A Beginner’s Guide to Traveling on Points and Miles

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Welcome to the world of miles and points! We’re glad you’re here. In this beginners guide, we’ll show you the basics of airline miles, hotel points and credit card points. We will explain this hobby, the different types of travel reward “currencies” and the best ways to earn and redeem miles and points.

So sit back and get comfortable as we help demystify the fun and exciting world of miles and points.

» Learn more: The best travel credit cards might surprise you

Know your travel goals

This is an important consideration when evaluating what you would like to get out of your points and miles hobby. Do you want to travel several times a year to an exotic location, flying in first class on miles and paying for your hotel on points? Do you want to fly to visit friends and family using miles (but don’t care if you sit in economy or business class)? Or do you just want to learn what travel rewards are all about?

The good news is that regardless of your travel goals, understanding the basics of these currencies can make those goals a reality. Using points and miles to see the world can save a lot of cash. And when you get into this hobby, you begin to realize that all sorts of travel is affordable and within reach.

Setting clear travel goals can also help focus your attention and investigation. If you want to visit Japan, you can focus on relevant airlines and hotel programs while ignoring the rest (for now). This can help avoid overwhelm and the paradox of choice.

» Learn more: Are travel credit cards worth it?

Different types of points and miles

Think of points and miles (travel rewards) as another type of currency. Just like stocks, crypto, bonds or foreign currencies, travel rewards present a way to pay for your travel experiences and invest in your travel goals without using cash.

Each travel reward currency has its own value, just like a country’s currency. Many points and miles are worth roughly a cent apiece, but values vary ... It’s important to do the math whenever you’re considering a particular offer or promotion to figure out the approximate cash value. 100,000 points might sound like a lot, but it depends on what kind of points they are.

There are three types of travel rewards: airline miles, hotel points and transferable points.

» Learn more: What are travel points worth and why do they matter?

Airline miles

Airline miles are specific to each airline. One example of airline miles is United MileagePlus miles. To earn United miles, you need to register for a frequent flyer account with United. Then, each time you fly with United (or another Star Alliance airline — more on alliances later), input your MileagePlus number on the reservation to earn miles for the flight.

United (and many other airlines) also has its own co-branded credit cards, such as the United℠ Explorer Card, which earns United miles every time the card is swiped. In addition to flying and earning miles on your flights, using this credit card for everyday purchases is the best way to earn United frequent flyer miles.

The number of miles earned on a flight depends on various factors including the type of seat you book, distance flown and cost of the ticket. Similarly, the number of miles earned with a co-branded credit card also depends on the type of purchase. For example, the United℠ Explorer Card earns 2 United miles per $1 on restaurants and hotels, and 1 United mile per dollar on everything else.

Then, you can redeem your earned miles for award tickets on that airline (and its partners). Generally, airline miles are not transferable directly from one airline to another.

Here are the major airlines you should pay attention to when getting started with points and miles, as well as some useful details about each:

Popular domestic airline frequent flyer programs

There are several considerations to make before joining an airline loyalty program, but understanding your domestic options is a good place to start.

Alaska Airlines Mileage Plan: Great for West Coast travel and award tickets on Cathay Pacific to Asia.

American Airlines AAdvantage: Useful for off-peak rates to Europe in the fall and winter.

Delta SkyMiles: Good for last-minute bookings; no “close-in fees” for tickets booked less than 21 days before travel.

Southwest Airlines Rapid Rewards: Generally good award availability and straightforward pricing (award prices tied directly to cash fares).

United MileagePlus: Usually has the highest award availability due to Star Alliance membership.

Popular international airline frequent flyer programs

Air Canada Aeroplan: No 21-day close-in booking fees.

Air France/KLM FlyingBlue: Offers discounted monthly Promo Rewards.

British Airways Executive Club: Distance-based award chart makes it great for short-haul award flights.

Virgin Atlantic Flying Club: Excellent premium economy experience for low number of miles (despite high taxes).

Hotel points

Hotel points work very similarly to airline miles. Many hotel chains have their own loyalty programs, including Marriott Bonvoy and Hilton Honors.

