Employment Practices Liability Insurance: Does Your Business Need EPLI?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Most business owners rely on a good team to help their company succeed. However, you may also expose your company to risk the moment you begin the hiring process. Lawsuits alleging discrimination and harassment are on the rise. In 2018 alone, the Equal Employment Opportunity Commission handled 90,558 discrimination cases and helped claimants recover $505 million in damages.

Without adequate business insurance, your company might end up having to spend thousands of dollars to resolve an employee lawsuit. Employment practices liability insurance, or EPLI, gives small-business owners peace of mind that they won’t have to cover employee claims out of pocket. Learn more about EPLI in this guide, including what is and isn’t covered, how much EPLI coverage costs and where to buy it.

Do you need employment practices liability insurance?

Only about 3% of businesses with fewer than 50 employees purchase EPLI. Many small-business owners are unaware that EPLI coverage exists, or they decide the coverage is optional or too costly.

Any small-business owner with employees should consider buying employment practices liability insurance, but it’s especially important in industries that have high rates of employee turnover. Employees in such industries are more likely to allege discrimination, sexual harassment or wrongful termination, which are the main types of legal claims that EPLI covers.

For example, restaurants, construction and manufacturing companies and retailers should purchase EPLI. If you look at the EEOC’s summary of recent cases, you’ll see that many of the companies sued are in those industries.

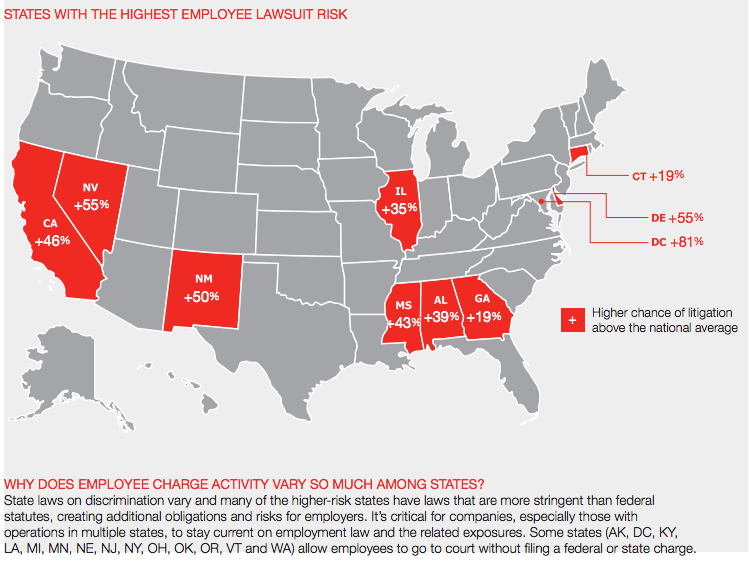

Even outside of those industries, it’s wise to buy basic EPLI coverage if your business can afford it. According to a study by insurance company Hiscox, the average U.S. company faces a 10.5% chance of having an employment claim filed against them. As the map below shows, the probability can increase to more than a 50% chance in some states, like California and New Mexico. Current events like the #MeToo movement and increased media attention to workplace discrimination have led to an increase in employee claims against all types of businesses. The average claim takes 318 days to resolve and costs $160,000, so insurance can be critical to your business’s survival.

Source: Hiscox

What does employment practices liability insurance cover?

By definition, employment practices liability insurance covers businesses against claims by employees that the company has violated their civil rights, but those claims can vary. The following types of claims are typically covered by EPLI:

Discrimination based on age, disability, gender, national origin, race or religion.

Sexual harassment.

Wrongful termination.

Retaliation (taking negative actions against an employee because they report discriminatory practices).

Employment-related defamation.

Invasion of privacy.

Failure to promote.

Breach of employment contract.

Deprivation of a career opportunity.

Negligent evaluation.

Lack of appropriate pregnancy and lactation accommodations.

There may be limited coverage for immigration claims, such as failure to check an employee’s work status.

There may be limited coverage for wage and hour claims.

Generally, EPLI will cover actions committed by anyone within the organization, whether that’s someone in top management or an entry-level employee. And most policies will cover the cost to settle a case out of court, as well as defense costs if an employee lawsuit goes to court. That said, every EPLI policy is different, so it’s wise to read the fine print.

