TaxAct Review 2024: Pricing, Features, Ease of Use

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

TaxAct is less well known among tax software providers, but it offers quality online software that generally costs less than TurboTax or H&R Block.

It may not be as fancy in some ways, but you can add screen sharing access with a tax pro, and the data-entry process is similar to other providers. And TaxAct’s prices are competitive. Jump to: Full review.

| |

Free Version Paid Packages | Pros:

Cons:

|

Full TaxAct review

TaxAct's prices

TaxAct’s products are generally less expensive than similar products from TurboTax and H&R Block. And price is an important factor, especially for people who need advanced tax software.

All filers can also upgrade to Xpert Assist, TaxAct’s tax help service, for an additional fee.

What you get from TaxAct's free version

TaxAct offers a free version that lets you file Form 1040 and Schedules A, C, D and E, but it can’t handle many common forms, which means it probably won’t work for you if you plan to deduct mortgage interest or report investment income.

Also, "free" isn't necessarily free: filing a state return carries a charge.

TaxAct at a glance

| |

FREE | $0 + $39.99 per state filed (Xpert Assist: $39.99). For dependents, simple filers who need help with college expenses, unemployment or retirement income. |

PAID PACKAGES | Deluxe $49.99 + $59.99 per state filed (Xpert Assist: $39.99). This option is ideal for homeowners and those who need to consider childcare expenses, student loan payments, deductions, credits and adjustments. Premier $79.99 + $59.99 per state filed (Xpert Assist: $39.99). Premier is good for investors who need to report capital gains and losses and those who have sold a home or own a rental property. Self-Employed $99.99 + $59.99 per state filed (Xpert Assist: $39.99). This tier is good for freelancers, contractors and small-business owners. Includes access to Schedule C and Schedule F. Promotion: NerdWallet users get 25% off federal and state filing costs. |

One note about prices: Providers frequently change them. Discounted services and packages may be available toward the beginning of the tax-filing season, but these markdowns tend to be replaced with surge pricing closer to the tax filing deadline. You can verify the latest price by clicking through to TurboAct’s site.

Simple tax filing with a $50 flat fee for every scenario

With NerdWallet Taxes powered by Column Tax, registered NerdWallet members pay one fee, regardless of your tax situation. Plus, you'll get free support from tax experts. Sign up for access today.

for a NerdWallet account

Transparent pricing

Maximum refund guaranteed

Faster filing

*guaranteed by Column Tax

TaxAct's ease of use

How it works

If you’ve filed with TaxAct before, you’ll start by importing last year’s return to reduce errors. Otherwise, you’ll fill out a questionnaire asking basic questions about your relationship status and your dependents. Then you’ll proceed to the tax forms where you’ll add information about your W-2s and any other tax-related situations.

Questions are phrased simply, and tax jargon is kept at a minimum. This makes the process of filing your taxes generally seamless. You simply answer questions and your return gets filled in behind the scenes.

Like with other tax software you’ll answer questions about your income, deductions and credits.

According to TaxAct, there is no option to downgrade to a lower-tier software once a filer has started their return or chosen to upgrade. If you don’t want to file with your upgraded software, you’ll have to start from scratch. Be sure to choose the right software before you get started.

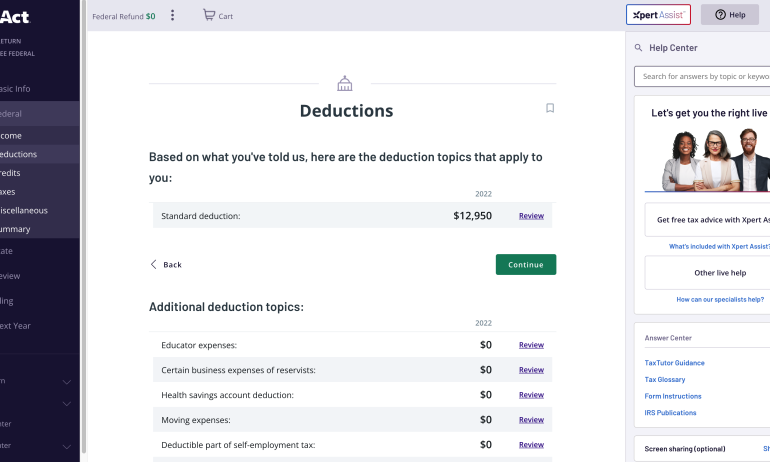

What it looks like

TaxAct has a similar look and feel to competitors’ products, with an interview process guiding you through it, and you can skip around more easily than most.