You can earn hotel points via paid hotel stays or by using that hotel chain’s co-branded credit card. One example of such a card is the Marriott Bonvoy Boundless® Credit Card. Similar to airline credit cards, each hotel chain’s credit cards incentivize members to use the card by giving bonus points for using the card at hotels. The Marriott Bonvoy Boundless® Credit Card, for example earns up 17 total points per dollar spent at over 7,000 participating hotels.

The best use of hotel points is usually for an award night redemption. Some hotel chains offer free nights to encourage members to use their loyalty points at the hotels (e.g., with Marriott you can book four award nights and get the fifth night free). In many cases, hotel points are transferable to airlines, but the transfer ratios are usually poor.

Popular hotel rewards programs

There are a few questions to ask before joining a hotel program, even the popular ones.

Transferable credit card points

Transferable points are the most flexible type of travel rewards currency. Examples of transferable points are Chase Ultimate Rewards® and American Express Membership Rewards, Citi ThankYou and Capital One Miles. The points are extremely versatile because you can redeem them in a number of ways, including for gift cards, cash back or by transferring to specific airline partners.

For example, American Express points are transferable to 18 airlines and three hotels. Because of their flexibility, these points are often considered more valuable than airline miles or hotel points.

Unlike airline miles and hotel points, transferable points are earned by using credit cards specific to the transferable point currency. For example, the Chase Sapphire Reserve® earns Chase Ultimate Rewards® points. The Business Platinum Card® from American Express earns Membership Rewards points. You cannot register for one of these rewards accounts without having a specific card (see below).

Now that you know the three main types of travel rewards, you are ready to get started. So what do you need to know before you begin?

The best airline and hotel rewards programs

As part of our Best-Ofs Awards initiative, NerdWallet performs a comprehensive, domestic industry-wide analysis of both airlines and hotels to make recommendations about the best of the best rewards programs.

Our 2024 findings determined that the best airline loyalty program is the Mileage Plan by Alaska Airlines. Here is how its peers compared:

On the hotel side of things, Hyatt also repeated as the best hotel rewards program.

Of course, the best awards program for you might not ladder up perfectly to our recommendations. If you have more access to certain brands (i.e. live near a Southwest hub) or prefer to stay at a Marriott, for instance, you'll want to take that into account before selecting loyalty.

Before you collect points and miles

Travel rewards beginners would be wise to keep the following in mind:

Know your credit score. For the most part, travel rewards credit cards are available only to those with excellent credit scores (720 and up). If your credit score is significantly below 720, it’s important to take steps to improve it if you’re interested in participating in this hobby. Think of your credit score as a pie cut into five pieces: payment history, credit utilization, length of credit history, mix of credit types and recent applications.

Prepare to pay bills in full each month. If you decide to open up a travel rewards card, you will likely want to meet a certain minimum spending requirement within several months to earn the welcome bonus. For example, the American Express® Business Gold Card offers the following: Earn 70,000 Membership Rewards® points after you spend $10,000 on eligible purchases with the Business Gold Card within the first 3 months of Card Membership. Terms Apply. You need to consider if you can meet that minimum spending requirement within the specified time frame. Paying interest to earn travel rewards negates the value you’d derive from earning points. Remember, this is supposed to be a fun way to save money and travel the world for nearly free — it should not put you in debt.

Limit your cash usage. The key to maximizing your miles and point earnings is to stop using any method of payment that does not earn travel rewards. If you get into this hobby, make it a habit to only use a credit card that earns travel rewards. The best way to do this is to stop using cash and/or your debit card. Take your travel rewards card with you everywhere you go and use it to pay for everything, even small things like a $2 Snapple.

Now that you know the basics of points and miles and what good habits to keep in mind, let’s have some fun and look at the best ways to earn them.

» Learn more: How do travel credit cards work?

Easiest ways to earn points

Below, we have listed the five best ways to maximize earning points and miles.

Utilize welcome bonuses on credit cards

The fastest and most efficient way to earn miles and points is by signing up for a credit card and using that card for everyday purchases. Credit card companies want to incentivize customers to use their products. For this reason, credit card companies will usually offer a sign-up bonus to a first-time holder of a credit card — making it the best way to accumulate travel points quickly.

Sign-up bonuses can be as high as 100,000+ points depending on the offer. Usually, a higher offer corresponds to a higher minimum spending requirement. This makes perfect sense because credit card companies want to reward customers who use their products the most. As a rule of thumb, an offer of 50,000 points/miles or more is considered a “good” offer.

