5 Best Ways to Earn Marriott Points

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Although there are plenty of ways to earn Marriott points, some strategies are easier than others. Follow along as we discuss the five best ways to earn points with Marriott Bonvoy.

Easiest ways to earn Marriott Bonvoy points

If you're wondering: "How do I earn Bonvoy points?" Here's how.

1. Apply for a Marriott credit card with a large welcome bonus

There are currently four Marriott cards available — two from American Express and two from Chase. Although three of the cards come with an annual fee, those cards also offer larger welcome bonuses and more valuable perks. Here’s an overview of your Marriott credit card options:

Annual fee | $0. | $95. | $250. | $250. | $650. |

Welcome offer | Earn 30,000 Bonus Points after spending $1,000 on purchases in your first 3 months from account opening with the Marriott Bonvoy Bold® Credit Card. | Earn 3 Free Night Awards (each night valued up to 50,000 points) after spending $3,000 on purchases in your first 3 months from account opening with the Marriott Bonvoy Boundless® Credit Card! | Earn 85,000 Bonus Points after you spend $4,000 in purchases in your first 3 months from your account opening. | Earn 155,000 Marriott Bonvoy bonus points after you use your new Card to make $5,000 in purchases within the first 6 months of Card Membership. Terms Apply. | Earn 185,000 Marriott Bonvoy bonus points after you use your new Card to make $6,000 in purchases within the first 6 months of Card Membership. Terms Apply. |

Points earned on Marriott spending | 3 points per dollar spent. | 6 points per dollar spent. | 6 points per dollar spent. | 6 points per dollar spent. | 6X points per dollar spent. |

Bonus points earning rate | 2 points per dollar spent on other travel purchases; 1 point per dollar spent everywhere else. | 3 points per dollar on the first $6,000 spent in combined purchases each year on gas stations, grocery stores and dining; 2 points per dollar spent everywhere else. | 4 points per dollar on the first $15,000 spent in combined purchases on restaurants and U.S. supermarkets. 2 points per dollar everywhere else. | 4 points per dollar on the first $15,000 spent in combined purchases on restaurants and U.S. supermarkets. 2 points per dollar everywhere else. | 3X points per dollar spent at U.S. restaurants and on flights booked directly with the airline; 2X points per dollar everywhere else. |

Free award night | None. | One night redeemed at up to 35,000 points every year. | One night redeemed at up to 50,000 points every year if you spend $15,000 on the card within a calendar year. | One night redeemed at up to 50,000 points every year if you spend $15,000 on the card within a calendar year. | One night redeemed at up to 85,000 points every year. |

Marriott Bonvoy elite status | Qualify for Silver based on elite night credits. | Automatically receive Silver status annually on your card anniversary. | Automatically receive Gold status annually on your card anniversary. | Automatically receive Gold status annually on your card anniversary. | Automatically receive Platinum status as long as you’re a cardholder. |

Elite Night Credits | 15 each year. | 15 each year, earn an additional night for every $5,000 spent. | 15 each year. | 15 each year. | 25 each year. |

Global Entry/TSA PreCheck credit | None. | None. | None. | None. | Up to $100 every four to five years. |

Statement credits | None. | None. | None. | None. | Up to $300 in statement credits per calendar year (up to $25 back per month) for dining purchases at restaurants worldwide. |

Priority Pass Select membership | None. | None. | None. | None. | Yes. |

Foreign transaction fees | None. | None. | None. | None. | None. |

» Learn more: Which Marriott Bonvoy card should I choose?

2. Transfer from American Express Membership Rewards

Since Marriott is a 1:1 transfer partner of American Express Membership Rewards, you can transfer AmEx points to Marriott Bonvoy.

NerdWallet values Bonvoy points at 0.8 cent while AmEx points are worth 2.8 cents each.

AmEx points can be transferred to many different partners, so they potentially hold a lot of value. Due to the disparity in point value between AmEx and Marriott, transferring only makes sense if there’s a high transfer bonus from AmEx, or if you need to top-up a redemption with Marriott. All point transfers are final, so before transferring points, confirm that your desired Marriott points redemption is available.

There are more than 10 American Express cards that earn Membership Rewards points. Check out this article to see which AmEx card makes sense for you.