Embedded links throughout offer tips, explainers and other resources, and the help center links to a searchable knowledge base.

A shopping cart icon at the top tells you which package you’re buying, whether you’ve also selected add-ons, and how much your total software bill is so far.

TaxAct's handy features

You can switch from another provider: TaxAct will import last year’s return from TurboTax or H&R Block via a PDF of your 1040 return.

Auto-import of certain tax documents: You can import W-2s or take a photo of them and import a QR code, and you can upload 1099-B information from your broker if you have it in a spreadsheet (a CSV file). All of this lets you avoid spending time keying in numbers from little boxes.

Donation calculator: The Deluxe, Premier and Self-Employed packages all feature TaxAct’s Donation Assistant, which is helpful for quickly finding the deduction value of donated clothes, household items and other objects.

Platform mobility: Because the software is online, you can log in from other devices if you’re working on your return here and there, but TaxAct no longer offers a mobile app.

Simple tax filing with a $50 flat fee for every scenario

With NerdWallet Taxes powered by Column Tax, registered NerdWallet members pay one fee, regardless of your tax situation. Plus, you'll get free support from tax experts. Sign up for access today.

for a NerdWallet account

TaxActs's human tax help

Xpert Assist

All TaxAct filers can add access to live, on-screen tax advice from a tax pro with TaxAct’s Xpert Assist service for an additional $39.99. To use Xpert Assist, you start by submitting a question. Then, the appropriate expert to answer those questions will reach out to you over the phone. When talking with the expert, you can share your screen. TaxAct says its tax pros are CPAs and enrolled agents.

You can also have an expert review your return before you file.

TaxAct's support options

Here's a look at the various ways you can find answers and get guidance when filing your return with TaxAct.

Ways to get help

General guidance: Searchable knowledge base.

Tech support: Free tech support by phone for all with weekend and after-hours support during the tax-filing season.

If you're audited

Getting audited is scary, so it’s important to know what kind of support you’re getting from your tax software. First, be sure you know the difference between “support” and “defense.” With most providers, audit support (or “assistance”) typically means guidance about what to expect and how to prepare — that’s it. Audit defense, on the other hand, gets you full representation before the IRS from a tax professional.

TaxAct works with ProtectionPlus to offer its clients free, full-service audit assistance. Customers can also buy audit defense from ProtectionPlus for $49.95. Coverage includes three years of audit services for this year’s return, and TaxAct says the product will guide you through the audit process, handle IRS and state correspondence on your behalf, help with tax debt and provide tax-fraud assistance. TaxAct says that if there is an issue with its calculations TaxAct will pay up to $100,000 to cover audit and legal costs.

TaxAct refund options

No matter how you file, you can choose to receive your refund several ways:

A direct deposit to a bank account is the fastest option. You can also have it loaded onto an American Express Serve prepaid debit card (if you’re getting a refund on your state taxes, see if your state offers a prepaid card option as well) or sent as a paper check.

Other options include applying the refund to next year’s taxes or buying U.S. savings bonds with your refund.

You have the option of paying for the software out of your refund — but there’s a $17.99 charge to do that.

How TaxAct compares

Promotion: NerdWallet users get 25% off federal and state filing costs. | |

| |

Promotion: NerdWallet users can save up to an additional 10% on TurboTax. | |

|

Bottom line: Is TaxAct right for you?

Across the board, TaxAct’s offerings are less expensive than similar products from competing providers. That’s a nice score — especially for filers who value function over form and want affordable human help if necessary.

» How does TaxAct stack up against the competition? TaxAct vs. TurboTax

Methodology

NerdWallet’s comprehensive review process evaluates and ranks the largest online tax software providers. Our aim is to provide an independent assessment of available software to help arm you with information to make sound, informed judgements on which ones will best meet your needs. We adhere to strict guidelines for editorial integrity.

We collect data directly from providers, do first-hand testing and observe provider demonstrations. Our process starts by sending detailed questions to providers. The questions are structured to equally elicit both favorable and unfavorable responses. They are not designed or prepared to produce any predetermined results. The provider’s answers, combined with our specialists’ hands-on research, make up our proprietary assessment process that scores each provider’s performance.

The final output produces star ratings from poor (1 star) to excellent (5 stars). Ratings are rounded to the nearest half-star. For more details about the categories considered when rating tax software and our process, read our full methodology.

DIVE EVEN DEEPER IN TAX SOFTWARE

Federal Income Tax Calculator: Return and Refund Estimator 2023-2024

Track My Refund: How to Check Your 2024 Tax Refund Status