Underrated Reasons Why You Need a United Gateway Card

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

The United Gateway℠ Card is the newest in the lineup of United MileagePlus travel rewards credit cards available from Chase. Its $0 annual fee, but there are plenty of other reasons to sign up for this card, from travel protections to no blackout dates on award travel.

Want to know more? Here, after a quick review of the card’s best-known features, are some underrated reasons why you might need a United Gateway℠ Card.

» Learn more: United Airlines MileagePlus program: The complete guide

The well-known reasons

All it takes is a glance at the perks and benefits of the new United Gateway℠ Card to see that there are plenty of reasons to sign up. Among the more well-known:

Earn 20,000 bonus miles after you spend $1,000 on purchases in the first 3 months your account is open.

2 miles per $1 spent with United.

2 miles per $1 at gas stations, local transit and commuting including taxis, rideshare services, trains, tolls and mass transit systems.

1 mile per $1 on all other purchases.

$0 annual fee.

» Learn more: Six benefits of United Airlines credit cards

Underrated United Gateway℠ Card benefits

Here are a few of the underrated reasons to get the United Gateway℠ Card that you may have missed.

No blackout dates

Use miles to book award travel and enjoy expanded award availability, just by having the card. That means more flight options and no restrictions or blackout dates, even if you’re trying to book the last seat on a flight.

25% back on United in-flight purchases

Whether you use your card for meals, entertainment or Wi-Fi on board any United flight, you’ll get 25% of the purchase price back as a statement credit. This is especially handy for long flights where you may want to stock up on meals and snacks and maybe send a few work emails.

No foreign transaction fees

Like any good travel rewards card, the United Gateway℠ Card comes with no foreign transaction fees, which means you can use it abroad without adding hefty fees on top of every purchase.

Oftentimes, credit cards with no annual fee do not waive foreign transaction fees, so this is a notable perk.

Travel protections

The United Gateway℠ Card also comes with a whole suite of travel protections. An auto rental collision damage waiver covers theft and collision damage that occurs to your rental vehicle, provided you paid for the rental with your card. Just decline that pricey rental company insurance.

You’ll also enjoy trip cancellation and interruption insurance. That means you can get up to $1,500 back per person or $6,000 per trip for nonrefundable passenger fares in the event of a covered sickness or injury, which offers peace of mind when booking — as long as you pay for your travel with the card.

Purchase protections

The United Gateway℠ Card offers protections for everyday purchases. Pay with your card and items are covered for 120 days against damage or theft up to $500 per claim and $50,000 per account. So buy with confidence.

Extended warranty protection adds a year to eligible U.S. manufacturers’ warranties of three years or less. This could especially come in handy for expensive electronics purchases.

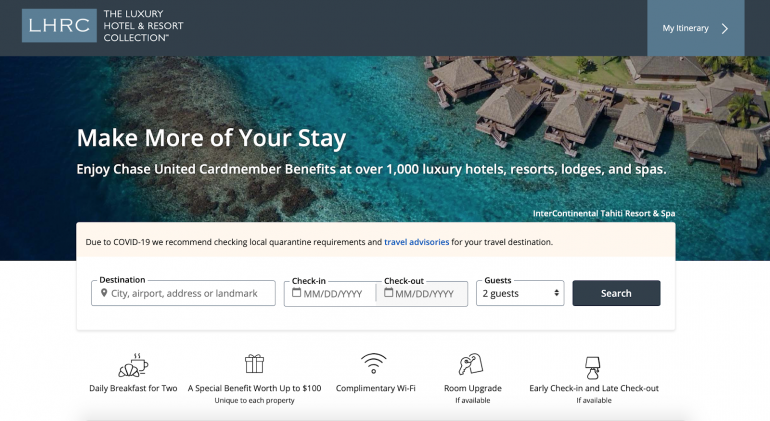

Luxury Hotel & Resort Collection benefits

Book a qualifying stay with your United Gateway℠ Card at any of the 900-plus properties in the Luxury Hotel & Resort Collection and enjoy benefits like free daily breakfast for two, dining or spa credit, complimentary Wi-Fi, a room upgrade if available, and the possibility of early check-in and late checkout. Just book on the LHRC website and pay with your card for these automatic benefits.

Complimentary DashPass membership

The United Gateway℠ Card now offers one-year complimentary DashPass membership, getting you unlimited deliveries with $0 delivery fees and lower service fees from certain restaurants through DoorDash and Caviar. You must activate your membership by Dec. 31, 2024, to take advantage of this benefit. Note that you'll be automatically enrolled in DashPass at the current monthly rate once the free year expires.

The bottom line

For a travel rewards card with a $0 annual fee, the United Gateway℠ Card benefits are useful for frequent and even infrequent United flyers. It doesn’t come with some of the high-profile perks of other United MileagePlus cards that are geared toward more regular United customers, but for users whose largest spending categories are transportation expenses close to home, this card offers a solid sign-up bonus and the opportunity to rack up miles toward an award flight fast.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024, including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card