How to Get the Most from the United Club Infinite Card

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

If you fly United Airlines regularly, you may want to take a look at the United Club℠ Infinite Card. It comes with a $525 annual fee, and a list of perks geared toward United flyers designed to make the fee worthwhile.

Here’s a look at the benefits the United Club℠ Infinite Card provides:

4 miles per dollar on United purchases, 2 miles per dollar on dining at restaurants (including eligible delivery services like GrubHub, Caviar, Seamless and DoorDash) and travel purchases, and 1 mile per dollar on all other spending.

United Club access for the primary cardholder and up to two adult guests or a family (one adult guest and any dependent children younger than 21).

Two checked bags each for up to two passengers on the same reservation.

Expanded Saver Award availability.

TSA PreCheck, Global Entry or NEXUS enrollment fee credit every four years.

25% rebate on in-flight purchases.

Hertz Gold Plus Rewards President’s Circle status.

Perks during stays at Luxury Hotel & Resort Collection properties.

One year of complimentary DashPass.

Now that you know the benefits, here’s how to maximize them to get the most out of the United Club℠ Infinite Card.

» Learn more: United MileagePlus program: The complete guide

Visit United Clubs

Holding the United Club℠ Infinite Card means holding a key to United Clubs and participating Star Alliance lounges when flying United or its partners. The membership includes access for the cardmember and up to two adult guests or one adult guest and any dependent children younger than 21.

For most United flyers, an annual membership to United Club lounges would cost $650, so the card’s annual fee of $525 is fully offset by this benefit alone. Visit a lounge at least nine times per year to break even, based on United's $59 single-visit fee.

Check bags for free

Most co-branded airline credit cards come with a checked bag. The United Club℠ Infinite Card comes with two free checked bags each for the primary cardholder and one companion on the same reservation.

Normally, United charges $30 to $35 for the first checked bag and $40 to $45 for the second each way on domestic flights. So this card benefit can save you up to $320 per round-trip itinerary. To qualify for the perk, make sure to use your United Club℠ Infinite Card to pay for the flights and add your MileagePlus number.

» Learn more: Airline credit cards that offer free checked bags

Book expanded Saver seats on United

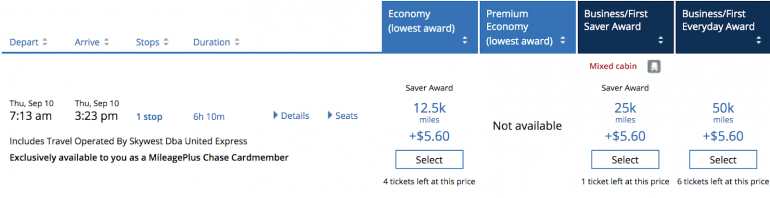

One of the most valuable benefits of the United Club℠ Infinite Card is that you get more choices for award flights at Saver level. When searching for flights to book with miles, United cardholders are offered more options than MileagePlus members without a credit card. You’ll see these itineraries during the booking process. They will say, “Exclusively available to you as a MileagePlus Chase Cardmember.”

Getting access to more Saver space can mean flying with fewer connections on United-operated itineraries, enduring shorter layovers, redeeming fewer miles or having more departure times to choose from. To locate the award flights available to cardholders only, you must be logged in to your United MileagePlus account.

Enroll in either TSA PreCheck or Global Entry

Enroll in one of the trusted traveler programs, pay the application fee with your United Club℠ Infinite Card, and you’ll be reimbursed for the cost.

Both programs’ memberships last for five years. TSA PreCheck costs $78, Global Entry costs $100 and NEXUS costs $50. The United Club℠ Infinite Card will reimburse either of these fees in the form of a statement credit every four years when you renew. The name on the application doesn’t have to match the name on the credit card, which means you can give the credit to a family member or a friend.

Save 25% on in-flight purchases

Whenever you buy meals, premium beverages or Wi-Fi access onboard a United flight, make sure to use your United Club℠ Infinite Card. You’ll receive a 25% discount on your purchase in the form of a statement credit. If you frequent in-flight snacks, these savings can slowly add up over the course of the year.

The bottom line

A first glance at the United Club℠ Infinite Card’s annual fee and you may say, “It’s not for me.” But by using the card perks and maximizing its earning potential, you can offset the cost.

Visiting United Club lounges every time you fly United Airlines, redeeming miles for award flights, checking bags for free and enrolling yourself or someone else in one of the eligible trusted traveler programs will get you the most out of the United Club℠ Infinite Card.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024, including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card