One example of a strong offer is the Chase Sapphire Preferred® Card, which is currently offering the following: Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

Credit cards come out with limited-time offers all the time, so if you’re considering getting a card but think the sign-up bonus is low, you can always wait to see if a better offer comes along.

» Learn more: The best credit card bonus offers available now

To get started, sign up for a credit card that earns airline miles, hotel points or transferable points. If this is your first card, a transferable point credit card will offer the most flexibility for earning and redeeming points.

If you already have a transferable point card and want to add another card to your portfolio, consider your travel goals. Do you fly with United often? If so, think about a United credit card as your next card. Is Marriott your favorite hotel chain? Maybe it makes sense to add a Marriott card to your portfolio. Regardless of your plans, deciding which card to get is a personal decision and there is no right or wrong answer.

Below, we’ve included a list of some of the best credit card offers currently available, organized by airlines, hotels and transferable points programs.

» Learn more: The best points and miles credit cards for beginners

Airline credit cards

American Airlines: The AAdvantage® Aviator® Red World Elite Mastercard® is currently offering the following: Earn 50,000 AAdvantage® bonus miles after making your first purchase and paying the $99 annual fee in full, both within the first 90 days. When the card is used on eligible American Airlines purchases, you will earn 2 miles for $1. All other purchases earn 1 mile per $1.

Alaska Airlines: The Alaska Airlines Visa® credit card earns 3 Alaska miles for every $1 spent on eligible Alaska Airlines purchases, 2 Alaska miles for every $1 spent on eligible gas, EV charging station, cable, streaming services, and local transit including ride share purchases, and 1 Alaska mile for every $1 spent on all other purchases.

United Airlines: The United Club℠ Infinite Card has a high annual fee: $525. Despite the high annual fee, the card offers 4 United miles per $1 on United purchases, 2 United miles per $1 on restaurants and travel, a United Club membership, a $100 statement credit toward Global Entry, and much more.

» Learn more: NerdWallet’s best airline credit cards

Hotel credit cards

Marriott Bonvoy: Here’s the current offer on the Marriott Bonvoy Boundless® Credit Card: Earn 3 Free Night Awards (each night valued up to 50,000 points) after spending $3,000 on purchases in your first 3 months from account opening with the Marriott Bonvoy Boundless® Credit Card! The card also comes with an annual free night certificate worth 35,000 points and a ton of other perks. The annual fee is $95 and not waived in the first year.

Hilton Honors: The Hilton Honors American Express Business Card provides another excellent offer: Earn 175,000 Hilton Honors Bonus Points after you spend $8,000 in purchases on the Hilton Honors Business Card within the first six months of Card Membership. Offer Ends 6/5. Terms Apply. The annual fee is $195 and is not waived in the first year. With this card, you’ll earn 12 points per $1 on Hilton purchases and 5 points on the first $100,000 in other purchases in a calendar year (and 3 points per $1 thereafter). Terms apply. If Hilton hotels are your thing, this is a great card to have. To view rates and fees of The Hilton Honors American Express Business Card, see this page.

» Learn more: NerdWallet’s best hotel credit cards

Transferable point credit cards

Chase Ultimate Rewards®: Here’s the current offer on the Chase Sapphire Preferred® Card: Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠. On this card, you’ll earn 2 points per $1 on travel (5 points per $1 if you book travel through Chase' travel portal), 3 points per $1 dining at restaurants worldwide, select streaming services and online grocery purchases (excluding Target, Walmart and wholesale clubs) and 1 point per dollar on all other purchases. The card has a $95 annual fee that is not waived in the first year.

American Express Membership Rewards: The Platinum Card® from American Express currently has the following welcome offer: Earn 80,000 Membership Rewards® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership. Terms Apply. With this card, you’ll earn 5 Membership Rewards® points per $1 spent on flights and prepaid hotels booked on AmExtravel.com (on up to $500,000 per calendar year). You'll also get a $200 annual airline credit (enrollment required), $200 Uber Cash, $189 Clear credit and many other benefits. Although the annual fee is $695, the card provides various annual credits that offset the fee. Terms apply. This is an excellent premium travel card.

