HTH Travel Insurance Review: Is It Worth the Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

HTH Travel Insurance

Pros

- Covers travelers up to 95 years old.

- Includes direct pay option so members can avoid having to pay up front for services.

Cons

- A 24-hour delay is required for baggage delay coverage on the TripProtector Economy plan.

- No waivers for pre-existing conditions on the lower-level plan.

HTH Travel Insurance

Pros

- Covers travelers up to 95 years old.

- Includes direct pay option so members can avoid having to pay up front for services.

Cons

- A 24-hour delay is required for baggage delay coverage on the TripProtector Economy plan.

- No waivers for pre-existing conditions on the lower-level plan.

Travel insurance aims to protect you when things go awry, and it can cover a variety of issues that might happen when you’re taking a trip, including canceled flights, medical emergencies and baggage delays.

HTH Travel Insurance sells multiple types of travel insurance policies. Some examples are coverage for pre-existing conditions, single-trip plans, annual plans and more. Let’s look at HTH, the plans the provider offers and whether purchasing a plan is right for you.

What does HTH travel insurance plans cover?

HTH offers several types of travel medical insurance, as well as trip protection plans that include coverage for trip cancellation or interruption, baggage delays, and accident or sickness.

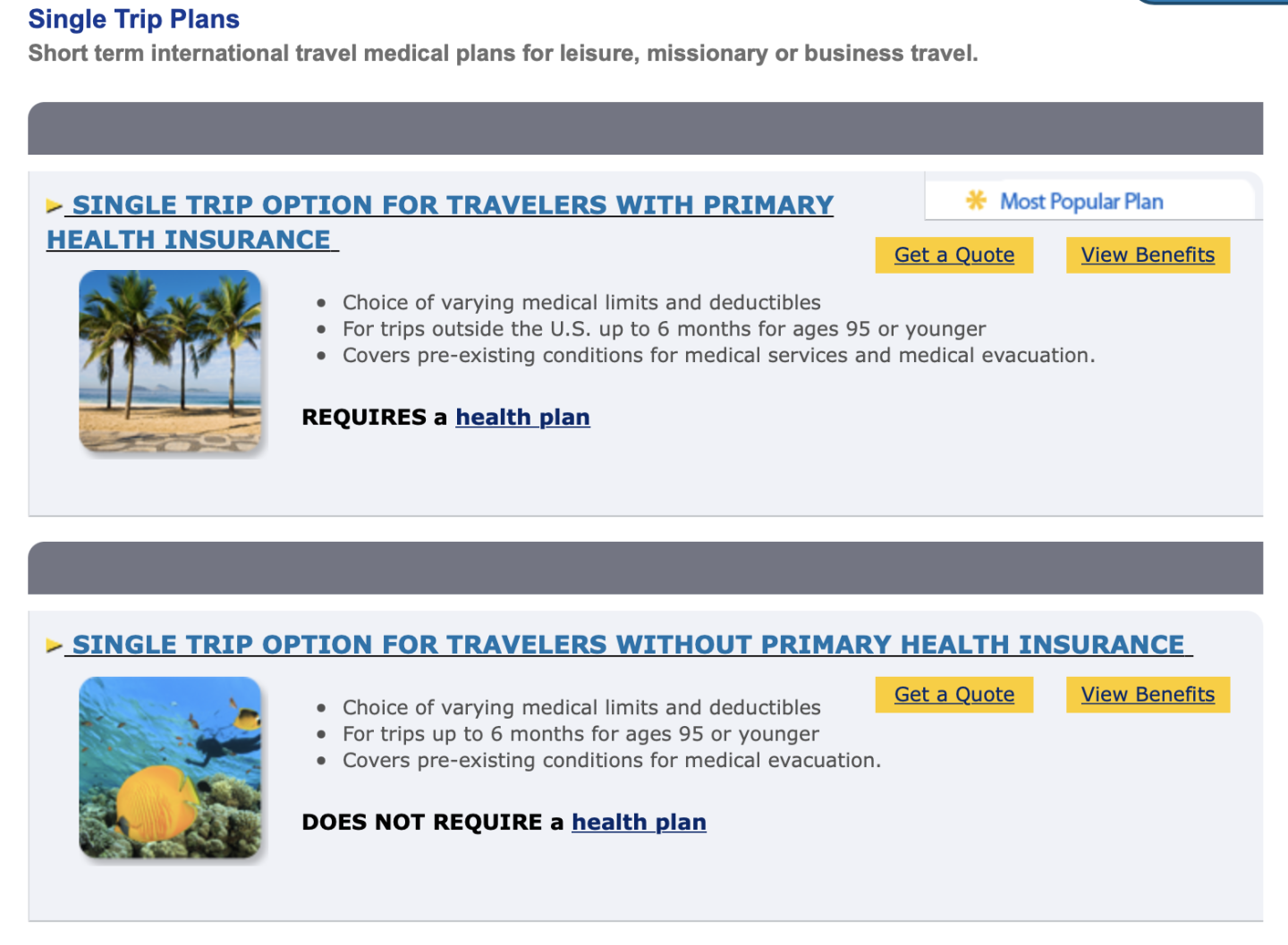

HTH single-trip plans

Single-trip plans are insurance policies that provide coverage during a specified time period. You’ll travel once and then come home. This contrasts with multi-trip or annual plans.

HTH offers two types of single-trip plans:

Plans for people with primary health insurance in the U.S.

Plans for people who don’t have primary insurance.

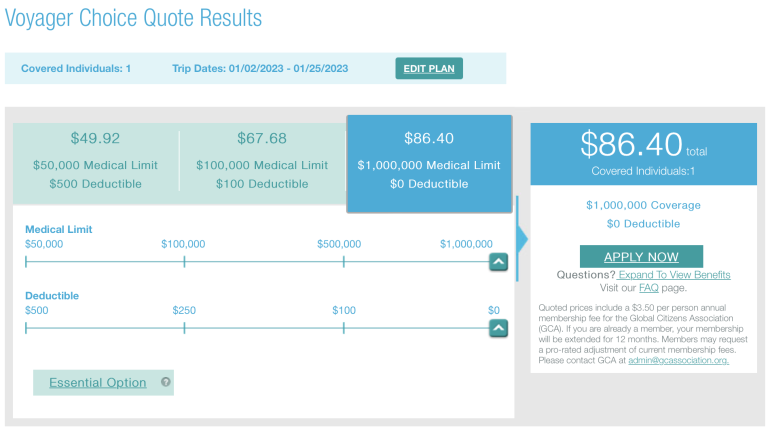

HTH single-trip plan cost

To figure out the cost of a plan, we input a search for a 45-year-old from California traveling for 23 days in January.

With those parameters, HTH returned two quotes, which included the same coverage for travelers whether they had a health insurance policy or not.

HTH travel medical insurance for a single trip

The Voyager Essential plan — for those without primary medical insurance — was cheaper, coming in at $44 for its least expensive option. However, this plan had a 180-day exclusion for pre-existing conditions.

For those with primary medical insurance, the cheapest Voyager Choice plan was $49.

Note that these quotes offered only medical insurance.

