Interactive Brokers Review 2024: Pros, Cons and How It Compares

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Our Take

5.0

The bottom line:

on Interactive Brokers' website

Pros & Cons

Pros

Large investment selection.

Strong research and tools.

Over 19,000 no-transaction-fee mutual funds.

High order execution quality.

Cons

High minimum to earn interest on uninvested cash.

Compare to Similar Brokers

Current Product

NerdWallet rating 5.0 /5 | NerdWallet rating 4.9 /5 | NerdWallet rating 4.1 /5 |

Fees $0 per trade | Fees $0 per online equity trade | Fees $0 per trade |

Account minimum $0 | Account minimum $0 | Account minimum $0 |

Promotion None no promotion available at this time | Promotion None no promotion available at this time | Promotion Get up to $700 when you open and fund a J.P. Morgan Self-Directed Investing account with qualifying new money. |

Learn more on Interactive Brokers' website | Learn more on Charles Schwab's website | Learn more on J.P. Morgan's website |

Get more smart money moves — straight to your inbox

Become a NerdWallet member, and we’ll send you tailored articles we think you’ll love.

Full Review

Where Interactive Brokers shines

IBKR Lite: Interactive Brokers has long been a popular broker for advanced traders, but in 2019, the company launched a second tier of service — IBKR Lite — for more casual investors. With IBKR Lite, you get unlimited free trades of stocks and exchange-traded funds that are listed on U.S. exchanges.

Investment selection: If you're interested in trading other investments, including options, futures, mutual funds, crypto, fixed income and more, you can do that on hundreds of exchanges in dozens of countries.

Advanced platform: As the name implies, IBKR Pro is geared toward advanced traders. If that's you, you'll probably like the broker's per-share pricing of $0.005 per share, advanced trading platform, and unmatched range of tradable securities — including foreign stocks.

Both tiers of service have a $0 account minimum and offer fractional shares of stock. IBKR Lite and IBKR Pro have no account maintenance or inactivity fees.

Where Interactive Brokers falls short

Website ease-of-use: Interactive Brokers provides a great deal of information on its website, but finding and interpreting the information you want isn't always easy. For IBKR Pro customers, the various commission and fee structures can make it hard to quickly identify what your costs will be. Portions of the website are dedicated to institutional, broker and proprietary trading accounts, and that can be confusing.

Lack of IPO and OTC access: By most measures, Interactive Brokers excels when it comes to investment selection. But unlike some other brokers, they do not offer users any way to invest in initial public offerings (IPOs). IBKR Lite accounts also do not have access to over-the-counter (OTC) stocks.

Interactive Brokers is best for:

Casual and advanced traders.

Day traders.

Margin accounts.

Options trading.

Research and data.

International investors.

Interactive Brokers at a glance

Account minimum | $0 |

Stock trading costs |

|

Options trades |

|

Account fees (annual, transfer, closing, inactivity) | None. |

Number of no-transaction-fee mutual funds | Over 19,000. |

Tradable securities | • Stocks. • Bonds. (Treasuries, corporates, municipal bonds, non-U.S. sovereign bonds, certificates of deposit, bond funds.) • Mutual funds. • ETFs. • Options. • Fractional shares. • Futures. • Crypto. • Forex. • Metals. |

Interest rate on uninvested cash | Minimum balance to earn interest is $10,000.

|

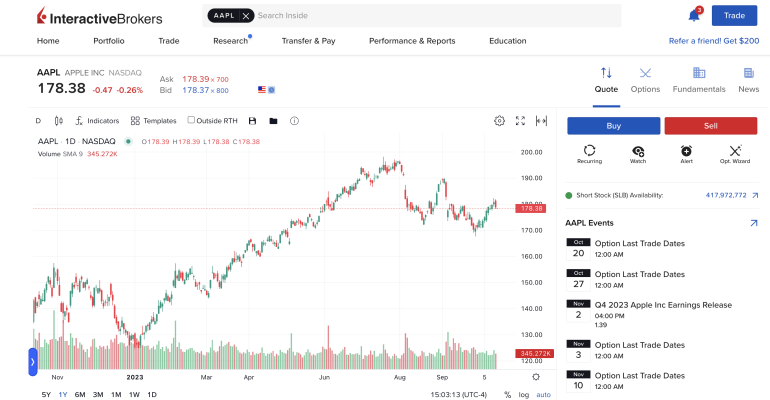

Trading platform | Interactive Brokers offers three different apps, two different web portals and two different desktop trading platforms. Its main platforms, IBKR Mobile, Client Portal and Trader Workstation, offer a smooth trading experience with powerful charting tools. |

Mobile app | Advanced features mimic the desktop app, but iOS and Android user ratings are average. |

Research and data | Extensive research offerings, both free and subscription-based. |

Customer support options (includes how easy it is to find key details on the website) | 24-hour phone and chat service Monday to Friday. Chat service from 1:00 p.m. to 7:00 p.m. Eastern time on Sundays. |

» Looking to switch brokers? View the best broker promotions right now

Interactive Brokers in more detail

Account minimum: 5 out of 5 stars

Interactive Brokers allows you to open an account with no minimum required.

