How to Book a Southwest Flight to Las Vegas on Points

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Southwest Airlines flies to 103 destinations throughout the United States, including the fabulous Las Vegas. If Las Vegas is your destination and you collect Southwest Rapid Rewards, you may be wondering how to book a Southwest flight to Las Vegas on points.

The process of redeeming points for award flights with Southwest is quick and easy. Here’s what you need to know to book Southwest award flights to Vegas.

Steps to booking a Southwest award flight to Vegas

1. Log into your Rapid Rewards account

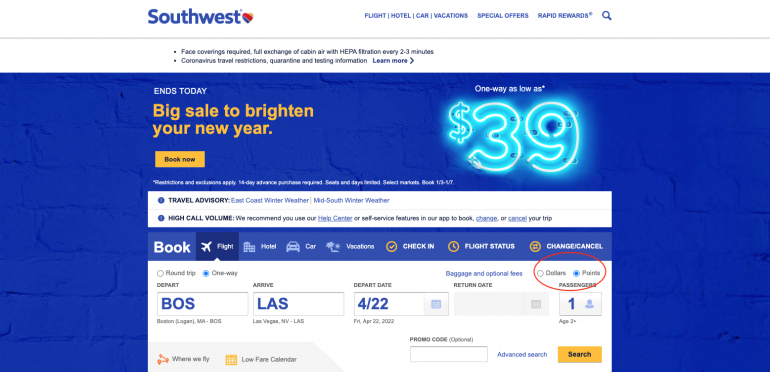

First, go to Southwest.com and log into your Rapid Rewards account. You’ll need to be logged in to view your points balance and redeem points for flights.

2. Find your preferred flight

Once logged in, you’ll want to perform a search to find your preferred flight. Remember to select points instead of dollars to search for award flight availability.

Southwest has a Low Fare Calendar, which can help you save money and points. This tool will show you the cheapest dates.

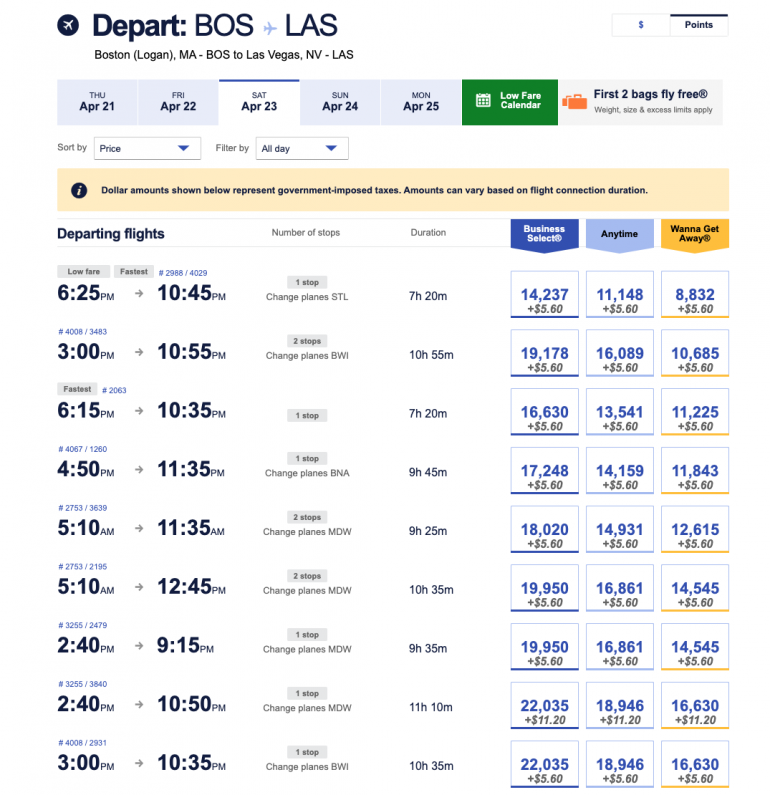

3. Compare flight options for your chosen date

After performing your search, take a look at the available flight options. You can sort flights by:

Arrival.

Departure.

Duration.

Price.

Stops.

You can also refine your filters and choose flights with arrival or departure times that are:

All day.

Before noon.

Noon to 6 p.m.

After 6 p.m.

Southwest also shows you available options in all three fare classes. Remember, Wanna Get Away is Southwest’s most affordable fare. Anytime or Business Select fares will cost you more points, but these fare classes come with additional benefits, such as the ability to earn more points.