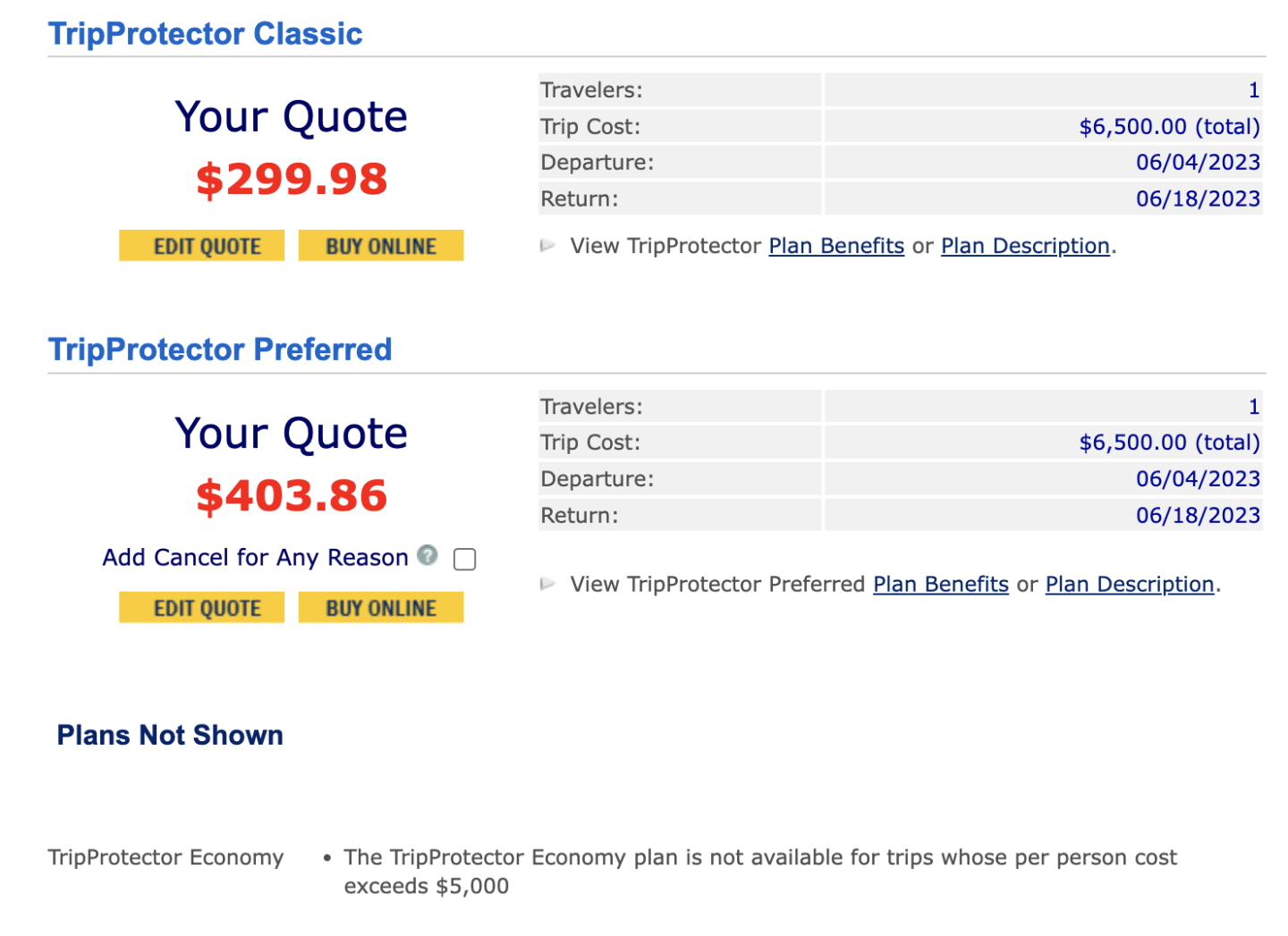

HTH travel insurance plans

HTH has three plans that cover trip interruption and trip delay.

For this type of insurance, we input a search for a 25-year-old Ohio resident traveling to Switzerland for two weeks in June with a trip cost of $6,500.