Stock trading costs: 5 out of 5 stars

If you're a casual investor, it’s hard to beat the free trades you'll enjoy with IBKR Lite. But even advanced traders who opt for IBKR Pro will like the low stock and ETF commission structure at Interactive Brokers, which favors frequent, high-volume traders with a maximum commission of $0.005 per share.

The broker also offers tiered pricing to lower rates even more. Investors who trade up to 300,000 shares a month can pay $0.0035 per share; tiered rates based on trading volume go as low as $0.0005 per share for clients who trade more than 100 million shares a month. Exchange and regulatory fees are extra on this plan.

Options trades: 4 out of 5 stars

Options trading is offered at competitive pricing, for both Pro and Lite customers, with a $.65 charge per contract and no base, plus Pro customers get discounts for larger volumes.

Account fees: 5 out of 5 stars

Interactive Brokers charges no annual, account, transfer or closing fees, which is relatively rare among brokers we review.

Interest rate on uninvested cash: 2 out of 5 stars

Interactive Brokers pays competitive interest rates on uninvested cash — if you meet the minimum balance for it, which is substantial. The broker does not pay any interest on balances below $10,000, and even for larger accounts, it only pays interest on the portion above $10,000.

That said, those above-$10,000 interest rates are pretty good compared to the rates paid by other brokers. Lite accounts earn 3.83%, the benchmark federal funds rate minus 1.5% — while Pro accounts earn 4.83%, the benchmark rate minus 0.5%.

Number of no-transaction-fee mutual funds: 5 out of 5 stars

The retirement-investor set will be happy with the broker's impressive list of no-transaction-fee mutual funds — over 19,000 in all, above and beyond the vast majority of the broker's competitors.

Tradable securities available: 5 out of 5 stars

Interactive Brokers offers something for everyone here: Advanced traders will love the huge selection of products, including standard offerings of stocks, options and ETFs, precious metals, forex, warrants and futures. The broker also offers overnight trading on more than 10,000 domestic stocks and ETFs.

Interactive Brokers offers one of the widest bond selections of any broker we review, giving investors direct access to Treasury bonds, corporate bonds, municipal bonds, CDs and even sovereign bonds from other countries. Some other brokers only offer bond access in the form of bond funds — and those are available on IBKR as well.

The broker also offers fractional shares of both domestic and Canadian stocks and ETFs. The ability to purchase a portion of a company's stock, rather than a full-priced share, makes it easier to invest in companies that have lofty share prices. That, in turn, makes it easier to maintain a diversified portfolio, especially for investors with smaller accounts.

Finally, Interactive Brokers offers some of the lowest margin rates in the business, charging Lite customers just 7.83% (the benchmark rate plus 2.5%) and Pro customers 5.83% to 6.83% (benchmark plus 0.5% to 1.5%) depending on volume.

Crypto offering:

Interactive Brokers introduced cryptocurrency trading in 2021, and the offering gives users 24/7 access to bitcoin, ethereum, litecoin and bitcoin cash. And while the service doesn't offer commission-free trading like some brokers do, the fees are pretty minimal, and are capped at 1%.

More advanced crypto investors may want to opt for a pure-play crypto brokerage instead, however. Like many other traditional stock brokers, IBKR does not offer crypto-crypto trading pairs, staking functionality, or the ability to use your own wallet.

Trading platform: 4 out of 5 stars

The casual traders who find IBKR Lite appealing will find the Client Portal platform adequate for their trading needs. But both IBKR Lite and IBKR Pro traders seeking something more powerful can now enjoy access to IBKR Desktop, which is one of the most richly-featured trading platforms available for advanced traders.

How we nerd out testing trading platforms

Our reviewers — who are writers and editors on NerdWallet’s content team — hands-on test every online broker platform in our analysis. That way, we’re able to report on every aspect of the user experience, from funding a new account to actually placing trades.

We score each broker against a set of criteria that factors in both the capabilities offered and the actual user experience of trading with those capabilities. This includes how easy it was to sign up for and fund a new account. Note that a broker may score very highly for the platforms it offers, but low for the experience of actually using that platform. These are scored separately in our analysis, and they are weighted evenly when factored into the broker’s overall score. This means a broker can offer an advanced trading platform, but if it is clunky to use or the process of opening an account is unnecessarily arduous, that will be reflected in their score.

The platform is fast and includes standard features such as real-time monitoring, alerts, watchlists and a customizable account dashboard that allows investors to screen for multiple metrics simultaneously. An "option lattice" helps traders find option contracts on a particular stock that are outliers in terms of price, volatility or other key metrics.

Other tools available to IBKR customers through their various platforms include a volatility lab, advanced charting, heat maps of sector and stock symbol performance, paper trading and a mutual fund replicator, which helps users identify ETFs that replicate the performance of a selected mutual fund but offer lower fees. Interactive Brokers For You notifications offer customized alerts about events that could affect a trader’s investments.

Worth noting: Another broker we review, Zacks Trade, offers its customers access to white-labeled versions of IBKR's Trader Workstation product. Zacks Trade charges higher trade commissions, but offers clients free calls with support reps who are licensed brokers. It's an option worth considering for traders who want the power of Interactive Brokers' trading platforms alongside a bit more personal support.

