How Do I Know If the Southwest Rapid Rewards Plus Credit Card Is Right for Me?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Southwest Airlines is known for offering low-cost fares as well as money-saving perks not offered by most airlines. For example, Southwest offers up to two free checked bags per passenger. The airline also does not charge a change fee if you need to adjust your flight. And using the Southwest app provides free movies and on-demand entertainment.

The Southwest Rapid Rewards® Plus Credit Card is a great card for those hoping to stack up Southwest Rapid Rewards points for travel. How do you know if this card is right for you? We dive into some of its most notable features to help you decide.

Are you a penny-pincher?

The Southwest Rapid Rewards® Plus Credit Card offers a generous welcome bonus: Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

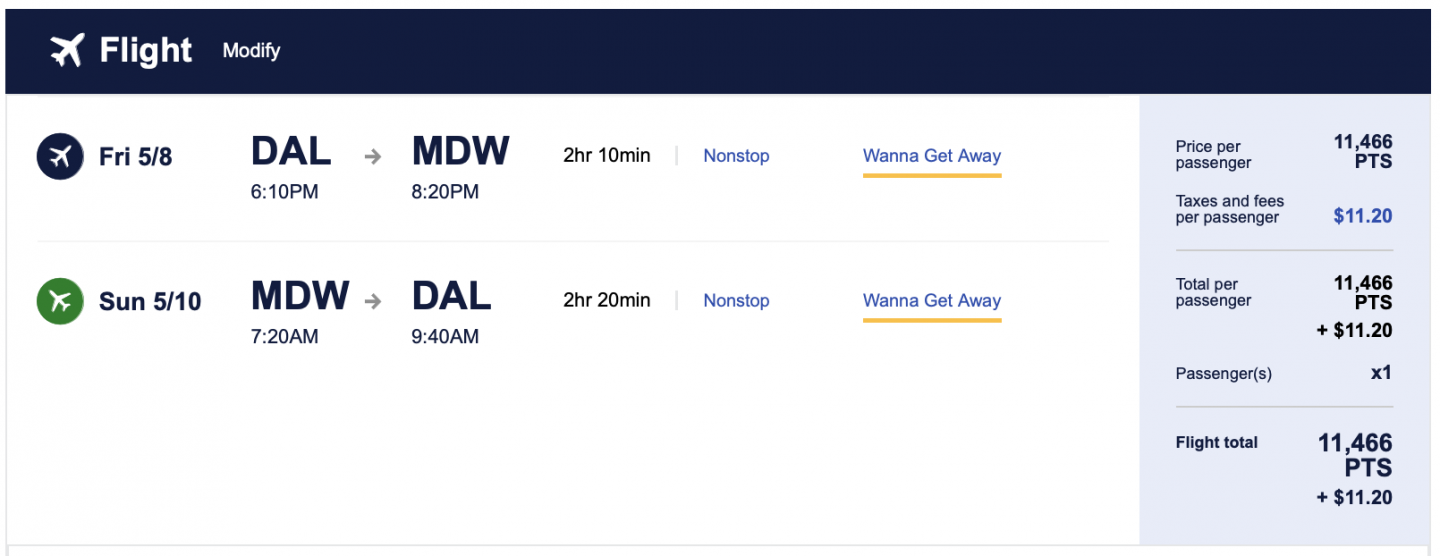

These points could cover multiple round-trip tickets. For example, we found this round-trip flight between Dallas and Chicago for only 11,466 points.

Do you travel with friends?

The Southwest Rapid Rewards® Plus Credit Card can make traveling with a loved one more affordable, thanks to the Companion Pass. This benefit allows you to designate a companion who can travel alongside you free of charge, regardless of whether the fare is booked with points or cash.

Typically, if it's not offered as part of a sign-up bonus, you’ll need to earn 135,000 qualifying points in one calendar year (or take 100 flights) to qualify for the Companion Pass.

Are you loyal?

Loyalty continues to have its benefits when you are not only a Rapid Rewards member but a holder of the Southwest Rapid Rewards® Plus Credit Card. The card earns 2 points per $1 spent on Southwest flights, with Rapid Rewards car rental and hotel partners and on internet, cable, phone, and select streaming, plus cardholders earn 3,000 bonus points every card anniversary.

The card does have an annual fee of $69, so make sure you'll utilize the benefits enough as a loyal Southwest patron.

» Learn more: Southwest Rapid Rewards program: The complete guide

Do you travel often?

Southwest partners with a number of hotels and rental car companies. Rapid Rewards members can earn points through these travel partners, such as Avis (you’ll earn 600 points per rental). You can also earn 600 points by staying at Marriott Bonvoy hotels. (Note that if you choose this option, you will not earn Marriott points).

For those who travel often, being a cardholder can help you collect and redeem points faster.

» Learn more: Chase 5/24 rule explained

Do you travel domestically?

Southwest is mainly a domestic airline, with the exception of flights to Mexico, the Caribbean and Central America. The card really works best for travelers who need flights around the U.S.

The bottom line

International or infrequent travelers may not feel much love from the Rapid Rewards program offered by Southwest. However, frequent domestic flyers can really rack up rewards to make the Southwest Rapid Rewards® Plus Credit Card worth the annual fee.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024, including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

Planning a trip? Check out these articles for more inspiration and advice: Which Southwest Airlines credit card should I get? Benefits of Southwest Airlines credit cards Find the best travel credit card for you

on Chase's website

1x-5x

Points60,000

Pointson Chase's website

1.5%-6.5%

Cashback$300

2x-5x

Miles75,000

Miles