How to Find Travel Insurance That Offers COVID Coverage

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Traveling now carries with it more uncertainty than ever before. If you plan on traveling anytime soon, one thing you can do to protect yourself is get a trip insurance policy that includes coronavirus coverage. Previously, many insurers excluded COVID-related claims due to the virus’ status as a foreseen event/pandemic.

But now, some insurers are changing their tune. Here’s what you need to know about how to find travel insurance providers that offer coronavirus-related coverage, as well as what is and isn’t covered.

Does travel insurance cover COVID?

Coronavirus coverage falls into several categories:

Trip cancellation: You need to cancel a trip prior to departure because you, a covered travel companion or possibly someone you need to care for contracted COVID-19.

Trip delay: Your trip is delayed due to changing COVID-related guidelines.

Travel medical coverage: You (or a covered travel companion) become ill with COVID-19 while traveling abroad and incur health care expenses or require an evacuation.

Of providers that are offering COVID policies, most are covering these expenses.

» Learn more: The majority of Americans plan to travel this year, according to recent NerdWallet study

What is not covered

Countries with Level 4 travel advisories: Some insurers disclose that if a Level 4 Do Not Travel advisory is issued by the U.S. Department of State for a specific country, you will not receive coronavirus-related coverage. With cases surging in various countries unexpectedly, the list of Level 4 countries is constantly changing. Before booking a trip and purchasing a policy, make sure to check that the country does not have a Level 4 advisory.

Fear of getting sick while traveling: Canceling a trip because you’re afraid you’ll get sick does not qualify for coverage under your travel insurance policy. Travel insurance providers have a list of standard reasons that qualify for cancellation, including: car accident, jury duty, terrorist act, military duty and other extenuating circumstances. If you want ultimate flexibility to cancel a trip (no matter the reason), you’ll want to look into the cancel for any reason, or CFAR, supplemental upgrade, which is offered on some travel insurance plans. When you purchase CFAR, you can get up to 75% of your nonrefundable deposit back as long as you cancel at least two days in advance. Not all plans offer CFAR as an option, so research before you purchase if you're interested in this add-on.

COVID-related events not directly related to you: If you planned on going to a conference or a family reunion that was canceled due to COVID-associated concerns, your travel insurer will not reimburse your nonrefundable flight or hotel accommodations.

» Learn more: The best travel insurance companies right now

Finding travel insurers covering COVID-19

Generally, the policies underwritten by U.S.-based travel insurance providers vary by state, trip information, traveler’s ages and other various details. Travel insurance comparison site Squaremouth (a NerdWallet partner) is one of the very few comparison sites that allows you to filter by policies that offer coronavirus coverage.

To find a policy that specifically covers coronavirus-related losses, input your departure and return dates, your main destination and select “Search for Policies Now.”

In our example, we input the following details: A $3,000 paid-in-full trip to Greece leaving on Oct. 9 and returning on Oct. 18 by a 40-year old U.S. citizen who is a resident of California. The policy will include trip cancellation coverage.

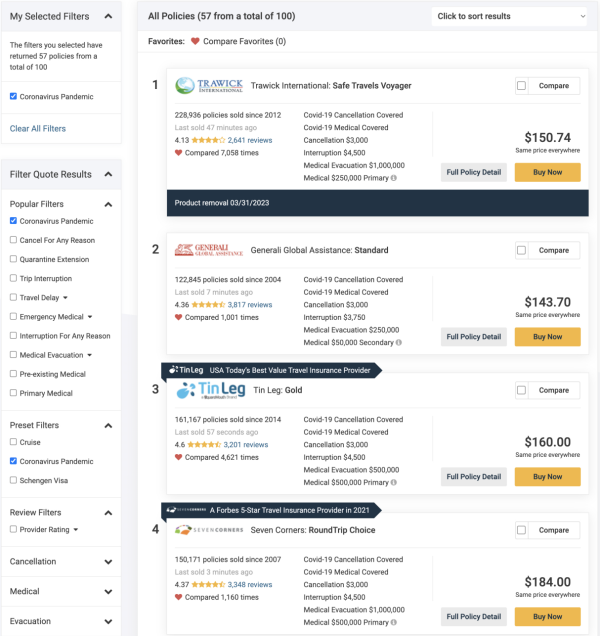

When incorporating the “Coronavirus Pandemic” filter, the results reveal that 57 out of 100 policies include this coverage. You can select additional filters, such as cancel for any reason, if you’re looking for that optional upgrade.

The results can be sorted by price, top sellers, top reviews and insurance providers, offering plenty of ways to easily search for the specific policy you’re looking for.

Each of the top three policies (which is just a sampling of the nearly 60 options) includes coronavirus cancellation and medical coverage, and displays the associated limits. Trip cancellation coverage is $3,000, representing the value of the trip. The price of the policy is clearly stated and ranges from 4.8% to 6.1% of the total trip cost. This range represents very typical travel insurance costs.

» Learn more: Is travel insurance worth it?

The best COVID travel insurance

A recent NerdWallet analysis determined providers Berkshire Hathaway Travel Protection, IMG and John Hancock Insurance Agency, Inc., among others.

COVID travel insurance, recapped

Once you narrow your search, you’ll want to review the full policy details to ensure you’re familiar with what exactly is covered and not covered.

If you have specific questions — especially as they relate to the constantly changing travel advisories or whether coronavirus is considered as a foreseen event (which some providers will not cover) — you’ll want to reach out to the insurer. The last thing you want is to purchase travel insurance and later find out it will not cover you in your intended destination.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2023, including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x

Points60,000

Pointson Chase's website

1x-5x

Points60,000

Pointson Chase's website

1x-2x

Points50,000

Points