Missed Tax Day? File as soon as possible to limit penalties. Try our fast, hassle-free tax filing. It's just $50.

Missed Tax Day? Try our fast, hassle-free tax filing. It's just $50.

Learn moreMany or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

What is a W-2?

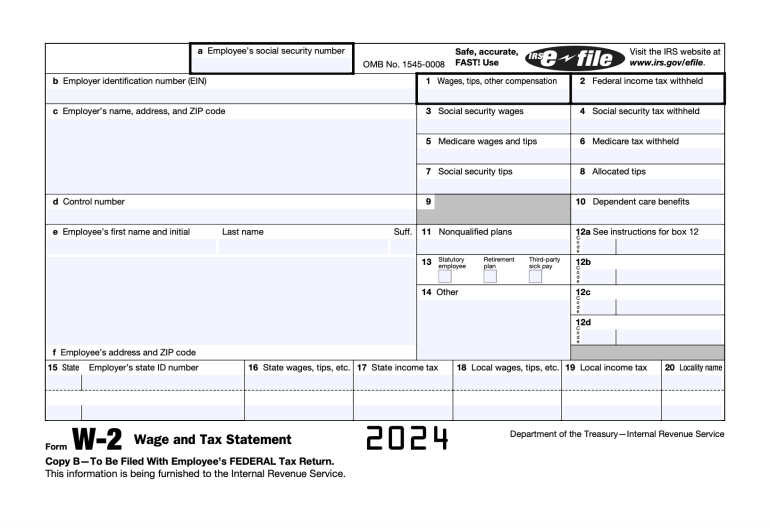

IRS Form W-2, also known as a “Wage and Tax Statement,” reports an employee’s income from the prior year and how much tax the employer withheld. Employers send out W-2s to employees in January. A copy also goes to the IRS.

You should receive a W-2 from every employer that paid you at least $600 during the year. Tip income may be on your W-2. Freelancers or independent contract workers who do not have taxes withheld by an employer get 1099s from their clients, not W-2s.

Simple tax filing with a $50 flat fee for every scenario

With NerdWallet Taxes powered by Column Tax, registered NerdWallet members pay one fee, regardless of your tax situation. Plus, you'll get free support from tax experts. Sign up for access today.

for a NerdWallet account

Transparent pricing

Maximum refund guaranteed

Faster filing

*guaranteed by Column Tax

When are W-2s sent out in 2024?

You should have your W-2 in hand by the first week of February. The IRS requires employers to mail W-2s to the government and employees by Jan. 31 or face penalties. Employers can also send employees their W-2s electronically, but it’s not required. That means you may be able to get yours online.

Even if you quit your job months ago, your ex-employer can still wait until Jan. 31 to send you a W-2 — unless you ask for it earlier, in which case the employer has 30 days to provide it.

How to get your Form W-2

If your W-2 form for the current year doesn’t show up in the mail by mid-February, first ask your employer for a copy and make sure it has the right address. Your employer may also tell you how to get your W-2 online from the HR department or payroll processor.

If you still haven't received your Form W-2 by the end of February, call the IRS. You’ll need to provide information about when you worked and an estimate of what you were paid.

Remember that your tax return is still due by the tax filing deadline, so if you don't have your W-2, you might need to file for tax extension or estimate your earnings and withholdings to get it done on time. The IRS might delay processing your return — read: refund — while it tries to verify your information.

If your W-2 finally shows up after you already filed your tax return, you might need to go back and amend your tax return with a Form 1040-X.

» Ready to file? Check out NerdWallet's top picks for tax software

Simple tax filing with a $50 flat fee for every scenario

With NerdWallet Taxes powered by Column Tax, registered NerdWallet members pay one fee, regardless of your tax situation. Plus, you'll get free support from tax experts. Sign up for access today.

for a NerdWallet account

Understanding your W-2 form

You use the W-2 to help file your tax return. Form W-2 shows more than just what you were paid. It also details how much you contributed to your retirement plan during the year, how much your employer paid for your health insurance, or even what you received in dependent care benefits. All of that data affects your tax picture — your retirement contributions might not be taxable, for example.

Employers are legally required to send copies of your W-2 to the Social Security Administration and IRS (“Copy A”) and your state and local tax authorities (“Copy 1”). The IRS — and the state, if your state has income taxes — will compare the income you reported on your tax return to the information your employer sent to the government.

How to read your W-2

Box 1: Details how much you were paid in wages, tips, bonuses and other compensation.

Box 2: Shows how much federal income tax was withheld from your pay by your employer.

Box 3: Shows much of your pay in Box 1 was subject to Social Security tax.

Box 4: Shows how much Social Security tax was withheld from your pay.

Box 5: Shows much of your pay in Box 1 was subject to Medicare tax.

Box 6: Shows how much Medicare tax was withheld from your pay.

Box 7: Shows how much of the tip income you reported to your employer (those tips are included in Box 1) was subject to Social Security tax.

Box 8: Shows the amount of other taxable tip income your employer allocated to you. This pay isn't included in Box 1.

Box 10: Shows the amount of dependent care benefits your employer paid to you or incurred on your behalf.

Box 11: Generally, this box shows how much money was distributed to you during the year from your employer's deferred compensation plan.

Box 12: Here, there are four areas in which the employer can provide more detail about some or all of the pay reported in Box 1. For example, if you've contributed to your company's 401(k) plan, the amount of your contributions might show up in Box 12 with the code letter "D." There are many codes, which you can see in the IRS' W-2 instructions.

Box 13: This box indicates whether your earnings are subject to Social Security and Medicare taxes but aren't subject to federal income tax withholding, whether you participated in certain types of retirement plans, or whether you got certain kinds of sick pay.

Boxes 16-19: Show how much of your pay is subject to state income tax, how much state income tax was withheld from your pay, how much income was subject to local taxes, and how much local tax was withheld from your pay.

If you're looking for a copy of an old W-2 that you attached to a prior tax return and you can't get a copy from the employer that originally issued it, you can request an IRS tax transcript online or use IRS Form 4506 to request a copy of your tax return.

What to do if your W-2 is wrong

If your employer leaves out a decimal point, gets your name or a dollar amount wrong, or checks the wrong box, point out the mistake and ask for a corrected W-2. Waiting for a new W-2 will cost you time, but here’s something that could make you feel better: The IRS might fine your employer if the error involves a dollar amount or “a significant item” in your address.

Frequently asked questions about W-2 forms

What's the difference between a W-2 form and a W-4 form?

A W-2 is a document that employers must send or mail to employees by the end of January. It contains a summary of the income earned and the amount of taxes withheld during the prior tax year. Employees use this statement to fill out their tax returns.

A W-4, on the other hand, is a form that employees complete and submit to their employees, typically when they begin a new job. The information an employee provides on a W-4 about their filing status and withholding helps an employer determine how much tax should be withheld on paychecks throughout the year.

What's the difference between a W-2 form and a 1099 form?

W-2s and 1099s are both informational returns that taxpayers use to complete their federal tax returns. An employer sends a W-2 form to employees, which contains a summary of annual income or wages earned and the amount of taxes withheld during the previous tax year. Freelancers, independent contractors, or self-employed people who are not employees typically receive a 1099 form instead of a W-2 form.

Can you file taxes without a W-2?

You are still required to file your tax return on time even if you don’t have your W-2 on hand. If your employer did not issue a W-2 or issued an incorrect form, you can use Form 4852 as a substitute when filing taxes.