Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

If you want your regular coffee spot, hole-in-the-wall restaurant or family-owned bistro to stay in business post-pandemic, ordering food for takeout or delivery is one of the ways you can keep the cash flowing for them.

As a bonus, all of the spending you do now at your favorite restaurants can help you earn rewards to fund your next vacation. Here are some of the best credit cards to help you support your community’s food establishments with delivery and takeout orders (while earning points and miles for your future travel needs).

Credit cards with bonuses on restaurant spending

When you place your order, try to use a credit card that earns extra points in the restaurant spending category. Here are some popular options:

For points on dining

The Chase Sapphire Reserve® offers 3x points per dollar on dining (and travel, in case you want to book ahead with current flexible change policies).

The Chase Sapphire Preferred® Card, with its lower annual fee, also offers 3x points on dining.

For cash back on dining

The Capital One Savor family of cards has great choices for consumers looking for cash back instead of travel rewards. The Capital One Savor Cash Rewards Credit Card offers cardholders an unlimited 4% cash back on dining.

Meanwhile, the no-annual-fee Capital One SavorOne Cash Rewards Credit Card offers 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all other purchases. The former offers 2% cash back on grocery stores, which will also be helpful during this “stay at home” period.

The Costco Anywhere Visa® Card by Citi is another option. It has 3% cash back on dining, in addition to 2% cash back on Costco purchases. Bulk toilet paper aisle, here we come!

For miles

If your loyalty lies with a specific airline and you’re focused on future travel opportunities, there are some airline credit cards that offer dining bonuses, too. Three of four cards in Delta’s family of co-branded cards come with double miles at restaurants.

The United℠ Explorer Card and the recently revamped United Club℠ Infinite Card offer 2x miles on every dollar spent at restaurants.

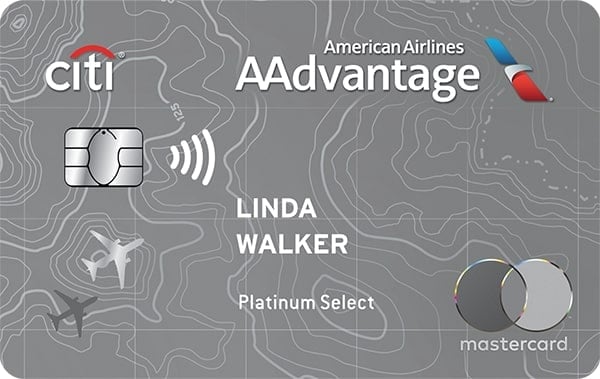

Similarly, American Airlines has the Citi® / AAdvantage® Platinum Select® World Elite Mastercard® that offers double miles on dining and the American Airlines AAdvantage® MileUp®, which offers double miles on groceries (including grocery deliveries).

Take advantage of credit card food delivery benefits

UberEats has waived delivery fees for independently owned restaurants during the COVID-19 outbreak. Your credit card might offer benefits, too. For example, the recently revamped Chase Sapphire Reserve® covers a minimum one-year DashPass subscription, which allows you to save on all of your DoorDash orders.

You must activate your subscription by Dec. 31, 2024, to take advantage of this benefit. If you activate your subscription more than a year out from the end of 2024, you'll get to enjoy this perk for more than the 12-months minimum.

Cardholders of the American Express® Gold Card can get a monthly $10 in Uber Cash to use when they order through UberEats in the U.S. (up to $120 a year). They must add their card to their Uber account to begin receiving the Uber Cash.

Plus, cardholders can use a monthly $10 statement credit on Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and participating Shake Shack locations. Terms apply.

Use your airline’s dining program for takeout

If you want to go the extra mile, check out which local restaurants are on your favorite airline’s dining program. It’s free to join — all you have to do is link a card and you can earn bonus miles for dining at certain restaurants in your neighborhood.

For example, with American Airlines’ AAdvantage Dining Program, you can earn 3x miles per dollar you spend at participating restaurants if you sign up for the program and subscribe to emails. Suddenly, your $25 takeout order has earned you 75 miles.

Pay for it with your Citi® / AAdvantage® Platinum Select® World Elite Mastercard®, and now your takeout order has earned you an additional 50 miles, for 125 miles in total.

Dining programs usually have sign-up bonus promotions as well, just like credit cards. Find out what the requirements are — usually, spending at least $25 or $30 at a restaurant within the first 30 days of joining — and plan how you’re going to eat your way to meeting that offer threshold, while supporting restaurants during such a difficult time.

Shop online

Finally, many local retailers have online stores you may not have ever visited if you’re used to their brick-and-mortar location. But businesses are getting creative: Coffee shops sell some roasts you can make at home, and ice cream purveyors can ship you pints for your movie marathons. Even my local hummus guy from the farmer’s market is delivering.

Many of these online purchases at food establishments still count for extra points when you pay with credit cards that have bonuses on dining. You also have the option of buying gift cards, when available, so you can still help restaurants and cafes right now and visit later.

The information related to the Capital One Savor Cash Rewards Credit Card has been collected by NerdWallet and has not been reviewed or provided by the issuer of this card.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024, including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-5x

Points60,000

Pointson Chase's website

1.5%-6.5%

Cashback$300

2x-5x

Miles75,000

Miles