Quinten Lovejoy, an insurance risk advisor at Crane Agency, says, “Costs covered by EPLI policies vary by carrier. For example, policies cover settlement costs almost universally. However, the challenge in some EPLI policies is that either defense costs are [subject to a specific limit] or defense costs are not covered at all. The best EPLI policies provide set limits for settlement and unlimited defense costs outside that limit.”

The best EPLI policies are also flexible enough to accommodate evolving employment law and policy. For instance, some states now prohibit employers from asking about a job applicant’s criminal history during the initial stages of the hiring process. In other states, employers can’t discriminate against an employee or job applicant based on their credit history. Only some EPLI insurers provide coverage against claims related to these laws.

Shop Now on Tivly's website Or call 888-698-3034 |

What’s not covered by employment practices liability insurance?

Employment practices liability insurance, as you might expect, doesn’t provide coverage for every type of employment-related claim. The following types of claims usually aren’t covered by EPLI:

Employee illnesses and injuries: You’ll need to purchase workers' compensation insurance to cover employee injuries and illnesses that occur on the job.

Employee theft: To cover acts of employee dishonesty, you’ll need to buy a fidelity bond or a larger commercial crime insurance policy.

Professional errors: If someone in your company makes a professional error which triggers an employee lawsuit, this isn’t covered by EPLI. You’ll need separate malpractice or professional liability insurance.

Management decisions: EPLI doesn’t cover certain types of management decisions or board of director decisions, such as improper use of company funds or failure to follow company bylaws. In those cases, directors and office insurance can provide coverage.

Union disputes: Claims arising from labor relations disputes or collective bargaining agreements aren’t covered by EPLI.

Unemployment insurance claims: Most states have agencies that are devoted to handling unemployment benefit claims and they don’t fall under the scope of employment practices liability insurance.

As we mentioned in the previous section, EPLI carriers generally only provide limited coverage for wage and hour claims and breach of contract claims. Some carriers might not cover such claims at all and others might offer lower coverage or only cover court costs.

While a few insurers will cover lawsuits by 1099 independent contractors, most EPLI policies are designed only to cover legal claims initiated by W2 staff employees. 1099 workers might sue a company for discrimination or harassment, claiming they were misclassified and are actually employees. If you want to be covered for such claims, make sure you review your policy carefully.

Claims-made vs. occurrence-based EPLI

Another factor that will impact your EPLI coverage is the type of EPLI policy. There are two types of EPLI policies: claims-made and occurrence-based. More common are claims-made EPLI policies, in which a claim will only be covered if the incident happened and the employee’s lawsuit was filed while the policy was in effect. The downside here is that you have to regularly keep renewing your policy on time to ensure that there are no gaps in coverage. An occurrence-based policy will cover claims that occurred during the policy period, even if the lawsuit was filed after the policy expired.

The cost of employment practices liability insurance

The cost of employment practices liability insurance can start as low as $500 per year for $1 million in coverage for a company with fewer than five employees. The best way to get a more exact price estimate is by providing an insurance carrier with information about your business and employees.

The following factors affect your cost:

Number of employees.

Type of employees (full-time, part-time or seasonal).

Industry.

Location (location in a state like New York or California can increase cost because these states offer more legal protection for employees).

Historic employee turnover rates at the company.

The company’s claims history..

Hiring/firing procedures.

Documentation of employee training and conduct.

Amount of coverage and size of deductible.

According to Jim Loughlin, senior sales director at insurance marketplace CoverWallet, the biggest determinants of cost are “how many employees you have on payroll, the state where you operate and the type of industry you work in. If your company has any past history of claims or lawsuits, the cost will rise.” The amount of coverage you want will also affect your cost. EPLI coverage can range from as little as $100,000 to as much as $25 million. The policy will also have a deductible, which is the amount of money you’ll have to pay upfront before the insurer pays a claim.

How to lower the cost of employment practices liability insurance

The best way to lower the cost of EPLI coverage is to have safeguards in place that minimize the risk of employee lawsuits. James Ryan, Public Affairs Specialist at the Equal Employment Opportunity Commission, recommends taking the following steps to lower the risk of employee claims:

Assess the business’s discrimination and harassment risk factors and take steps to minimize any risk.

Ensure that all employees understand their legal responsibilities and the business’s anti-discrimination and anti-harassment policies and complaint procedures.

