, you can make purchases on it to earn crypto rewards. You can do this at the end of the card’s reward cycle by redeeming the cash-back you’ve earned into one of the cryptocurrency options offered.

The app waives Venmo transaction fees for these automatic purchases, though you’ll still pay the 0.5% market spread.

Setting alerts

The app can send push notifications that alert users to crypto price changes. You can customize these alerts with a specific currency and the desired percentage price increase or drop. Crypto alerts can be found in the app’s settings under “Push Notifications.”

What protections does Venmo offer?

Like with other exchanges, your crypto funds on Venmo aren’t eligible for Federal Deposit Insurance Corp. coverage, which would protect up to the first $250,000 in deposits. But Venmo says that crypto purchases will be protected from unauthorized activity. If you suspect fraudulent activity on your account, Venmo says you should contact customer service.

On a similar note...