You Can Now Spend Your Way to Southwest A-List: Here’s Why You Shouldn’t

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Southwest has made a slight tweak to its terms and conditions that has potentially significant implications for those hoping to earn Southwest A-List elite status. Now, you can spend your way to A-List status on Southwest — without even setting foot on a plane.

For years, eligible Southwest credit card holders have been able to earn 1,500 Tier Qualifying Points for every $10,000 spent on eligible Southwest credit cards (note that this spend requirement will drop to $5,000 starting in 2024). However, you could only earn a maximum of 15,000 Tier Qualifying Points through credit card spending, meaning you'd reach this cap after spending $100,000.

However, in an unannounced change to its terms, Southwest removed this limit. Now, Southwest Rapid Rewards members can earn an unlimited number of Tier Qualifying Points through credit card spending. But, should you spend your way to A-List on Southwest? Let's take a look at why you might want to — but why you probably shouldn't.

Perks of Southwest A-List elite status

To decide if it is worth spending your way to Southwest A-List status, let's consider the perks of Southwest's first tier of elite status. A-List members get priority boarding, 25% bonus points on qualifying flights, same-day standby, a dedicated phone line, priority check-in and priority security.

That list may seem a bit underwhelming compared to elite perks on other airlines. However, Southwest doesn't have a first-class cabin or lounges. So, there isn't much more Southwest can offer its frequent flyers.

How to spend your way to A-List on Southwest

Southwest requires 35,000 Tier Qualifying Points — or 25 one-way qualifying flights — for A-List status. As you earn just 1,500 Tier Qualifying Points per $10,000 in spending, you'd need to spend $240,000 on a qualifying Southwest card to earn A-List status from card spending alone.

You can reduce the amount you need to spend on credit cards by earning Tier Qualifying Points on Southwest flights. Note that only paid Southwest fares earn Tier Qualifying Points; you won't earn any TQP on flights booked with Rapid Rewards points.

Say you spend $2,000 on Wanna Get Away fares. Rapid Rewards members earn 6 Tier Qualifying Points per dollar on Wanna Get Away fares, so you'd earn 12,000 TQP through flying. That leaves another 23,000 Tier Qualifying Points left to earn through credit card spending. You'd need to spend $160,000 on eligible Southwest cards to earn A-List status. That's still a ton of spending to put on a Southwest credit card.

Which cards qualify for A-List spending

Four Chase-issued Southwest credit cards are eligible to earn Tier Qualifying Points:

That's all but one of the Southwest credit cards that are currently available to new cardholders. Only the Southwest Rapid Rewards® Plus Credit Card is missing from the list.

» Learn more: The best airline credit cards right now

When it makes sense to spend your way to A-List on Southwest

As part of earning the Southwest Companion Pass

The biggest reason you might want to spend a lot on a Southwest credit card is to earn the Southwest Companion Pass, which allows you and a companion to fly on the same itinerary for the cost of just one fare, plus taxes and fees, for an entire year. To achieve this buy-one-get-one-free Southwest pass, a Rapid Rewards member needs to earn 135,000 Companion Pass qualifying points in a calendar year. Members can earn Companion Pass qualifying points through flying, shopping and dining partners, home and lifestyle partners, and spending on Southwest credit cards.

The Companion Pass is so valuable for some frequent travelers that it may be worth putting a lot of spending on a Southwest credit card to earn it. And you might just earn A-List elite status to boot.

Say you expect to earn 25,000 points through flying and 20,000 points through other qualifying activities. That would leave you 80,000 qualifying points short of earning the Companion Pass. You can satisfy this by spending $80,000 on a Southwest credit card. And by doing so, you'd end up earning both the Companion Pass and A-List status. The 12,000 bonus Tier Qualifying Points you'd earn from spending on the card would put you over the top.

» Learn more: The pros and cons of Southwest’s Companion Pass

Topping off your earnings from flying

Similarly, if you're a frequent Southwest flyer, it may be worth spending on an eligible card to top off your Tier Qualifying Points to earn A-List, or the even-higher A-List Preferred, elite status.