Citi ThankYou: The Citi Premier® Card has the following signup offer: Earn 60,000 bonus ThankYou® Points after you spend $4,000 in purchases within the first 3 months of account opening. Plus, for a limited time, earn a total of 10 ThankYou® Points per $1 spend on hotel, car rentals, and attractions (excluding air travel) booked on the Citi Travel℠ portal through June 30, 2024. The annual fee is $95 and it is not waived for the first year. You will also earn 3 points per $1 at restaurants, supermarkets, gas stations, flights and hotels. The points can also be transferred to 16 airlines and two hotels and there are no foreign transaction fees.

Capital One Miles: The Capital One Venture Rewards Credit Card has the following welcome bonus: Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel. The annual fee is $95. You earn 2 points per $1 on all purchases and there are no foreign transaction fees. You will also receive a $100 statement credit towards Global Entry or TSA PreCheck, plus two complimentary visits to certain lounges.

» Learn more: How to choose a travel credit card

Use the right credit card for the right bonus spending category

Not all travel credit cards are created equal. Depending on which card you have, the card will offer bonus points for spending in a specific category. For example, the Chase Sapphire Preferred® Card earns bonus points on travel and dining at restaurants. So, if you hold this card along with another credit card, you’d probably use the Chase Sapphire Preferred® Card for all your travel and dining expenses.

Another excellent card to have in your portfolio is the Chase Freedom Flex℠, which offers rotating quarterly bonus categories.

For example, during the first quarter of 2022 (January 1-March 31), you can earn 5% cash back on up to $1,500 spent at grocery stores (excluding Walmart and Target) and on eBay.

Furthermore, you can turn the 5% cash back earned on the Chase Freedom® into Chase Ultimate Rewards® points. If you hold a premium travel card like the Chase Sapphire Preferred® Card, you can pool your points, and get 25% more value when you redeem your points for trips through Chase's travel portal.

You can maximize your point earnings by using the Chase Freedom® for all purchases that earn 5 points per $1 and using the Chase Sapphire Preferred® Card for all other purchases. If you max out the bonus category, you will earn 7,500 Chase Ultimate Rewards® points per quarter. Earning 30,000 points per year on a no-fee card is a pretty sweet deal.

Book flights and hotel stays

Each time you book a flight or make a hotel reservation, make sure that you’ve registered for the airline or hotel chain’s loyalty program and input your loyalty number into the reservation. Although this is a very straightforward way to earn travel rewards, it is often overlooked. Make it a habit to not skip this step.

Shop in dedicated portals

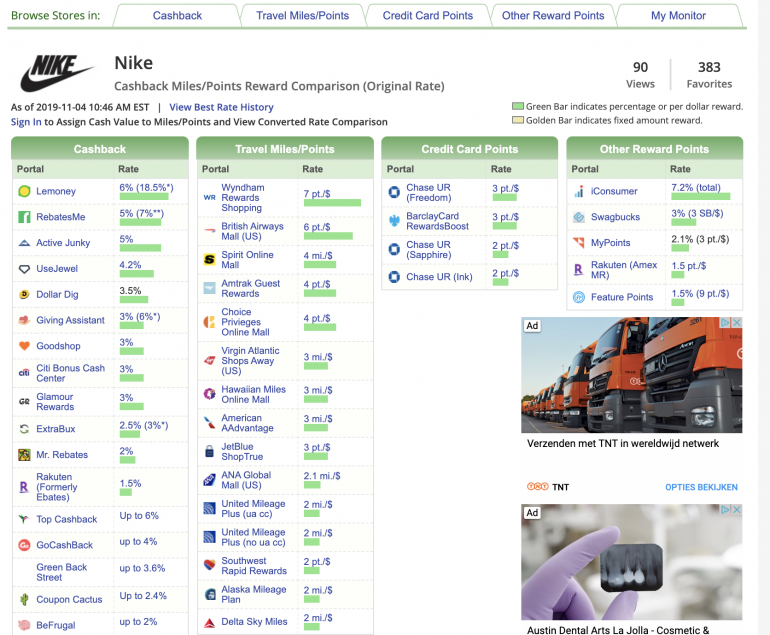

An extremely easy way to earn points and miles is by shopping online via shopping portals. CashbackMonitor lists all shopping portals currently offering cash back, airline miles, hotel points or credit card points (transferable points).