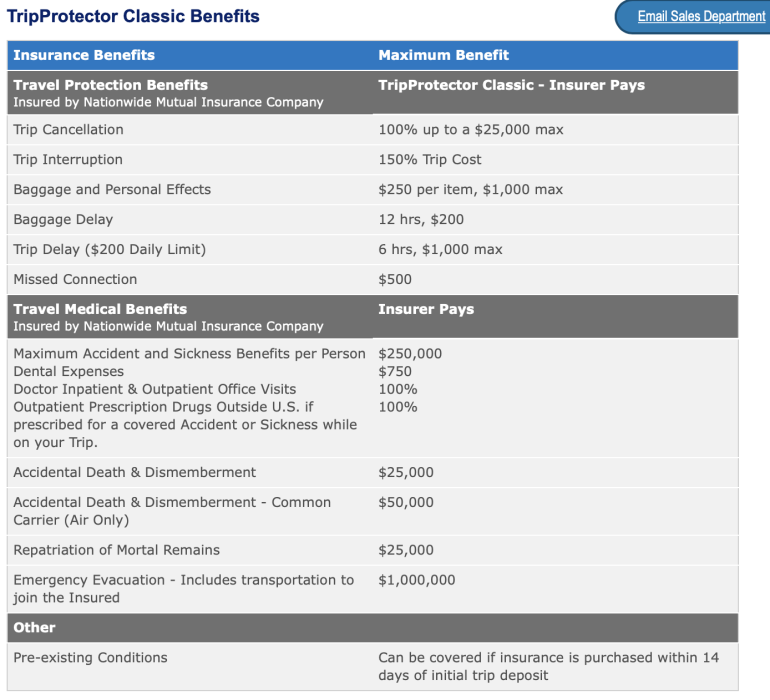

The traveler’s results showed she was eligible for two of the three plans. The cheapest plan came in at $300 and included 100% of the trip cost in case of cancellation, up to 150% of the trip cost in case of trip interruption and a variety of other benefits, including medical insurance coverage.

HTH annual plans

Annual plans from HTH are meant for those who travel often or who are away for longer than six months.

HTH offers two types of annual plans:

Plans for standard travelers.

Plans for maritime crew members, missionaries and students.

Both plans provide only medical coverage and don’t offer other trip protection benefits.

Don’t want to shell out for travel insurance? A variety of travel credit cards offer complimentary trip insurance assuming you pay for the trip with your card.