In addition to A-List perks, A-List Preferred elite members get a 100% points earning bonus when flying, free inflight Wi-Fi and an even more exclusive A-List Preferred phone number.

If you fly enough to get close to A-List Preferred status, you clearly fly Southwest enough to enjoy its extra perks. Rather than booking additional flights to get the final Tier Qualifying Points, you may want to spend more on an eligible Southwest credit card to get the next 1,500-TQP boost.

Alternatives to spending your way to A-List status

Except for the above situations, you probably shouldn't earn A-List status from spending on a credit card, even if you could. Here are a few considerations of why — and what you might want to do instead.

Earning at least a 2% return

Aim to get at least a 2% return on your spending when you aren't spending toward a credit card sign-up bonus. Why 2%? Several no annual fee cards offer 2% cash back earnings on all purchases. If you aren't getting at least 2% in total value from spending on another card, you should probably just earn 2% cash back instead.

Southwest credit cards earn a base of 1 Rapid Rewards point per dollar spent. And NerdWallet finds that Rapid Rewards are worth 1.5 cents per point. Spending on a Southwest credit card in non-bonus categories just to earn Tier Qualifying Points means you're potentially giving up a lot of value.

You might be able to easily justify spending extra on a Southwest credit card to earn the Companion Pass. But spending even more to hit A-List is likely not worth the opportunity cost.

Spending on other Chase cards

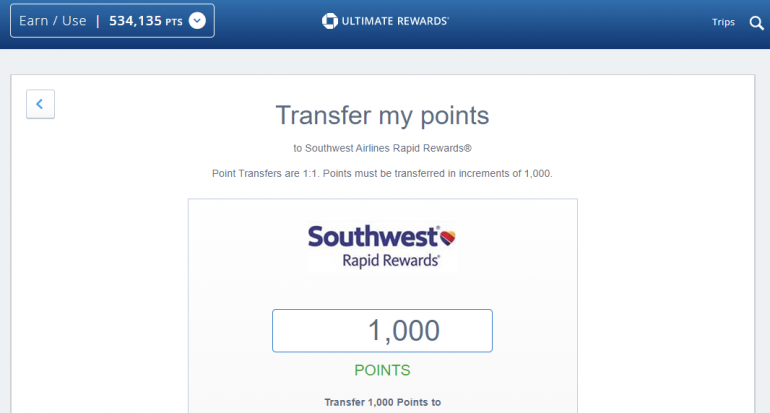

Southwest credit cards aren't the only way to earn Southwest Rapid Rewards points, as Chase Ultimate Rewards® points can be transferred to Southwest at a 1:1 ratio. That means you can effectively earn up to 10 Southwest points per dollar spent on the Chase Sapphire Reserve® by booking in the Chase travel portal, then transferring to your Rapid Rewards account. You can also effectively earn 5x Southwest points on the Chase Sapphire Preferred® Card with the same logic.

Chase Ultimate Rewards® points can be transferred to Southwest Rapid Rewards at a 1:1 ratio.

You can even effectively earn 1.5x Southwest points on everyday purchases. You'll need to charge purchases to a Chase Freedom Unlimited® to earn 1.5% cash back on non-bonus purchases ( or if Chase is running a limited-time offer, you could get lucky and take advantage of an even higher earn rate). Then, combine your cash back earnings with points earned through an eligible card — such as a Chase Sapphire Preferred® Card — to transform them into transferable Ultimate Rewards® points.

» Learn more: Southwest transfers and partnerships

If you're considering spending your way to A-List on Southwest

Eligible Rapid Rewards cardholders now have the option to spend a whopping $240,000 on their Southwest card to earn A-List elite status without even stepping on a plane. However, for most travelers, that's not going to make sense. The opportunity cost is too high, and the perks of A-List status aren't worth it.

Spending on a Southwest credit card to earn Tier Qualifying Points only really makes sense if you fly enough to be close to earning A-List status already. Or, it may make sense for you to spend heavily on your Southwest card while maximizing your point earnings to earn both the Companion Pass and A-List status simultaneously.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024, including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-5x

Points60,000

Pointson Chase's website

1.5%-6.5%

Cashback$300

2x-5x

Miles75,000

Miles