Let’s say for example you want to make a purchase from Nike.com. Check CashbackMonitor for current shopping portal offers.

As seen above, many shopping portals offer cash back for Nike.com purchases. To earn the points, simply click on the portal you would like to earn points with. If you want airline miles, you could earn 6 British Airways Avios per $1 or 2 United miles per $1 (at the time of this offer). If you’d prefer to have a more flexible currency, choose to earn 3 Chase Ultimate Reward points per $1 instead.

And don’t forget that these portal points are in addition to what you’ll earn from spending on your card. Let’s say you’re making a $100 Nike purchase and want some British Airways Avios. By simply clicking through the British Airways shopping portal, you will earn 600 BA Avios on the transaction. If you use your Chase Sapphire Preferred® Card for this purchase, you would also earn 100 Ultimate Rewards® points.

Dine at restaurants and earn points or miles (U.S. only)

Dining rewards programs provide an excellent and easy way to pick up some airline frequent flyer or hotel loyalty points just by dining at a participating restaurant. First, you sign up for an account with a dining program and add a credit card to your account.

Then, every time you visit a participating restaurant and use the card on file, frequent flyer miles will automatically post to your dining account. Currently, Alaska Airlines, American Airlines, Delta, JetBlue, Southwest, Spirit, United, Hilton and IHG offer dining programs.

These dining programs are run by the Rewards Network, so you can earn loyalty points on only one program at a time. At this time, only U.S. restaurants participate in the dining programs.

You can also earn extra points when you sign up for a new account. For example, at the time of publication United was offering a 2,500-mile bonus when you registered for the program and completed a dine within 30 days.

Now that you know about some of the best ways to earn travel rewards, let’s take a deeper look into how to redeem points.

Highest-value ways to use points

Airfare

Each airline that offers a loyalty program allows members to redeem frequent flyer miles for award seats. In addition, some airlines are members of alliances. Airlines that are part of the same alliance include codeshare agreements with one another that allow passengers to fly on one another’s flights and earn/redeem miles with each other.

For example, United Airlines is a member of Star Alliance, and so is Lufthansa. When you fly on Lufthansa, you can input your United Airlines MileagePlus number on the reservation and earn United miles.

Redemptions work the same way. You can use your United miles on United.com to book a Lufthansa award ticket. The ability to fly on alliance partner airlines opens up a world of possibilities for award redemptions.

The three main alliances are Star Alliance (26 member airlines), SkyTeam (19 member airlines), and Oneworld (14 member airlines).

Star Alliance members

SkyTeam members

Oneworld members

Star Alliance is the largest of the three and provides the most flexibility for earning and redeeming miles. Let’s say you hold the United Club℠ Infinite Card, which is currently offering the following sign-up bonus: Earn 80,000 bonus miles after you spend $5,000 on purchases in the first 3 months from account opening.

After meeting the minimum spend requirement, those bonus United miles are redeemable for award tickets on all of Star Alliance’s 26 member airlines — so you have numerous redemption options all over the world.

When applying for a credit card with a specific airline, consider which partner airlines you want to fly and redeem points with. Remember, airline miles are not easily transferable from one airline to another.

» Learn more: Your guide to airline alliances

Hotel stays

Hotel reward programs are similar to airlines, but much simpler. There are no alliances to worry about, or complicated transfer partners. These are the major hotel brands with reward programs:

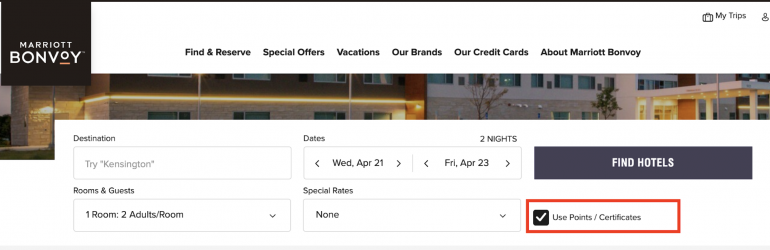

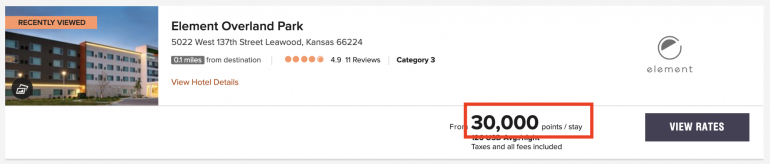

To use your points with each of these programs, you’ll search for hotel rooms through the website or app, usually selecting “use points” or a similar function on the search tool. For some programs, you have to be logged into your reward account in order to make these searches.

