AXA Travel Insurance Review: Is it Worth The Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

AXA

Pros

- Lowest-cost plan includes some medical coverage.

- Pre-existing conditions waiver add-on available for higher-cost plans.

Cons

- No add ons are available for Silver-level policyholders.

- CFAR upgrade is only available for highest-cost plan.

AXA

Pros

- Lowest-cost plan includes some medical coverage.

- Pre-existing conditions waiver add-on available for higher-cost plans.

Cons

- No add ons are available for Silver-level policyholders.

- CFAR upgrade is only available for highest-cost plan.

In the era of staff shortages and extreme weather, your trip may not go exactly to plan. When that happens, travel insurance can be a big help. Although an insurance policy can’t prevent a delay or cancellation from happening, it can help relieve the financial burden if something unpredictable does occur on your trip.

But how do you know which insurance provider to go with? Here's a look at AXA travel insurance to help you determine if one of its plans is right for you.

What is AXA?

AXA is a French insurance company that does business in over 200 countries. It offers many different types of insurance, including policies for travelers. These include coverage for baggage loss, trip cancellation and interruption, emergency evacuation and emergency medical costs. Cancel for any reason coverage is also offered.

AXA Assistance USA is part of the AXA Group.

» Learn more: How much is travel insurance?

AXA travel insurance plans

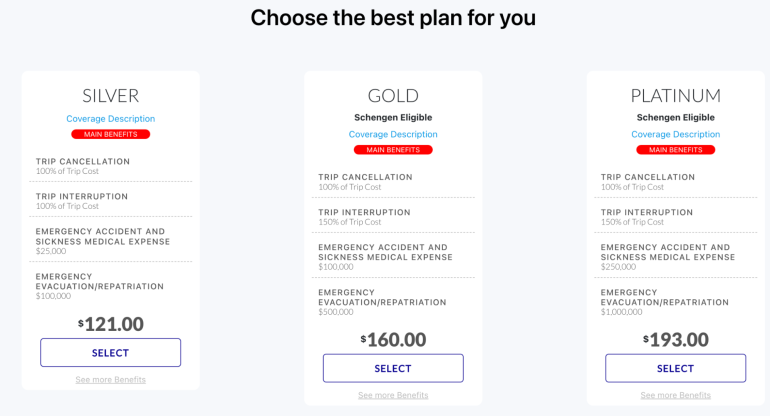

AXA Assistance USA offers travelers three insurance plans: Silver, Gold and Platinum. The plans are underwritten by Nationwide Mutual Insurance Company and their affiliates in Columbus, Ohio. Here's the coverage you can expect from each policy.

Silver: This is the least expensive plan that offers 100% trip cancellation and trip interruption coverage, $25,000 in emergency accident and sickness medical coverage and $100,000 in emergency evacuation and repatriation coverage.

Gold: The mid-range Gold policy comes with 100% trip cancellation and 150% trip interruption coverage, $100,000 in emergency accident and sickness medical coverage and $500,000 in emergency evacuation and repatriation coverage.

Platinum: The AXA Platinum travel insurance plan includes 100% trip cancellation and 150% trip interruption coverage, $250,000 in emergency accident and sickness medical coverage and $1,000,000 in emergency evacuation and repatriation coverage.

If you want to add Cancel For Any Reason coverage, you’ll need to select the Platinum plan and purchase a policy within 14 days of paying the initial trip deposit. It’ll cover 75% of the prepaid nonrefundable expenses for your travel.

If you’d like coverage for pre-existing medical conditions, a waiver is available on the Gold and Platinum plans as long as you buy coverage within 14 days of your first trip payment.

» Learn more: How does travel insurance work?

Which AXA travel insurance plan is best for me?

Let’s compare AXA’s plans, the costs and coverage for a 19-day trip to Indonesia that costs $1,500 for a 36-year-old traveler who lives in Utah.

Silver

Coverage and limits for the Silver-level plan include:

Trip delay: $100 per day, with a $500 maximum.

Trip cancellation: 100% of the trip cost.

Trip interruption: 100% of the trip cost.

Baggage delay: $200.

Lost baggage: $750, up to $150 per article.

Missed connection: $500.

Emergency evacuation: $100,000.

Accidental death and dismemberment: $10,000 ($25,000 if on a common carrier).

Emergency accident and medical expense: $25,000.

The plan cost for our sample trip is $55.

Gold

For $79, the Gold-level tier offers the following coverage and limits:

Trip delay: $200 per day, with a $1,000 maximum.

Trip cancellation: 100% of the trip cost.

Trip interruption: 150% of the trip cost.

Baggage delay: $300.

Lost baggage: $1,500, up to $250 per article.

Missed connection: $1,000.

Emergency evacuation: $500,000.

Accidental death and dismemberment: $25,000 ($50,000 if on a common carrier).

Emergency accident and medical expense: $100,000.

Collision damage waiver: $35,000.

