The Best Days to Book a Flight and When to Fly

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Believing there’s just one optimal day a week to save on flights — and that day is Tuesday — is the stuff of legends. And like all good legends, there is some truth to it … but it’s not the whole story.

The reality is that flight prices change constantly and at all hours of the day, adjusting to real-time demand. Airlines don’t restock on the same day every week like a grocery store, so you won’t find deals by waiting until Tuesdays to book. However, you might find some modest savings if you’re willing to fly on Saturdays or midweek, when there’s less demand than usual.

Here’s what the data shows on the best days to book a flight and when to fly.

» Learn more: The best travel credit cards right now

Best day to book a flight

No single day of the week is best to book a flight. You can find deals any day of the week since flight prices fluctuate with demand.

Airlines might offer sales, increase the number of seats on a route or even lower prices to match a competitor, so there’s no actual pattern in what day of the week has the best deals.

Best day to fly

Hopper — a travel booking app — collected flight booking data from October 2023 through April 1, 2024 for May 2024 departures. Here are the findings about the best day to fly.

Tuesday and Friday flights can help you avoid the rush earlier in the week

Sundays and Mondays are the most expensive days to depart for domestic trips. If you can’t fly on the cheapest days, flying on Tuesdays or Fridays might also be a good option. The average airfare is about 12% lower than peak Sunday prices on these days.

Mondays can still be a relatively expensive day to fly domestically. By departing on Monday instead of Sunday, you can expect to save only about $9, or about 3%.

Wednesdays and Saturdays are the cheapest day to fly internationally

Meanwhile, international flyers would also be wise to leave on Wednesdays or Saturdays, usually the cheapest days to depart for an international trip. That said, there isn’t a huge difference in price across the days of the week for most international routes.

Hopper estimates that leaving on a Wednesday for Europe will only save you about 10% compared to the most expensive day (Friday).

Fly on the holidays (or as far from it as possible)

Holidays are an entirely different beast, no matter whether it’s the Fourth of July or Labor Day. There are generally more people flying in the days around a holiday, so there are fewer airplane seats available and higher prices.

To get the best deal, book as early as possible. Because many airlines have flexible cancellation policies, it doesn’t hurt to lock in a decent rate ahead of time and rebook if the flight price drops in the months after. According to Google Flights’ 2023 insights, the best time to book a mid-December holiday flight is 71 days before departure.

In many cases, the best day to fly will be further out from the holiday. If the holiday falls on a Monday, flying the Tuesday before will likely be cheaper than flying the Friday before. You can also look at flying on the holiday itself. For example, flying on Christmas Day or Thanksgiving Day is usually much more affordable than flying on the days before or after.

Here are our recommendations for when to fly around some of the major holidays based on recent checkpoint data from the Transportation Security Administration (TSA):

• 5 points per dollar spent on travel (including flights) booked through Chase.

• 2 points per dollar on other travel (including flights).

Annual fee: $95.

• 5 points per dollar spent on flights booked directly with airlines or through American Express Travel (on up to $500K per calendar year). Terms apply.

Annual fee: $695.

• 3 points per dollar spent on air travel.

Annual fee: $95.

• 3 points per dollar spent on flights booked directly with airlines or on amextravel.com. Terms apply.

Annual fee: $250.

To view rates and fees of The Platinum Card® from American Express, see this page. To view rates and fees of the American Express® Gold Card, see this page.