The number of points needed per stay should be displayed in the search results.

Unlike airlines, which offer spotty award availability, most hotels offer award availability whenever there are any rooms available. This makes it much easier to use these points, especially when booking at the last minute.

» Learn more: How to choose between hotel loyalty programs

Rental cars

Unlike airlines and hotels, which follow similar rules across most brands and programs, rental car rewards are more of a wild west. Each program has its own rules for earning and using points.

That said, the basic reward approach applies: You’ll earn points or credits by using a single rental car company, and can then use these rewards to book future travel. The biggest trick, for a beginner, is to stick with one program for enough consecutive rentals to make use of the rewards.

Smart ways to redeem credit card points

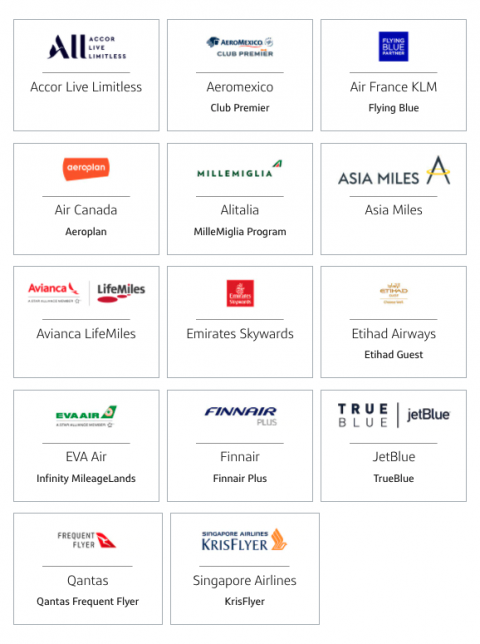

If you have a card that earns Chase Ultimate Rewards®, American Express Membership Rewards, or Capital One Miles you can transfer points from those cards to member airlines or hotels. Citi ThankYou only has airline transfer partners. The advantage of having a credit card points is that you can keep your points in their most versatile form (with the issuer’s program) until you are ready to transfer them to an airline or hotel. Once transferred, the points cannot be refunded back.

Chase Ultimate Rewards® — Over a dozen transfer partners

Chase has several transfer partners (10 airlines and three hotels). Generally, transferring points to hotels isn’t advisable due to the lower valuation of hotel points.

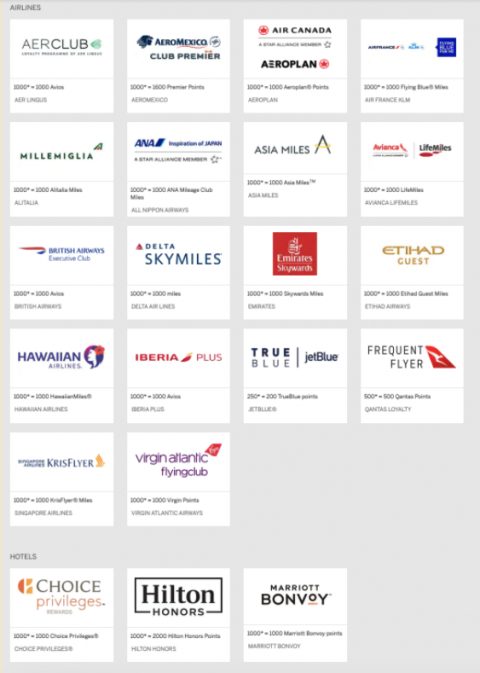

American Express Membership Rewards — 21 transfer partners

AmEx has even more transfer partners (18 airlines and three hotels). Although AmEx has more partners than Chase, Chase’s transfer partners include United, which until recently had one of the better award charts.

Given the numerous transfer partners available between Chase and AmEx, it’s easy to see why these programs are so valuable. Deciding which program to prioritize can be based on which companies you want to fly or stay with.

