The Basics of Airline Partnerships and Alliances

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Airline partnerships offer flexibility and opportunity for savvy travelers. They also offer complexity and potential confusion for beginners.

At their core, airline partnerships expand the value of frequent flyer rewards. If you have a bunch of Delta SkyMiles, for example, you can use them to book flights with Delta’s partners. On the flip side, if you book a cash flight with a Delta partner, you can choose to earn Delta miles instead of whatever loyalty miles are offered by that airline.

There are some additional perks to these partnerships, such as elite status benefits. We’ll cover those at the end of this guide. First, let’s tackle the basics.

Airline alliances vs. airline partnerships

Some airlines are part of global alliances with names like SkyTeam, Oneworld and Star Alliance. Others are not part of an official alliance but have a grab-bag list of partner airlines. And, confusingly, many airlines that are part of an official alliance also have partner airlines that are not in that alliance.

Let’s keep it simple: An alliance is just a type of partnership. So, for the most part, you can ignore whether a given airline is a “alliance partner” or just “partner” with another airline. Partners are partners.

Alliances are somewhat helpful for remembering partnerships. For example, if you know that one airline is in the Star Alliance, then you know that any other airline in that alliance will share many of the same partners. But beyond that (and some reciprocal elite status benefits, explained below), you can safely ignore the difference between a partnership and an alliance.

» Learn more: 5 things Star Alliance is doing right

Redeeming miles with partners

Using miles with one airline to book flights with a partner is one of the major reasons to care about airline partnerships. It increases the flexibility and potential value of your miles considerably.

Let’s say you have a bunch of Alaska miles and want to fly somewhere that Alaska doesn’t fly, such as Europe. That’s where partners come in. You can use your Alaska miles to book a flight to Europe on one of their partner airlines. The flight will be flown and operated by the partner, but you won’t need any of that partner’s miles to book your award ticket.

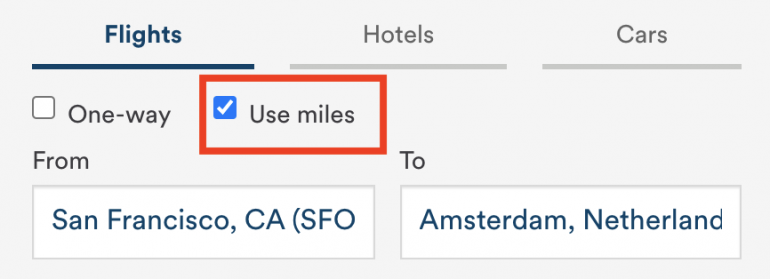

How does it work? It varies from airline to airline, but most will automatically show partner flights when you make an award search. Here’s what it looks like on Alaska’s website:

Making an award search using miles will lead to a results page that looks like this:

You can see that some of Alaska’s partner airlines, such as Icelandair and American Airlines, are automatically included in the search results. Some itineraries even include a mixture of flights operated by Alaska and its partners.

Some airlines, such as United, will let you filter results to exclude or include partner airlines.

Usually, you’ll want to include partner flights, and only filter them out if you’re looking for a very specific route or aircraft.

Earning miles with partners

Here’s where many travelers get confused and make rookie mistakes. Generally, when you’re flying on an international airline, such as KLM or Singapore Airlines, you’ll want to attribute the miles you earn on that flight to a domestic airline partner. Let’s break that down with an example.

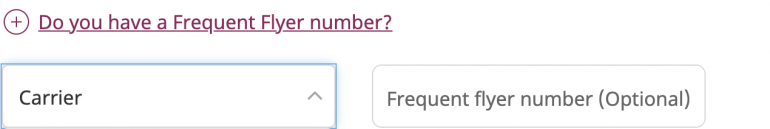

Let’s say you’re booking a flight to the Middle East on Qatar Airways. During checkout, you see a field like this, asking for your frequent flyer account:

You have three options:

You can enter your Qatar frequent flyer info or create an account.

You can enter the frequent flyer info for one of Qatar’s partners (such as Alaska or American).

You can skip this step. After all, you’ve never flown with Qatar and are unlikely to again.

Option 2 is almost always the best decision. Chances are you already have an account with either American or Alaska, Qatar’s two U.S. partners, and might already have some miles saved in that account. Earning more miles with a U.S. airline is usually preferable to earning a handful of miles with an airline you almost never fly (option 1).

Option 3 is almost never advisable, unless you can’t stand keeping track of travel rewards (in which case you probably shouldn’t be reading this guide at all).

One IMPORTANT caveat

The way you earn miles with an airline partner may differ significantly from the way that you earn miles when flying with the airline itself.

For example, miles on American Airlines are earned based on the cost of the ticket, while American miles earned when flying on partner airlines are based on a percentage of the miles actually flown. Tools like wheretocredit.com offer helpful ways to see the best way to attribute a given flight.

Elite status partner benefits

If you have elite status with a given airline, you might receive reciprocal benefits from some or all of its partners. This is more often true with airlines that are part of a global alliance.

For example, flyers with Delta Medallion status automatically get separate SkyTeam elite status, which affords perks when flying on any SkyTeam airlines. This makes the experience more consistent if you’re flying on a mixed itinerary of Delta and its partners.

Elite status perks from partners are generally more limited than those offered on the airline with which you have elite status.

Transferring miles between partners

There is a difference between general “partnerships” in the way we have been describing them and “transfer partnerships.” The latter generally refer to transferable travel currencies, like credit card points.

Generally speaking, you cannot transfer airline miles from one program to another. In the rare cases where you technically can do so, it is generally not advisable, as these transfers usually zap the value of your miles.

This highlights why it’s so important to earn miles with one member of a partnership, rather than earning several small pools of miles across multiple airlines. Since you can’t pool these miles into one account and redeem them, they are likely to languish for years or expire.

The bottom line

Understanding how airline partnerships work will hopefully clear up some confusion and put you on a path toward taking advantage of their benefits.

Remember:

You can mostly ignore the difference between a partnership and an alliance.

You can use miles to book flights with partners. This is not the same as transferring your airline miles from one program to another (which is typically not advised).

You can earn miles by flying with partners.

You (generally) can’t transfer miles between partners.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024, including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-5x

Points60,000

Pointson Chase's website

1.5%-6.5%

Cashback$300

2x-5x

Miles75,000

Miles