Tips to find cheap flights any day of the week

Book one to three months in advance

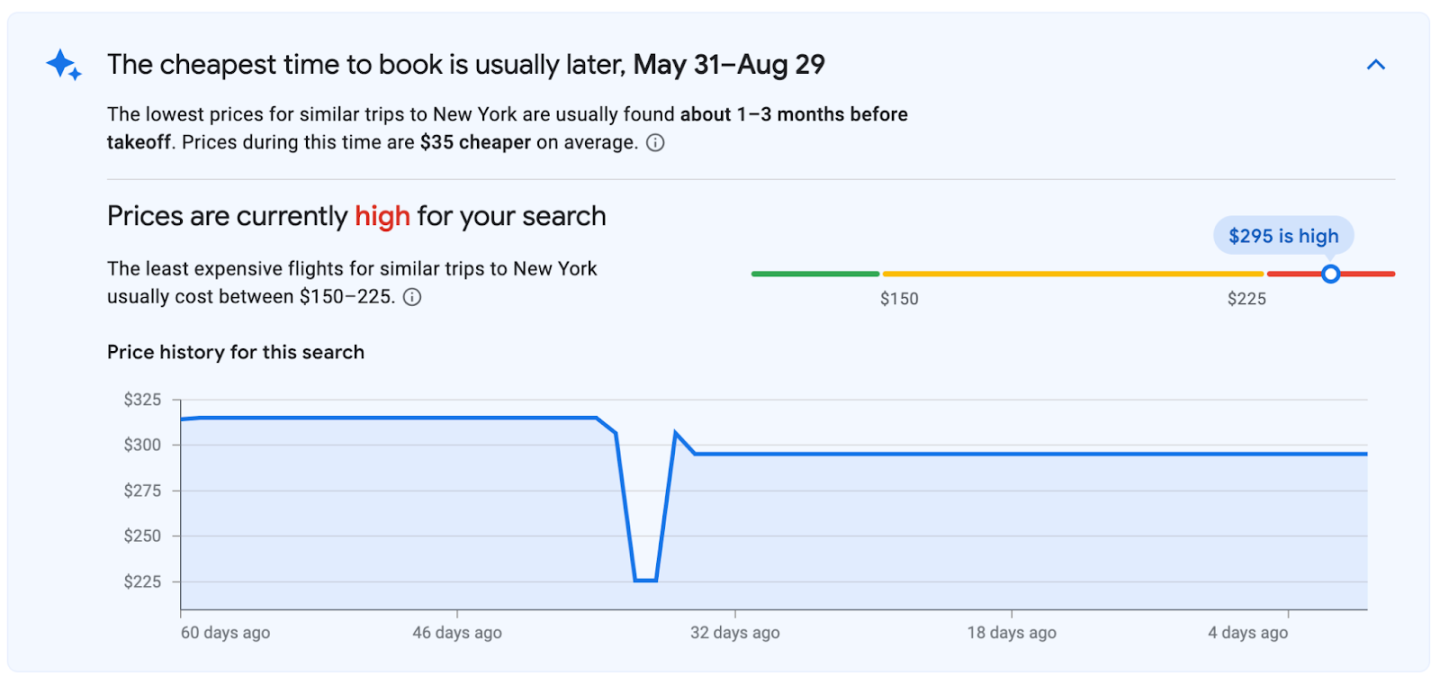

Even though no day of the week consistently has cheaper flights, there is a time period during which you should book before prices go up.

Going, a flight deals aggregator, recommends booking domestic flights one to three months in advance to avoid any price surges in the weeks leading up to the departure date. Last-minute flight deals aren’t super common and you risk not getting a seat at all because your desired flight might ultimately sell out. If you’re flying internationally, you’ll want to look two to eight months out.

It doesn’t hurt to look at flight prices before the ideal booking window. Google Flights, for example, sometimes shows in the search results when it expects prices to be the lowest based on historical data for your route.

Set a price alert

Let a computer program do the work for you. Instead of checking flight prices every day, set a price alert on the travel search engine of your choice — whether it’s Google Flights, Hopper, Skyscanner or Kayak. They’ll send you an email when they see the price drop.

Rebook if you find a cheaper price

Most airlines have adopted more flexible change and cancellation policies, which make it easier to rebook your flight and save money.

First, you’ll have to make sure that the original flight you booked will not have change or cancellation fees. For most airlines, that applies to most main cabin and premium class tickets on domestic flights and some short-haul international flights. You usually cannot change or cancel basic economy tickets for free.

If you can cancel or change without fees, set a price alert. When the price drops, you can cancel your flight and rebook (on the same airline or a different one) to get the cheaper price. Be aware that you might only get a travel voucher or credit if you cancel, so you should only use the option if you are fairly confident you will fly with the original airline again within one year.

Be flexible with destination, airport and dates

The golden rule of cheap travel remains: Be flexible. Use Google Flights to see if there are cheaper places to go by leaving the destination field blank when you search. Check nearby airports if you’re set on a destination and use the calendar views to find lower prices on different dates. Maybe embrace a long layover as a chance to see another city on your trip.

After all, the best day to book a flight and the best day to fly is when it’s cheapest, and that could vary depending on when and where you are going.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024, including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-5x

Points60,000

Pointson Chase's website

1.5%-6.5%

Cashback$300

2x-5x

Miles75,000

Miles