Lost Your Citi Credit Card? Now You Can Lock It Until You Find It

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

All of a sudden, your credit card isn’t in your wallet. But before you call your card issuer to report it missing, you want to be sure it really has been lost or stolen, rather than just left behind at a restaurant or stuck in the couch cushions after falling from your pocket.

If the card in question is from Citi, a new feature takes some of the stress out of the decision by allowing you to lock your account temporarily while you search for the card

"Citi Quick Lock," accessible through Citi's website and mobile app for any Citi credit card, lets you prevent new purchases or cash advances from being processed on your account, according to Citi spokeswoman Jennifer Bombardier. That means it could save you from spending hours updating all your recurring payments with the new credit card number your issuer gives you, only to find your original card moments later.

It's especially useful if:

You've accidentally left your credit card at a business and are planning to go back for it, but want protection from unauthorized purchases in the meantime.

You're not sure whether you've lost your card and need time to look for it, but don't want to sacrifice the security of your account.

Citi isn’t the first major issuer to offer an “on/off” switch like this. Discover has had a similar feature since last year. But the launch of Quick Lock might be a sign that this remote-control capability might become a standard feature on credit cards.

How to use it

If you have a Citi card, Quick Lock is already available, both on the web and through Citi’s mobile app. You don’t need to download any extra programs or pay any fees to make it work. Here’s how it operates on each platform.

For the web version:

Log on to your Citi account.

Click "Account Management” in the menu at the top of the page.

Click the link that says "Misplaced Your Card? Lock it" in the right-hand column. This takes you to Citi’s Quick Lock landing page, which shows you a green switch that reads “Active.”

Click the switch so it turns red and reads “Locked.” This will block new charges on your card temporarily, which means that no one will be able to use your card for purchases in-store, by phone or online, or to get cash advances. You can unlock it by clicking the switch again so it turns green.

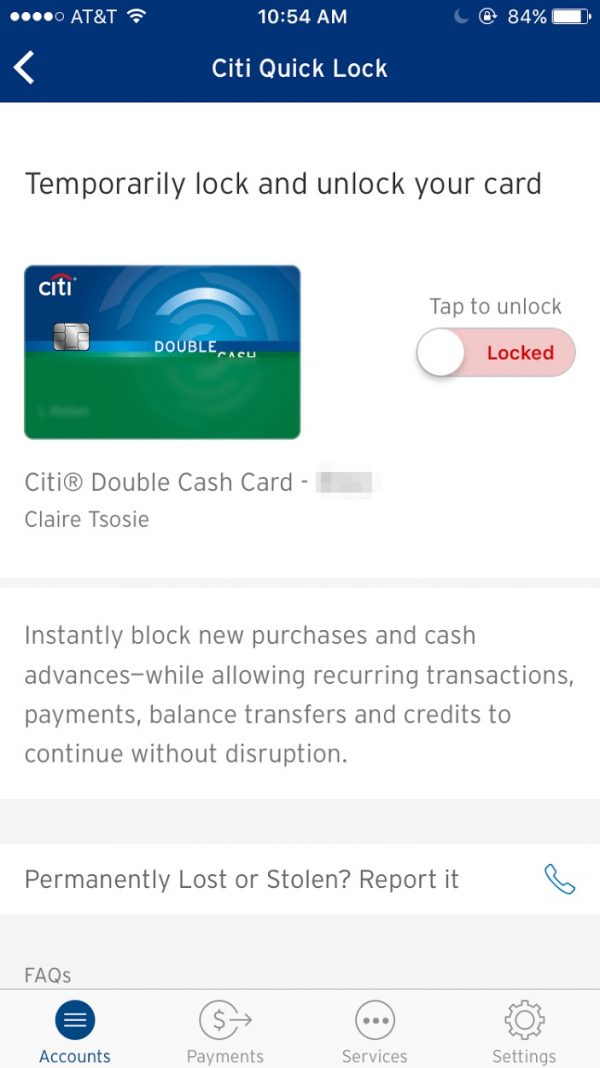

For the mobile app version:

Log on to your Citi account via Citi's mobile app.

Click on the link that says “Misplaced Your Card? Lock it” under your current balance information. This will take you to the Quick Lock page.

From here, the process is the same as on the desktop version. Click the green switch to lock your card and block new charges. To unlock, click the switch again so that it reads "Active."

After you reactivate your card by making the switch green again, your card will be ready to use immediately, Bombardier says.

Other cards that offer this feature

The idea of adding an on/off switch to credit cards or debit cards isn’t new, but it’s gained momentum in recent years.

Last year, Discover introduced a feature called “Freeze it®” that let cardholders freeze their accounts temporarily. Citi Quick Lock is similar to this feature in that it still allows recurring charges to take place. This can save you from paying late fees and fielding stern phone calls from subscription services. But from there, the two services differ, each blocking different types of transactions. Here's how they compare, according to information from Bombardier and Discover's website.

Citi Quick Lock | Discover Freeze it® | |

|---|---|---|

Which transactions are blocked when account is locked/frozen | - Cash advances - In-store purchases - Online purchases - Phone purchases | - Cash advances - Balance transfers - In-store purchases - Online purchases - Phone purchases |

Which transactions aren't blocked | - Balance transfers - Recurring payments | - Recurring payments |

Bank of America has introduced a similar locking feature for its debit cards, though it hasn’t rolled out the same capability for its credit cards. Malauzai Software, a company that makes apps for financial institutions, told The New York Times this year that about half of its 350 community bank and credit union clients also offer this type of feature to their customers for debit cards.

Among credit cards, this feature is still a differentiator. Citi has some standout cards with long 0% APR periods and best-in-class rewards rates, so Quick Lock can sweeten an already-good deal. But in the future, an on/off switch might become standard among credit cards, just as free FICO scores have quickly become the norm.

A convenience — but not a substitute for reporting a lost or stolen card

Whether you have a debit card or credit card with a freezing or locking feature, it's worth noting that temporarily blocking new transactions to your card isn't a substitute for reporting a card as lost or stolen.

If you find out your misplaced credit card is really, truly gone, call your issuer and report it, even if the card has been locked or frozen. This way, your issuer can give you a new number and card, and make sure you aren’t held liable for any potentially fraudulent transactions moving forward.

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.