Mortgage Origination Fee: How To Compare Lender Charges

Some or all of the mortgage lenders featured on our site are advertising partners of NerdWallet, but this does not influence our evaluations, lender star ratings or the order in which lenders are listed on the page. Our opinions are our own. Here is a list of our partners.

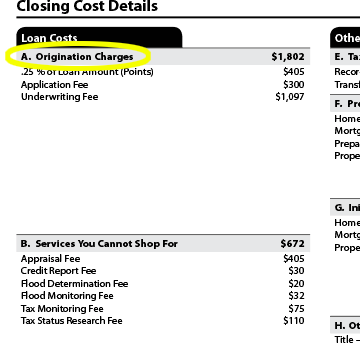

A mortgage origination fee is an upfront fee a lender charges for processing a loan. The fee is part of the closing costs you pay when the mortgage is finalized.

Like mortgage rates, origination fees vary among lenders, so it pays to shop around. The average mortgage origination fee in 2022 was about 1%, according to the most recent federal Home Mortgage Disclosure Act data. On a $350,000 mortgage, that would be $3,500.

How to spot origination fees

You can see how much a lender will charge by checking the Loan Estimate, an official document that spells out the terms and projected costs of the mortgage. The lender must provide a Loan Estimate within three business days after you apply.

The lender fees are detailed on the left side of Page 2 under "A. Origination Charges." Sometimes instead of charging a single origination fee, lenders will divide the fee into categories, such as application, processing, underwriting and verification fees. When itemized, each fee may look inconsequential, especially compared to the size of your loan. Don't let that confuse you. Check the total amount of origination charges when comparing fees among lenders.

How to compare lender fees and rates

Lenders make money by charging interest and fees. Sometimes they charge higher fees to lower their advertised rates, or they might advertise low fees but charge more interest.

To get a true look at the cost of borrowing, check the mortgage offer's Annual Percentage Rate, or APR. The APR, which is listed on Page 3 of the Loan Estimate, includes the interest rate, origination fees and discount points and provides an apples-to-apple way to compare lenders.

» MORE: What are mortgage closing costs?

Mortgage points, also known as discount points, are optional fees you pay upfront to reduce the interest rate.

Can you negotiate mortgage origination fees?

You can always ask a lender to reduce or waive some of the origination charges, but lenders may not budge. The best way to get a good deal is to apply with more than one lender, compare Loan Estimates and choose the lowest-cost offer.