HTH annual plan cost

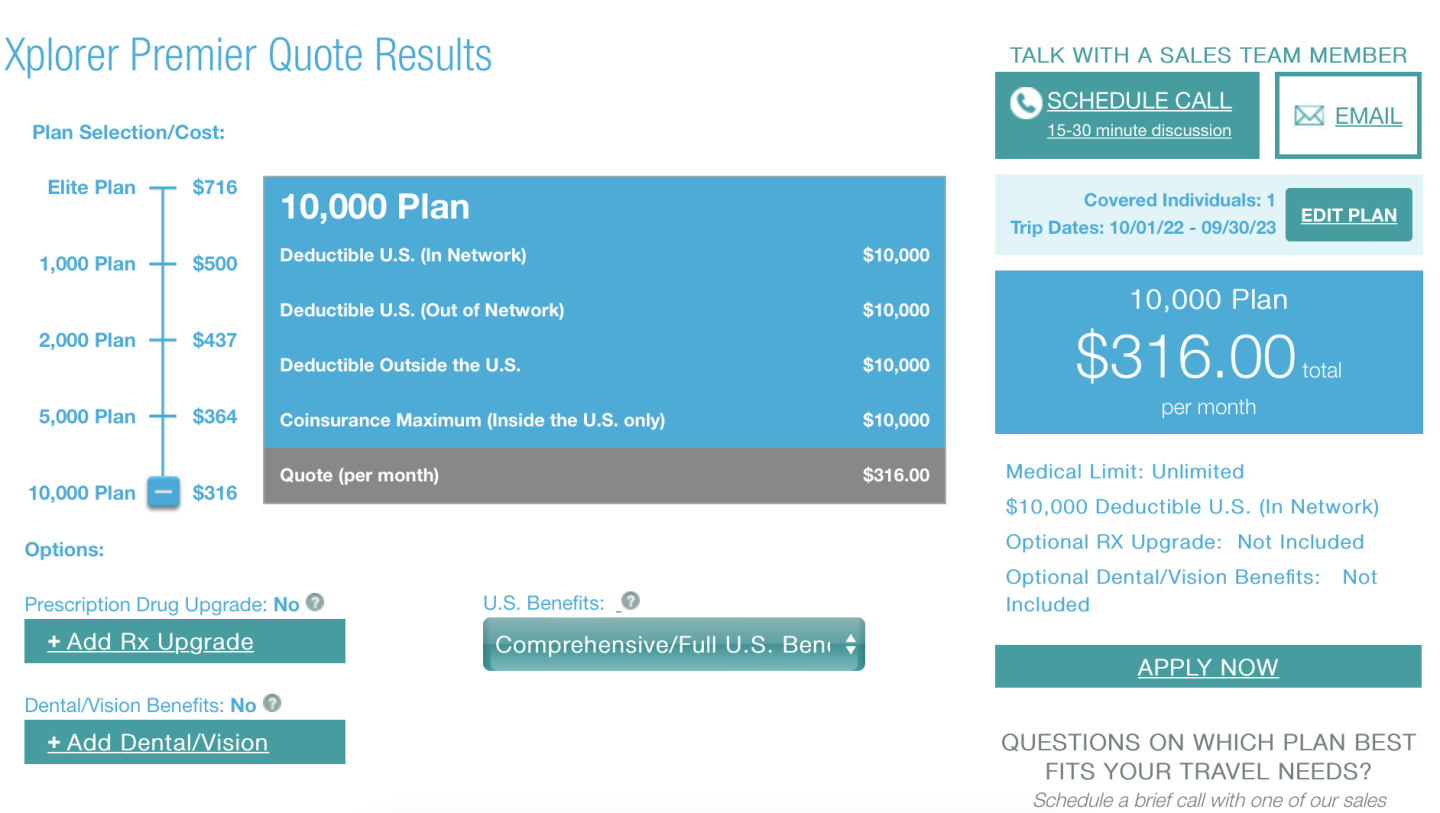

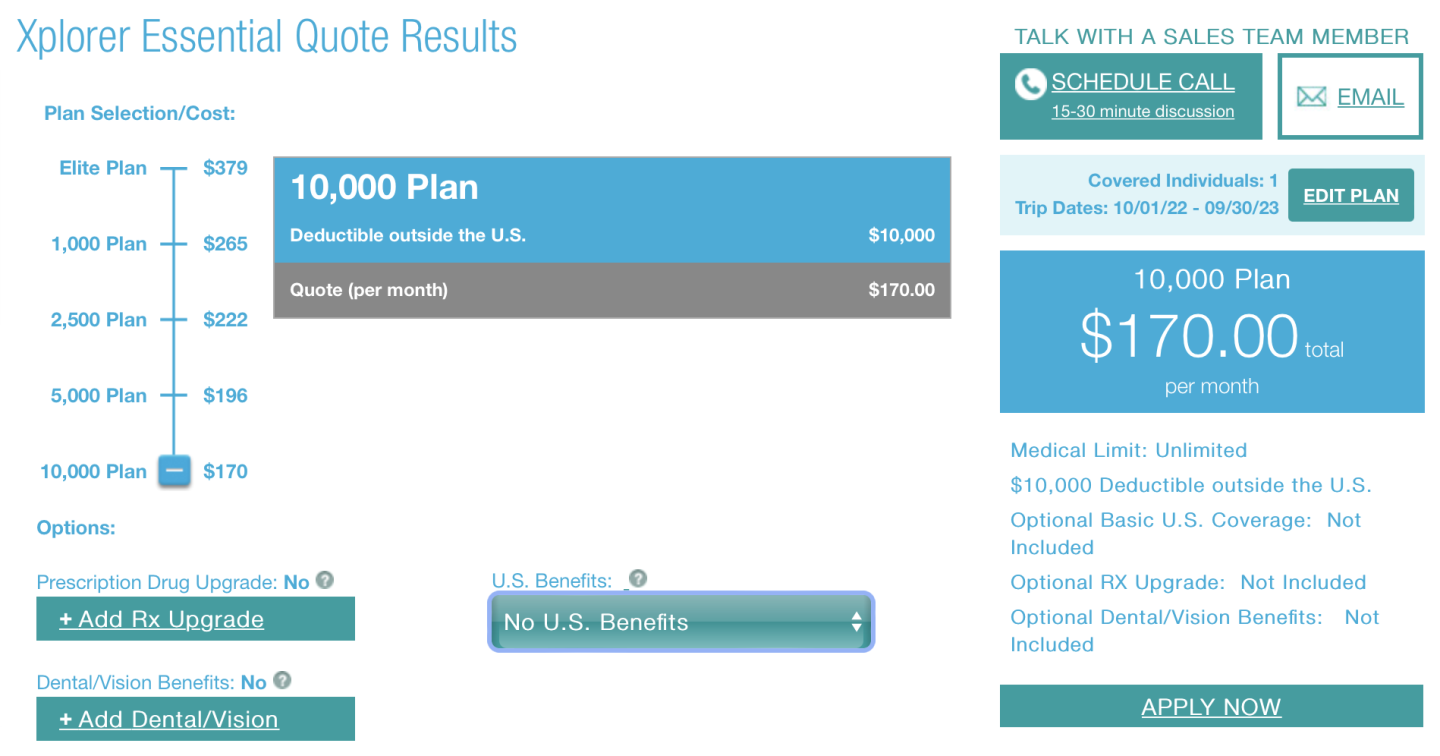

For this example, we sought an annual plan for a 32-year-old man who will be primarily in Thailand. HTH returned one result, featuring a plan costing $316 per month and requiring a $10,000 deductible.

It’s worth noting that the monthly cost dropped to $170 when we dropped plan benefits within the U.S. Rates will vary by provider and factor in your age, destination and the deductible you choose, so it’s important to compare prices before purchasing a plan.

» Learn more: How much is travel insurance?

Which HTH travel insurance plan is best for me?

Not everyone has the same needs when traveling, so not everyone should choose the same insurance policy. Here are some things to consider before purchasing a plan.

Look at coverage details

Scour your plan benefits to see what’s covered. If you won't need trip interruption insurance, don’t buy it. Similarly, depending on your health status, you may feel comfortable purchasing a less expensive plan with fewer medical benefits.

Think long term

How often do you travel? If you’re frequently out of the country, you’ll want to weigh the cost of purchasing multiple single-trip plans versus one annual plan. Do the math and see where you’d come out ahead.

Use existing coverage

Many travel credit cards offer travel insurance, though coverage levels will vary. To qualify for this complimentary insurance, you’ll need to pay for your trip using your eligible card. Common card benefits include trip interruption insurance, baggage delay reimbursement and emergency medical insurance.

» Learn more: How to find the best travel insurance

How to choose an HTH plan online

If you want to buy an HTH travel insurance policy, you’ll need to navigate to its website: hthtravelinsurance.com.

From there, you can input your personal information and receive a quote. Once you’ve decided on a plan that fits your needs, you’ll be able to apply for the insurance policy you’d like to purchase.

» Learn more: Does travel insurance cover medical expenses?

Most plans will have coverage for things like emergency medical care, but there can be gaps that you might not expect. Generally speaking, things like high-risk activities, medical tourism or intentional acts of harm are not covered by most travel insurance policies.

Coronavirus considerations

Not every travel insurance plan covers incidents of coronavirus. If this is something for which you’ll need coverage, be sure to check the fine print of your policy and plan benefits.

» Learn more: Is there travel insurance that covers COVID quarantine?

HTH travel insurance recapped

HTH offers a few travel insurance plans depending on your needs, including options for single- and multi-trip policies. Before you buy a plan, be sure you’ve understood its coverage and costs, especially compared with other policies.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024, including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x

Points60,000

Pointson Chase's website

1x-5x

Points60,000

Pointson Chase's website

1x-2x

Points50,000

Points