» Learn more: Do Marriott points expire?

3. Transfer from Chase Ultimate Rewards®

If you have a credit card from Chase that earns Ultimate Rewards® points, you can transfer those points to Marriott at a 1:1 ratio. Point transfers are instantaneous and must be done in increments of 1,000 points. Once you transfer points from Chase to Marriott, the transfer cannot be reversed.

Marriott points are worth 0.8 cent each, and Chase points are valued at 2.2 cents, so this transfer isn’t advisable. Also, Chase is not as generous as AmEx with transfer bonuses, so getting an equivalent value from your points is unlikely.

Similar to AmEx, Chase has great transfer partners, so it’s up to you to determine how valuable those points are when compared to Marriott Bonvoy points. The following Chase credit cards earn Ultimate Rewards® points:

Personal cards

Business card

Chase also offers several cash-back credit cards that allow you to treat cash-back rewards as Ultimate Rewards® points when paired with one of the above cards. You can effectively pool your points together and treat them all as Ultimate Rewards® points.

Those cash-back cards are:

Personal cards

Business cards

4. Stay at Marriott Hotels

Earning Marriott points the traditional way, by staying at hotels, is another option for racking up Bonvoy points. You can earn 10 points per $1 spent on qualifying purchases at the following Marriott properties:

Stays at Residence Inn by Marriott, TownePlace Suites by Marriott and Element hotels earn 5 points per $1, while Marriott Executive Apartments and ExecuStay properties earn 2.5 points per $1.

» Learn more: Find the best hotel credit card for you

With earnings of 10 points per $1 spent at most Marriott hotels, accumulating points is fairly easy. Plus, if you have elite status with Marriott, your earnings rate increases.

Silver elites earn a 10% points bonus.

Gold elites earn a 25% points bonus.

Platinum elites earn a 50% points bonus.

Titanium and Ambassador elites earn a 75% points bonus.

With Gold status and above, you can also choose bonus points as a welcome gift, though the number you’ll earn varies by brand.

» Learn more: Complete guide to the Marriott rewards program

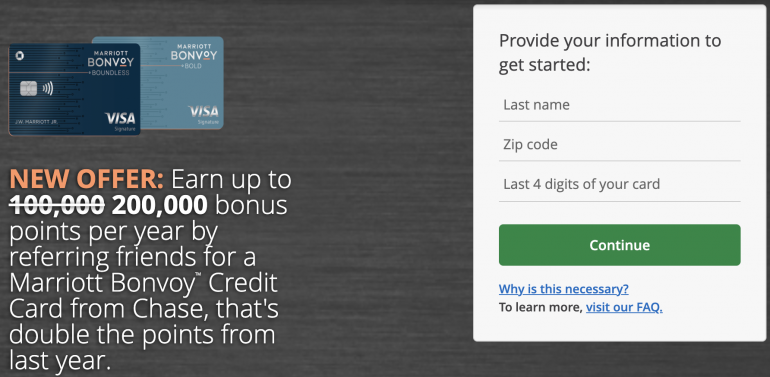

5. Refer a friend

An often overlooked way to earn Marriott Bonvoy points is through refer-a-friend bonuses, which are offered by Marriott, Chase and American Express. If you earn referral points on your Chase or AmEx cards, you can then transfer those points to Marriott.

You could earn 40,000 points per referral on the Marriott Bonvoy Boundless® Credit Card or Marriott Bonvoy Bold® Credit Card, for a maximum of 200,000 points per year.

» Learn more: Beginner's guide to points and miles

American Express provides referral bonuses as well, though each bonus is customized to the specific cardholder. To see what your referral bonus would be, log in to your American Express account.

If you have a friend who is looking to get a Marriott, Chase or American Express card, why not send them your referral link and pick up some extra points?

If you want to earn Marriott points fast ...

Marriott points are relatively simple to earn given the availability of several co-branded credit cards, transfer relationships with both Chase and AmEx, and the ease of earning points for Marriott hotel stays.

If you’re looking for even more ways to earn Marriott points, check out our complete guide, which details all the possible ways to earn Bonvoy points.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024, including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

2x-17x

Points150,000

Pointson Chase's website

1x-14x

Points30,000

Points