Expedia Payment Plans: What to Know

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

There’s no doubt that travel can be expensive. Between flights, hotels, rental cars and more, booking and paying for a trip all at once can seem daunting if you haven’t saved for it. That’s why payment plans — the option to pay in installments over time instead of all at once — can be so enticing. Are they a good idea?

Online travel agencies like Expedia are popular services for travelers. But does Expedia let you buy now and pay later? It does.

Here, we break down what Expedia payment plans are and what’s important to know before you sign up for one on this third-party site.

What is a ‘buy now, pay later’ loan?

Buy now, pay later (BNPL) services are offered by many travel brands and companies these days as booking payment plan vacations becomes more common. They are payment options that offer travelers a way to book travel now, but pay for it over a specified period of time in regular installments.

It’s similar to a credit card, but these loans may have lower interest rates and they typically offer automatic deductions from your debit card or bank account.

There are several companies that offer these sorts of loans across the web, but Expedia partners with Affirm to offer the service to their customers.

» Learn more: Should you use Buy Now, Pay Later services for travel?

How do Expedia payment plans work?

Expedia makes it easy to book your travel and pay using a trip payment plan. All you have to do is select the flights, accommodations, car rentals or even cruises that you’d like to book, then select “Monthly Payments” during the checkout process.

You’ll be prompted to log in to Affirm or create an account if you haven’t already. On-screen prompts will then lead you through the process, which includes a soft credit check to make sure you’re eligible for what is essentially a loan. This check won’t affect your credit score.

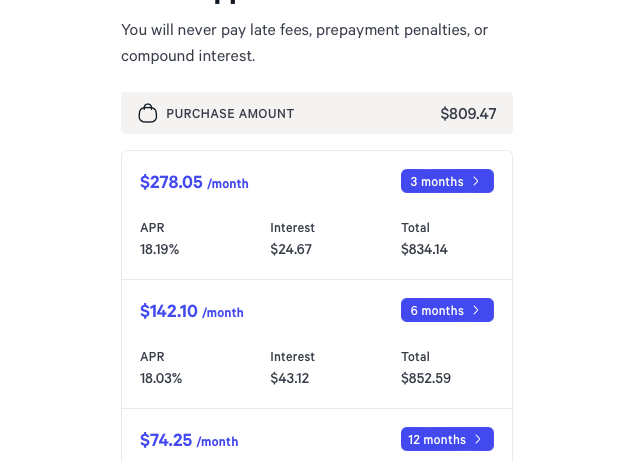

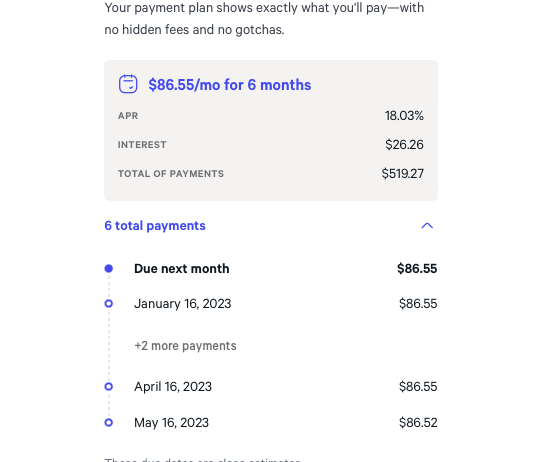

You’ll then see a list of payment options if you’re approved. In our search for a flight and rental car for a week-long trip to San Francisco that costs $809.47, we had the option to pay in three-, six- or 12-month installments. The monthly payment, interest amount, APR rate and total cost is displayed for each option so you know how much extra you’ll be paying on top of the base price of your travel.

Select an option that suits you, then choose whether to have automatic payments deducted from your account via a debit card or bank account. You’ll then complete checkout and pay over time, starting with your first payment the following month.

» Learn more: How to book travel on Expedia

Downsides of using an Expedia payment plan

Expedia makes it easy to book travel now and pay for it later, but it’s not necessarily a good idea for everyone.

There’s the loan’s interest to deal with, which you wouldn’t have to pay if you pay for your travel in full, assuming you pay your credit card balance and avoid interest charges. On the upside, Affirm states in their terms and conditions that they don’t charge late payment fees or penalty fees if your payment is returned or doesn’t go through (say, from lack of funds in your bank account). You won’t likely get the same treatment from your bank.

That said, if you are more than 120 days late on a payment, Affirm may send you to collections, which may impact your credit score.

If you or the airline have to cancel or postpone your travel plans, refunds can get tricky. Expedia will refund the base cost of your travel, but you will still be on the hook for any interest that has already accrued.

» Learn more: What factors affect your credit scores?

Should you book travel using an Expedia payment plan?

Does Expedia do payment plans? Yes — but that doesn’t mean it’s a good option for everyone or every situation.

For starters, depending on the interest rate of the credit cards you already have, you may be paying as much, or more, interest with Affirm. Even if Affirm offers a slightly lower rate, it’s likely not worth the headaches of having to deal with multiple entities (airlines, Expedia and Affirm) if your travel plans change or are canceled.

There are times when using an Expedia payment plan could come in handy, of course. For example, if you’re unable to pay for a last-minute ticket in full, and your available credit cards have much higher interest rates than Affirm, a payment plan might save you money.

But if you’re a points and miles collector, the biggest downside is that you won’t be earning any additional benefits like you do when paying with a travel rewards credit card. That means you’re potentially leaving hundreds or thousands of points and miles on the table that could eventually go toward award flights or hotel stays.

There is also the option of no- and low-APR rewards cards available.

» Learn more: How travel credit cards work

Expedia payment plans recapped

When booking travel on Expedia, the available payment plans offered through Affirm may sound like an enticing option. The BNPL service may be smart way to break up a purchase, especially if you get a low-interest offer and know you can make your payments on time.

On the other hand, refunds and cancellations can be complicated if travel plans change, and you won’t earn points and miles like you would when paying with a travel rewards credit card.

So before you utilize the service, read the fine print, weigh your options and choose wisely.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024, including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-5x

Points60,000

Pointson Chase's website

1.5%-6.5%

Cashback$300

2x-5x

Miles75,000

Miles