TravelSafe Insurance Review: Is It Worth the Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

TravelSafe

Pros

- Covers up to $300 redepositing points and miles on eligible canceled award flights.

- Optional add-on protection for business equipment or sports rentals.

Cons

- Multi-trip or year-long plans aren’t available.

TravelSafe

Pros

- Covers up to $300 redepositing points and miles on eligible canceled award flights.

- Optional add-on protection for business equipment or sports rentals.

Cons

- Multi-trip or year-long plans aren’t available.

Are you wondering whether or not you should buy travel insurance? There are several travel insurance companies out there offering protection from unexpected events like illness, flight cancellations and lost baggage. TravelSafe insurance is one such provider — it features a range of protections to give you peace of mind when on the road.

Let’s take a look at TravelSafe trip insurance, the types of plans it offers and how to choose the right plan for you.

What does TravelSafe insurance cover?

Both TravelSafe plans cover travel mishaps such as trip cancellation, lost luggage and missed connections. They also include some coverage for emergency medical procedures and evacuations. However, the higher-level TravelSafe Classic plan offers additional coverage, such as accidental death and dismemberment coverage and non-medical evacuation.

The amount of coverage for each benefit differs between plans, as well. And additional add-ons (such as Cancel for Any Reason coverage), can be applied to either, for additional fees.

TravelSafe travel insurance plans and costs

Before you purchase travel insurance, you’ll first want to decide what type of plan you need. There are multiple types available depending on what you’re doing, where you’re going and how much coverage you want.

TravelSafe insurance offers two different plan types: Basic and Classic. Both of them only cover single trips; the company doesn’t sell multi-trip or year-long plans.

TravelSafe Basic

The TravelSafe Basic plan offers a lower level of protection than the company’s more expensive option, TravelSafe Classic.

To get an idea of the cost and coverage you’d get with a TravelSafe Basic plan, we put in a search for a 32-year-old woman going on a two-week trip to multiple countries. The total estimated trip cost was $4,500.

The TravelSafe Basic plan came back with a total cost of $177 and included trip cancellation coverage up to $10,000, trip delay reimbursement, baggage delay coverage, and $35,000 for emergency medical, among other benefits.

TravelSafe also offers medical insurance-focused plans through a partnership with Trawick International. These plans are much cheaper than the Basic or Classic options but lack some of the other plans’ benefits.

TravelSafe Classic

As the higher tier of travel insurance, TravelSafe's Classic plan includes greater benefits than TravelSafe Basic. Using the same search parameters, the total cost for a TravelSafe Classic plan came out to $234 — $57 more than the Basic plan.

However, with this level of coverage, policy holders get trip cancellation of up to $100,000, as well as $100,000 worth of emergency medical and $2,500 worth of coverage for lost luggage. This can be a smart plan to purchase if you are traveling with expensive items in your suitcases, such as photography equipment or jewelry.

» Learn more: Common myths about travel insurance and what it covers

The two plans compared

The coverage levels vary pretty significantly between TravelSafe's Basic and Classic plans, although the price difference between the two isn’t huge.

Here are some of the most important differences in coverage levels between the two plans:

TravelSafe Basic coverage levels | TravelSafe Classic coverage levels | |

|---|---|---|

Trip cancellation | 100%, up to $10,000. | 100%, up to $100,000. |

Trip interruption | 100% of the trip cost. | 150% of the trip cost. |

Missed connection | $500. | $2,500. |

Baggage delay | $100. | $250. |

Lost luggage | $500. | $2,500. |

Emergency medical | $35,000. | $100,000. |

Emergency evacuation and repatriation of remains | $100,000. | $1,000,000. |

24-hour accidental death and dismemberment coverage | N/A. | $25,000. |

Non-medical emergency evacuation | N/A. | $25,000. |

COVID-19 coverage | Yes. | Yes. |

Which TravelSafe insurance plan is best for me?

As we mentioned above, there are different types of coverage available based on your needs. Before you make a purchase, be sure to consider all your options.

If you’re going on a simple, short round trip: TravelSafe Basic might be good enough option.

If you’ll be going on adventurous or longer trips: Consider the TravelSafe Classic, which offers way more coverage for not that much more.

If you have a premium travel card (e.g., the Chase Sapphire Reserve®): These cards often offer some trip cancellation and trip interruption coverage, so the TravelSafe Basic option might be enough.

Consider optional add-ons

TravelSafe’s insurance also offers the ability to add extra coverage. This includes rental car insurance, Cancel For Any Reason insurance (CFAR), and accidental death and dismemberment coverage during flights.

See if you have existing coverage

Many credit cards offer travel insurance as a benefit. This insurance is complimentary and automatic as long as you have paid for your travel with your card. While coverage will vary depending on the card you use, you’ll commonly see credit cards cover rental car insurance, trip cancellation insurance, emergency medical insurance and lost luggage insurance.

Before buying any travel insurance plan, check your credit card benefit guides to see what they may already cover.

» Learn more: How to find the best travel insurance

Can you buy a TravelSafe plan online?

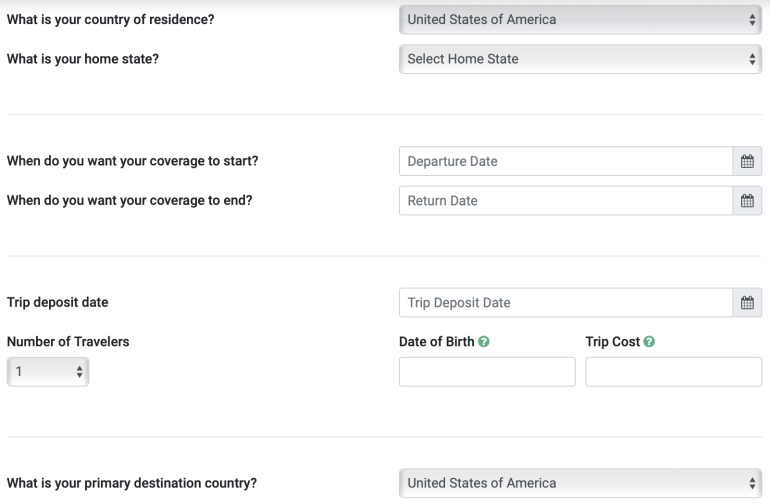

Yes. The first step to buying a TravelSafe plan is navigating to its website at travelsafe.com.

From the homepage, you’ll want to select the blue box that says “Get a Quote.” You’ll then be taken to a page asking for your personal information, including dates of travel, age and state of residence.

After you’ve filled in the information, you’ll be presented with quotes for both of TravelSafe’s plans. Once you’ve chosen a plan, you’ll go through the checkout process to purchase your travel insurance.

What isn’t covered by TravelSafe?

If you’re the type of person who likes to hang out in restaurants and visit museums during your vacation, it’s likely your travel insurance will cover you if something unexpected happens.

However, if you tend to find yourself doing more extreme activities, like skydiving or scuba diving, you’ll want to give the fine print of your travel insurance a closer look. Most plans have specific exclusions for high-risk activities, in addition to acts of self harm and other designated events.

» Learn more: How much is travel insurance?

TravelSafe travel insurance, recapped

TravelSafe’s two travel insurance plans offer comprehensive coverage for when you’re away from home. Compare the benefits of each before deciding on a purchase — and be sure to double-check whether you already have existing coverage from a travel credit card.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024, including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x

Points60,000

Pointson Chase's website

1x-5x

Points60,000

Pointson Chase's website

1x-2x

Points50,000

Points