Each of the airlines and hotels shown above has different award charts and redemption requirements. When electing to transfer miles, consider the value of your transferable points compared to the value of the redemption you have in mind.

Citi ThankYou — 16 airline partners

Although Citi lists 16 airline partners, they are only available if you have a premium Thank You card such as the Citi Premier® Card or Citi Prestige® Card. If you have a no fee card like the Citi Rewards+® Card, you will only be able to transfer your ThankYou points to JetBlue, Choice or Wyndham.

Capital One Miles — 19 partners

Capital One is one of the newer programs and has done a good job of adding new partners and currently has 19 options for customers.

More advice for getting started

We’ve thrown a lot of information at you already in this guide, but don’t worry: As you get more practice with earning and redeeming travel rewards, the easier it will all be to understand. Here are some tips to help you get started on those first redemptions, as well as some common pitfalls to avoid

Earning points if you’re an infrequent traveler

One of the biggest misconceptions about travel rewards is that they are only useful for frequent travelers. After all, weren’t the original rewards called “frequent flyer” programs for a reason.

Infrequent travelers can get just as much value from these rewards by focusing on a few priorities:

Target big welcome bonuses. The welcome bonuses on credit cards, which are the points or miles you earn for signing up and hitting a minimum spending threshold, are not fixed. These cards will boost their bonuses periodically, or add other valuable perks.

Don’t chase travel-based promotions. Airlines and hotels will run deals to earn X number of points by taking Y number of flights or booking Z nights at a hotel. These are great for travel junkies, but not worth chasing or paying attention to if you aren’t.

Set your spending categories and forget them. Different cards will earn a different number of points and miles based on where you use them, as described above. But you don’t want to have to do the math at every checkout. Give yourself easy reminders (including taping notes to your cards) so you know which one to use on gas, groceries, dining, etc.

Redeeming points for good-enough value

When you start researching travel rewards redemptions online, you’ll likely notice an emphasis on “maximizing” value. On the surface that makes sense — isn’t that what we’re trying to do with all currency, from dollars to miles?

Yet it’s important to accept good-enough reward redemptions, especially when starting with this hobby. Your goal should be to offset or eliminate the cost of your travel goals, not to fly around the world in first class (unless that is your goal). In other words, the way to get the most objective value from your points might not align with your other priorities.

Keep it simple:

Use the 80/20 rule to avoid perfectionism. Look for easy redemptions that check most of your boxes. Don’t labor four hours looking for the perfect redemption — it likely doesn’t exist.

Make sure you’re getting the baseline value for a given travel currency by using a calculator. If a given flight or hotel stay gives you above-average value, that’s good enough.

Have fun. If slogging through award calendars searching for availability is starting to feel like a chore, take a step back and find another, easier strategy.

Common pitfalls

If travel rewards were easy, everybody would be doing it. The companies that run these programs want to entice you with big welcome bonuses and flashy promotions, but often make the work of actually redeeming points and miles confusing and complicated.

Here are some common pitfalls to avoid as a beginner:

Don’t try to learn everything. What’s a fare class? What are United Airlines’ stopover rules? The travel rewards world is full of jargon, regulations and know-it-all experts. Don’t try to learn it all before you start, or you’ll never start. Stick to your goals and learn what you need to in order to achieve them. Your knowledge will naturally expand.

Don’t hoard your points. Saving money is a good thing, as its value can increase over time. Saving travel points, on the other hand, is generally a bad financial move, as they generally devalue with time. Don’t just earn points: Spend them!

Don’t chase value. Booking a business-class flight to Norway in January might offer the best bang for your points, but … do you really want to visit Norway in January?

The bottom line

Although the world of miles and points can seem daunting, it doesn’t have to be. The best way to get started is to apply for a travel credit card that matches your needs. Then, learn how to maximize earning travel rewards.

The last step is knowing how to redeem points for the best redemptions, though this is more of an art than a science. There is no right answer and no ideal redemption that is right for everyone. However, getting started can put you on the path to traveling the world for nearly free. Think of travel rewards as another currency to add to your portfolio.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024, including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-5x

Points60,000

Pointson Chase's website

1.5%-6.5%

Cashback$300

2x-5x

Miles75,000

Miles