4. Select, confirm and book your flight of choice

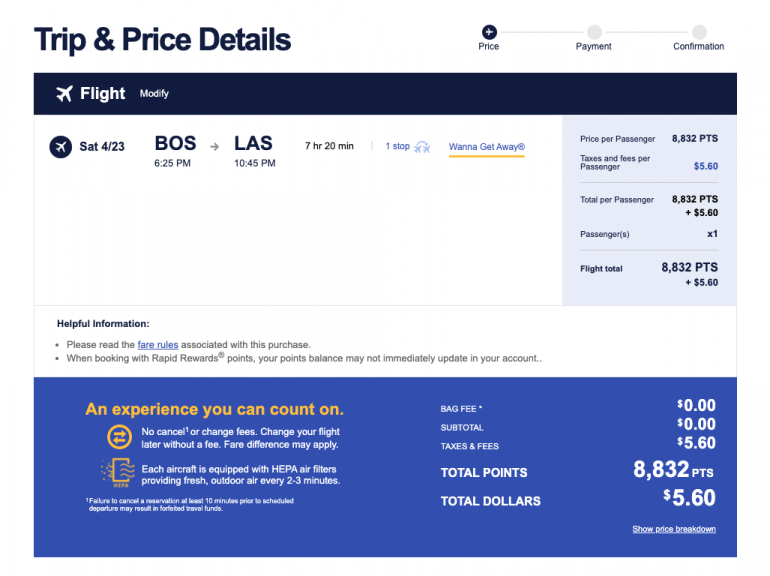

Next, you’ll want to select your desired flight. After choosing your flight, Southwest will display the specific details of your flight. Now is the time to make sure everything looks correct.

If you have enough points, you’ll be able to begin the checkout process and can click the Continue button to proceed and redeem your points for the award flight.

If you don't have enough points, Southwest will prompt you to buy points or select a different award flight. If you’re only a few points away from what you need, it may make sense to top off your account. But we usually don't recommend buying points because purchased points often cost more than their value.

NerdWallet values Rapid Rewards points at 1.5 cents each. Southwest Airlines' points begin at 3 cents each for purchase, so it usually doesn’t make sense to buy points. Instead, it’s better to earn points by making purchases with Southwest Rapid Rewards credit cards.

» Learn more: Which Southwest Airlines credit card should I get?

Other tips for booking an award flight to Las Vegas on Southwest

If you’re looking for Southwest award flights to Vegas, these tips may be helpful:

Consider redeeming points for Wanna Get Away Fare tickets. Wanna Get Away is Southwest’s most affordable fare type. If you’re looking to use as few points as possible for your redemption, you may want to buy this fare type.

Southwest offers free ticket changes and free cancellations on award tickets. You can cancel or change your award ticket without penalty. As long as you cancel at least 10 minutes before your scheduled takeoff, your reward points will be returned to your Rapid Rewards account — even if you booked a Wanna Get Away fare ticket.

Redeem points when flights are on sale. A few times a year, Southwest runs an airfare sale. You can take advantage of discounted airfare — even on award tickets. This is an excellent opportunity to get the flights you need for fewer points.

Keep an eye out for points purchase promotions. If you’re a few points shy of what you need for redemption and need to buy points, look for promotions. Southwest Airlines runs points buying promotions, and this can make points more affordable. With these promotions, the more points you buy, the more you save.

Earning a Companion Pass can be worthwhile. When flying with Southwest Airlines, a Companion Pass will allow you to book an additional ticket for a companion at only the cost of taxes and fees. You’ll need 100 qualifying one-way flights or 135,000 qualifying points in a calendar year to earn this perk. It’s like getting a nearly free airline ticket. This perk can be used on flights booked with cash or points.

Get a Southwest Airlines credit card to earn points faster. If you’re planning a trip to Las Vegas and are short on points, a Southwest credit card may help you earn more Rapid Rewards points faster. Take the Southwest Rapid Rewards® Premier Credit Card: Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening. That's a nice chunk of points that will be added to your account.

If your travel dates are flexible, use the Low Fare Calendar. A quick way to save points and find the lowest fares possible is to use Southwest’s built-in Low Fare Calendar. With this money-saving tool you can view the cheapest available flights in dollars or points.

» Learn more: Your guide to booking award flights on Southwest

Final thoughts on Southwest flights to Las Vegas

If you’re planning a trip to Las Vegas and have Southwest Rapid Rewards points to use up, check to see if there’s a redemption option that makes sense for you. It’s easy to book a Southwest flight with points. Plus, when you book Southwest award flights to Vegas, your trip will be more affordable. If your plans change, Southwest Airlines is extremely flexible with no change or cancellation fees.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024, including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-5x

Points60,000

Pointson Chase's website

1.5%-6.5%

Cashback$300

2x-5x

Miles75,000

Miles