The Hardest Airline Miles to Earn — and Why They’re Worth It

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

When flying United Airlines, most travelers default to earning miles through United's MileagePlus loyalty program. However, I credit all of my United Airlines and Star Alliance flights to the loyalty program of an airline that I've never flown: Asiana Airlines.

Why's that? Asiana Club miles are much more valuable to me than United miles. After all, you can use Asiana miles to fly business class to Europe for just 40,000 miles. And while United miles can be easily generated by transferring Chase Ultimate Rewards® points, Asiana Club miles are much harder to earn.

Let's look at five of the hardest miles to earn and why they're worth the difficulty to get.

» Learn more: The best travel credit cards right now

1. Alaska Airlines Mileage Plan

Seattle-based Alaska Airlines may be one of the larger airlines in the U.S. However, the airline's miles aren't easy to get outside of flying. In addition, Mileage Plan isn't a transfer partner of any major bank's transferable points currency. That means it's challenging to build up or top off your Alaska mileage account quickly.

That's a shame, as Alaska Mileage Plan miles are quite valuable. When used for Alaska flights, NerdWallet found Mileage Plan miles are worth just 1.4 cents for economy awards but 1.4 cents for business class awards.

Redemptions on Mileage Plan partners can be even more valuable. For example, one of the best Alaska Airlines sweet spots lets travelers book Cathay Pacific awards from the U.S. to Asia for just 35,000 miles in premium economy or 50,000 miles in business class. Even better, you can build in a stopover in Hong Kong for no additional mileage cost.

How to earn Alaska Mileage Plan miles

You have several options to take advantage of these sweet spots. The easiest way of building up a stash of Mileage Plan miles is to sign-up for the Alaska Airlines Visa Signature® credit card. New cardholders: Get 60,000 bonus miles plus Alaska's Famous Companion Fare™ ($99 fare plus taxes and fees from $23) with this offer. To qualify, make $3,000 or more in purchases within the first 90 days of opening your account.

Alternatively, you can transfer Marriott Bonvoy points to Alaska Mileage Plan at a 3:1 transfer ratio. Plus, you'll earn a 5,000-mile bonus for every 60,000 points you transfer. That means you'll get 25,000 Alaska Mileage Plan miles for transferring 60,000 Bonvoy points.

» Learn more: Your guide to Alaska Airlines Mileage Plan

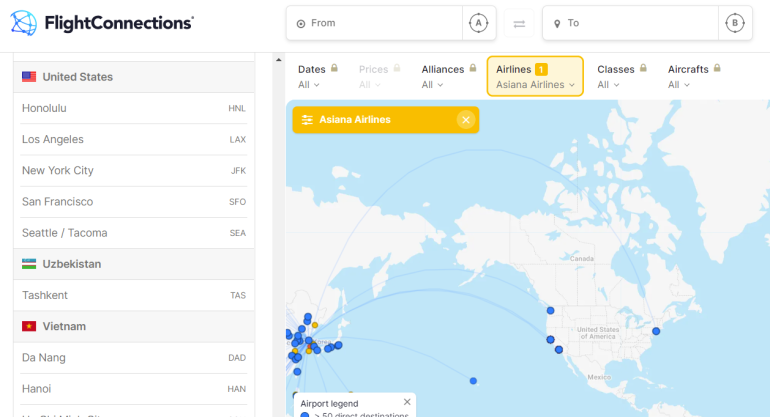

2. Asiana Club

Asiana Club is the mileage program of Korean-based Asiana Airlines. This Star Alliance airline currently flies to more than 60 destinations across 24 countries — including a handful of destinations in the U.S.

However, Asiana Club miles are valuable for more than just flights on Asiana. Most of the best Asiana Club redemptions are on partner airlines. Just some of the many sweet spots from the United States include:

United business class to southern South America for 35,000 miles each way.

United business class to Europe from 40,000 miles each way.

Lufthansa first class to Europe for just 50,000 miles each way.

United business class to South Africa for 60,000 Asiana miles each way.

How to earn Asiana Club miles

The primary way to earn Asiana Club miles is by flying Asiana or its Star Alliance partner airlines, such as United and Air Canada. You also have the option to transfer points from several hotel programs, including:

Best Western — get 1,000 miles for every 5,000 points you transfer (5:1 ratio).

IHG One Rewards — get 2,000 miles for every 10,000 IHG One points you transfer (5:1 ratio).

Marriott Bonvoy — 3:1 transfer ratio, with a 5,000-mile bonus for transferring 60,000 points.

World of Hyatt — get 500 miles for every 1,250 points you transfer (2.5:1 ratio).

Previously, Bank of America offered an Asiana Airlines Visa Signature Credit Card. However, this card is currently unavailable to new cardholders.

3. Japan Airlines JAL Mileage Bank

Japan Airlines is another Asian airline with an incredibly valuable mileage program: JAL Mileage Bank. However, unlike some airlines, Japan Airlines offers affordable redemption rates on its flights.

For example, use JAL Mileage Bank miles to book award flights between North America and Japan on Japan Airlines for:

25,000 miles each way in economy.

32,500 miles each way in premium economy.