Platinum

Platinum is AXA’s highest tier level. This plan includes:

Trip delay: $300 per day, with a $1,250 maximum.

Trip cancellation: 100% of the trip cost.

Trip interruption: 150% of the trip cost.

Baggage delay: $600.

Lost baggage: $3,000, up to $500 per article.

Missed connection: $1,500.

Emergency evacuation: $1,000,000.

Accidental death and dismemberment: $50,000 ($100,000 if on a common carrier).

Emergency accident and medical expense: $250,000.

Collision damage waiver: $50,000.

Lost golf rounds: $500.

Lost skier days: $25 per day.

Pet boarding fees: $25 per day (up to five days).

This level of coverage costs $95.

» Learn more: The best credit cards for travel insurance benefits

Can you buy AXA travel insurance online?

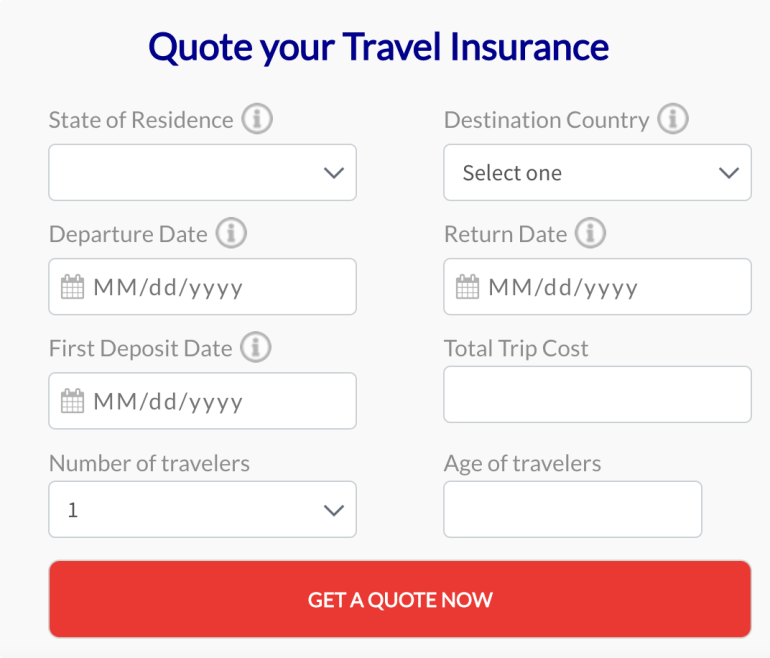

To get an AXA travel insurance quote, go to AXATravelInsurance.com and start by inputting your information in the quote box. Enter your state of residence, destination country, trip dates, date of first trip deposit, total trip cost, the number of travelers and their ages.

Once you’ve filled out the form, click on the “Get a quote now” button.

You’ll be presented with three quotes, one for each plan level. Make sure to click on the “See more benefits” link to get more information on each plan’s coverage limits. The plans with the highest coverage limits will be the most expensive.

If you need a pre-existing conditions waiver, select the Gold or Platinum plan. You’ll also have to purchase the plan within 14 days of making your initial trip deposit to be eligible.

The Gold and Platinum levels are also the two plans that offer Schengen zone coverage and a collision damage waiver. The Platinum plan is the only one that offers a Cancel For Any Reason add-on, so keep that in mind if you need more protection.

Overall, if you’re looking for emergency medical and emergency evacuation coverage specifically, the limits are good on all the plans, including the least expensive one.

To compare plans from multiple insurance providers at once, we recommend checking out Squaremouth, a travel insurance comparison site and a NerdWallet partner. The website helps you pick the right plan by displaying multiple quotes from many insurance providers, including AXA, in one spot.

Is AXA legit?

AXA began in the early 19th century as a small insurance company specializing in property and casualty insurance.

Since then, the company has evolved, changing names and acquiring other insurance brands, until it became AXA in the 1980s. It is now one of the largest insurance companies in the world. In other words, yes, AXA is a legitimate travel insurance provider.

» Learn more: The best travel insurance companies

What isn't covered by AXA travel insurance?

Every plan has different exclusions, so it's important to look at your coverage summary. Generally, pre-existing conditions without a previously purchased waiver are not covered.

Other limitations include:

Intentionally self-inflicted injuries.

Participation in bodily contact or extreme sports.

Traveling for the purpose of securing medial treatment.

Accidental injury or sickness when traveling against the advice of a physician.

Non-emergency treatment or surgery.

Is AXA travel insurance worth it?

It's said that travel is the only thing you buy that makes you richer. But you don’t want to become poorer if something goes wrong before or during a trip. We don’t know what the universe has in store for us, so buying a travel insurance policy is one way we can protect our investment.

AXA offers budget, mid-range and premium policies that are easy to understand, provide adequate coverage and don’t cost a fortune.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024, including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x

Points60,000

Pointson Chase's website

1x-5x

Points60,000

Pointson Chase's website

1x-2x

Points50,000

Points