Demonstrate the business owner’s commitment to preventing discrimination and harassment. For example, the business owner could: discuss the importance of complying with the business’s anti-discrimination and anti-harassment policies during new employee orientation and employee meetings; incorporate compliance with non-discrimination policies into performance evaluations; explain who employees can contact internally with discrimination questions, concerns or complaints; make introductory remarks during discrimination/harassment training; and/or otherwise champion equal employment opportunity within the business.

Share information about discrimination and harassment prevention early and often, such as in any employee handbooks, during new employee orientation, during employee meetings and in any internal business newsletters or publications.

Hold all employees accountable for complying with policies and acknowledge efforts to create and maintain a work environment in which discrimination and harassment aren’t tolerated.

Ensure that employees aren’t retaliated against for reporting employment discrimination or taking other actions protected by law (such as participating in an employment discrimination investigation or lawsuit or opposing employment discrimination). Retaliation is the most frequently alleged basis in charges of discrimination filed with the EEOC.

Seek assistance as appropriate. The EEOC’s Small Business Resource Center website has information tailored for small businesses. The EEOC also has designated small-business liaisons in offices across the country who can provide free information, training and outreach. The EEOC also provides information through its Attorney of the Day phone line, (202) 663-4691. Small businesses may also, of course, contact external human resources and/or legal experts for assistance.

You can put the above measures into place on your own and with the help of an employment lawyer.

Where to buy employment practices liability insurance

The market for purchasing employment practices liability insurance is actually quite small. A group of about 20 insurers underwrite about 85% of EPLI policies. That should make it easier to find the right policy for your company, but if you’re having trouble, we recommend hiring an insurance broker. A broker can also help you decipher exactly what is and isn’t covered by a specific policy. The insurance company will cover the broker’s fee.

We recommend that you buy an EPLI policy only from an insurance company which has at least an A-rating by AM Best. AM Best is a credit rating firm that scores insurance companies based on their financial stability.

Here are some of the top insurance providers for employment practices liability insurance:

AIG

AIG is an A-rated insurance company and the most active insurer for EPLI. It offers up to $25 million in coverage through their EPLI product, called Employment Edge. AIG provides coverage for a variety of employment-based claims brought against the company, management or employees. It also covers employment violations that occur over the internet, such as an employee making a discriminatory statement about a colleague in a chat room. There’s also third-party coverage, so you’re covered if a contractor or vendor claims that your company engaged in discrimination or harassment. Wage and hour claims aren’t covered, though AIG does sell a separate insurance product for that purpose. AIG also has risk control services designed to beef up your anti-discrimination efforts and lower your incidence of claims.

Chubb

Chubb can help your business thrive in the face of complicated employee challenges. It has an EPLI product called ForeFront Portfolio that covers a wide range of employment-related claims. Unlike some insurers, Chubb doesn’t require insurers to settle claims out of court. If you believe your business isn’t at fault, then you can litigate the claim in court with Chubb’s full backing. Chubb will also cover the full range of damages that a court might award to your employee, even punitive damages. Chubb also provides risk control services and special EPLI packages for professional firms.

Nationwide

Nationwide, an A-plus rated insurer, was not always one of the top insurance companies for EPLI coverage, but it's seen a 15% increase in EPLI applications between 2016 and 2017 — the same time that several public figures were accused of sexual harassment. Compared to Chubb and AIG, Nationwide is more focused on helping small businesses. Nationwide offers EPLI as a stand-alone policy and also offers EPLI as an endorsement to its business owners policy, or BOP, and general liability policy. Nationwide’s EPLI risk management services and law firm hotline can save business owners $1,000 or more during every policy period.

Travelers Insurance

Travelers also offers employment practices liability insurance as an optional add-on to their BOP. With your Travelers policy, you’ll receive protection against a wide range of employee lawsuits. You’ll also get free access to an online risk management program that has anti-discrimination training for managers and employees. Travelers even provides their EPLI customers with access to a helpline that’s staffed by employment lawyers. Claims reporting is very easy with Travelers.

CoverWallet

CoverWallet does things a little differently because it's an insurance marketplace, not an insurance company. Rather than underwriting its own policies, CoverWallet partners with several insurance companies and will help you find the best EPLI policy on the market from your business. All you have to do is fill out a quick questionnaire about your business, and CoverWallet will instantly generate EPLI quotes from multiple insurers. You’ll be able to see a summary of each insurer’s policy, and choose the one that offers the best coverage at the lowest price.

This article originally appeared on Fundera, a subsidiary of NerdWallet.