How I Track My Travel Credit Card Perks, Fees and More

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Travel credit cards offer great benefits. Whether you’re looking to avoid airline baggage fees, earn free hotel nights or rack up points and miles, these cards can make travel much cheaper and more comfortable.

But there’s one catch: You have to actually use these benefits.

That might sound obvious or even insulting, but it comes from personal experience. In my years juggling multiple travel credit cards, I’ve let valuable perks slip through the cracks more times than I’d like to admit. This spurred me to create a system for managing the important fees, benefits and dates associated with my cards.

In this article I’ll share my own credit card tracking system, which you can copy directly or use as inspiration to create your own.

» Learn more: The best travel rewards cards

The spreadsheet

Keeping track of the basics of your cards is easy when you only have one or two. After that, you might find it helpful to create a document to store relevant information in one place.

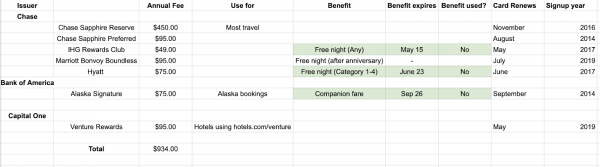

I use a Google spreadsheet to track my cards. One tab holds the info for my personal cards, with another for my small business cards.

I break each card out by issuer (i.e. bank), then include these details in each column:

Annual fee: Helps keep track of total credit card expenses and gives an at-a-glance sense of whether I’m getting that value from each card.

Use for: Each card provides spending bonuses and protections for different category of products. This column helps track which card to use when buying a specific product or service.

Benefit/expires/used: These three columns are used to track specific, one-time-use benefits for each card, such as free hotel nights and companion fares. I color these cells green when I have not yet used the benefit and set a reminder (see below) before the expiration date of each.

Card renews: I use this to track when the annual fee of a given card is due.

Sign-up year: It can be useful to remember when each card was activated. For example, canceling older cards can ding your credit more than canceling newer cards.

Here is a template on Google Sheets you can use for your own credit card tracking. Click “File” -> “Make a copy.” Then replace the details with your own card info. Don’t worry, your spreadsheet will only be visible to yourself unless you share it.

Calendar reminders

There’s no worse feeling than remembering you have a valuable credit card perk after it expires.

To avoid this problem, I create a calendar reminder one month before a benefit's expiration date. For example, my Alaska Companion Fare will expire in a little over a month. I will receive a notification soon reminding me to use it or lose it.

I also set reminders one month before each card’s renewal date. This gives me an opportunity to consider whether I’m getting enough value from the card to justify its annual fee. If not, I have a month to cancel or downgrade it to a no-fee alternative.

» Learn more: Top airline credit cards with companion tickets

Build your own

I made this simple system to track my travel credit cards in order to overcome my own inability to remember dates and fees. If you’re one of those people with a steel-trap memory for such things, you might not need the same spreadsheet or calendar reminders. It might serve you better to track the points you’ve earned in each program, or link to articles on redeeming points that you found particularly helpful.

Setting up your own tracking system could take less than an hour and save you hundreds of dollars in missed opportunities, or dozens of hours digging through accounts in search of pertinent details.

Planning a trip? Check out these articles for more inspiration and advice: Credit cards 101 How to apply for a credit card so you’ll get approved Need credit card recommendations? We can help

on Chase's website

1x-5x

Points60,000

Pointson Chase's website

1.5%-6.5%

Cashback$300

2x-5x

Miles75,000

Miles