50,000 miles each way in business class.

70,000 miles each way in first class.

Or, flyers can use JAL Mileage Bank to book award flights on Japan Airlines' Oneworld partners. The mileage cost of these awards depends on the total trip distance of the flights. This means round-trip awards are much better than booking two one-way awards.

Among the JAL Mileage Bank sweet spots is booking Cathay Pacific flights from New York to Singapore via Hong Kong. You can book business class for just 120,000 miles round-trip or first class for 170,000 miles round-trip.

How to earn JAL Mileage Bank miles

The most common way to accumulate JAL Mileage Bank miles is by flying on:

American Airlines.

Alaska Airlines.

British Airways.

Japan Airlines.

Japan Airlines' other Oneworld partners.

While JAL Mileage Bank isn't a transfer partner of any bank transferable points programs, you can transfer points to Japan Airlines from several hotel loyalty programs:

Accor Live Limitless — get 2,000 miles for every 4,000 points you transfer (2:1 ratio).

Marriott Bonvoy — 3:1 transfer ratio, with a 5,000-mile bonus for transferring 60,000 points.

IHG One Rewards — get 2,000 miles for every 10,000 IHG One points you transfer (5:1 ratio).

World of Hyatt — get 500 miles for every 1,250 points you transfer (2.5:1 ratio).

Diehard JAL Mileage Bank fans can get the JAL USA Card. However, the mileage earning rate isn't great:

Basic Rewards: 1 mile per $2 spent on qualifying purchases.

Premium Rewards: 1 mile per $1 spent on qualifying purchases.

» Learn more: The points collector's guide to Japan Airlines

4. Korean Airlines Skypass

Korean Airlines' Skypass award chart is so valuable that it has an expiration date. The current Skypass award chart is only valid until March 31, 2023. After that, redemption rates increase. Until then, you can take advantage of some excellent redemptions.

Award flights on Korean Airlines from North America to Korea, Japan, China or Northeast Asia start at just 70,000 miles round-trip in economy or just 125,000 miles round-trip in business class. You need to avoid a few weeks of peak dates to get these rates.

For partner flights — such as on Delta Air Lines, Air France and KLM — you can pay:

25,000 miles round-trip to anywhere in North America, including Hawaii.

80,000 miles round-trip in business class to Europe.

120,000 miles round-trip in business class to the Middle East or Africa.

How to earn Korean Airlines Skypass miles

Like Asiana and Japan Airlines, Korean Airlines partners with several hotel loyalty programs — including Marriott Bonvoy — which travelers can use to top off their mileage balance. Korean Airlines also partners with U.S. Bank to offer three different kinds of credit cards to U.S.-based travelers:

Skypass Visa Signature Card.

Skypass Select Visa Signature Card.

Skypass Visa Signature Business Card.

Each currently offers new cardholders 30,000 bonus miles after spending $3,000 in eligible purchases in the first 90 days.

» Learn more: The guide to the Korean Air Skypass program

5. Lufthansa Airlines Miles & More

Lufthansa Miles & More miles can help you unlock some of the business premium cabins to Europe — from Austrian Airlines business class to Lufthansa First Class.

For example, Lufthansa generally only opens first-class award space to partner loyalty programs within two weeks of departure. That's far too short of notice for most travelers to plan their vacation. However, if you have Miles & More miles, you can book Lufthansa First Class up to one year in advance. This once-in-a-lifetime award costs a reasonable 91,000 miles each way, but you'll need to pay almost $1,000 in taxes and fees.

Another great reason to collect Miles & More miles is to book Miles & More mileage bargains. These limited-time offers can provide incredible value when booking trips between the U.S. and Europe. For example, at the time of writing, you can book business class flights to multiple European cities for just 55,000 miles round-trip. That's less than half of the award chart price.

How to earn Lufthansa Miles & More miles

Lufthansa Miles & More might just be the most challenging miles to get. Miles & More isn't a partner of any major transferable point program, and World of Hyatt is the only hotel loyalty program we can find that partners with Lufthansa. That means U.S.-based travelers are limited to generating Miles & More miles by flying Lufthansa or its Star Alliance partners.

Or, you can sign-up for the Lufthansa credit card for U.S. travelers. Lufthansa partners with Barclays to issue the Lufthansa Miles & More Credit Card. New cardholders: 15,000 Lufthansa Miles Bonus

Cardholders earn 2x Miles & More miles on Lufthansa group airlines and 1x miles everywhere else. Plus, cardholders receive two Lufthansa business class lounge vouchers and a companion ticket each year for the card's $59 annual fee.

The bottom line

It's convenient to stick to the airline loyalty programs you already know. However, many of these programs have become so widely used that they don't need to provide competitive redemption rates. So instead, the airline loyalty programs with the hardest-to-get miles can provide the most value.

You might not end up switching to earning Asiana Club miles from your United and Star Alliance flights — as I do. However, it's worth exploring your mileage options a bit more to figure out if there's another program that can provide you a better bang for your mileage-earning buck.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024, including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-5x

Points60,000

Pointson Chase's website

1.5%-6.5%

Cashback$300

2x-5x

Miles75,000

Miles