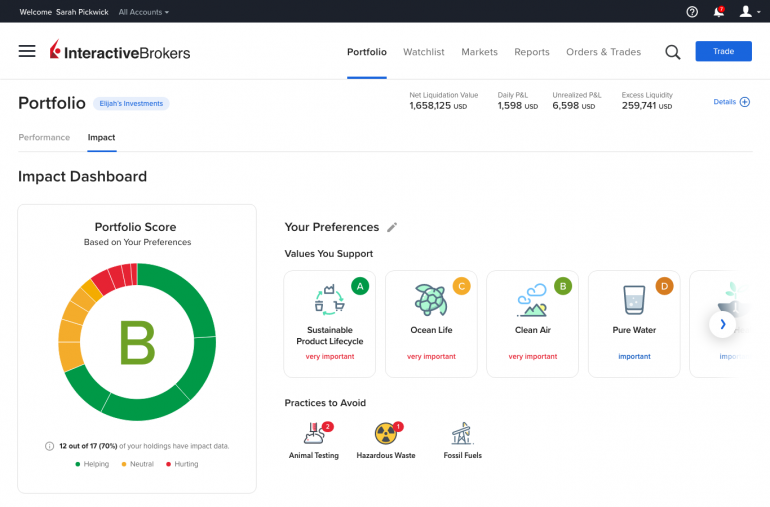

For investors looking to trade with a conscience, Interactive Brokers offers an Impact Dashboard, free to all users. The dashboard allows investors to select their personal investment criteria from 13 principles (including clean air and water, LGBTQ inclusion and gender equality). Investors can also exclude investments based on 10 categories, such as animal testing, corporate political spending and lobbying, and hazardous waste production.

Interactive Brokers earns high marks for its smooth-yet-highly-customizable trading interface, and for its excellent order execution quality — 100% of trades for S&P 500 and non-S&P index stocks are executed at the National Best Bid and Offer (NBBO) price or better.

The average execution quality of all brokers we review was 97.4% as of Aug. 31, 2023. That means 97.4% of orders were executed at a price that was at or better than the National Best Bid and Offer. Executing at or above the NBBO means you may receive price improvement, or a better share price than you were originally quoted.

However, there are a few things that prevented Interactive Brokers from earning the highest possible score for its trading platform, such as the lack of IPO access and the lack of OTC access for IBKR Lite. The broker also accepts payment for order flow (PFOF) for Lite customers. This business model involves routing customer orders through trading firms that use the order data to inform their own trading decisions.

The effects of PFOF are negligible for most investors, but under some circumstances it may result in orders being executed slightly slower or at slightly-worse prices than non-PFOF brokers.

Mobile app: 4 out of 5 stars

The IBKR mobile app, available to both Lite and Pro customers, is Trader Workstation on the go, with advanced trading shortcuts, more than 400 data columns, option exercise and spread templates, news, research, charting and scanners. Users can create order presets, which prefill order tickets for fast entry. Presets set up on Trader Workstation are also available from the mobile app. However, the app hasn't quite broken the 4.5-star barrier in terms of its Android and iOS ratings, so we can't give it 5 stars.

Research and data: 5 out of 5 stars

Interactive Brokers provides access to a huge selection of research providers and news services, many for free. It offers more thna 200 services from several dozen news and research providers. A few providers available to all clients include Zacks Investment Research, Morningstar Equity Ownership, Market Realist, 24/7 Wall Street and TheStreet. Hundreds of additional providers are also available by subscription.

Customer support: 4 out of 5 stars

Interactive Brokers offers 24-hour phone, email and chat support starting 8 a.m. Eastern time Monday through 8 p.m. Friday, and from 1 p.m. to 7 p.m. Sunday. However, there are no physical branches, so you won't be able to schedule an in-person meeting, if that's your preference.

While many brokerages are only open to U.S. investors, Interactive Brokers is available to investors in more than 200 countries and territories.

Other Interactive Brokers details you should know

Margin rates

Margin traders will benefit from the low rates at Interactive Brokers. For IBKR Pro customers, the margin rate is currently 6.83% (benchmark rate plus 1.5%), and NerdWallet users get an extra 0.25 percentage point discount. For IBKR Lite, it's 7.83% (benchmark rate plus 2.5%). Those rates apply on balances between $0 and $100,000; the rates drop at higher balances. The broker charges a blended rate based on the size of the margin loan, and has a calculator on its website to help investors quickly do the math based on their balance. (Only U.S. residents who open and fund a new IBKR Pro account are eligible for the discounted margin rate.)

Interactive Brokers IRAs

Interactive Brokers also offers IRA accounts, which are individual retirement accounts. Most financial advisors recommend saving for retirement in an IRA — alongside a employer retirement account, if applicable, like a 401(k) — because of the lucrative tax advantages. You can have an IRA in addition to a standard taxable brokerage account, such as one you might use to trade stocks or invest for non-retirement goals.

on Interactive Brokers' website

on Interactive Brokers' website

$0

per trade

$0

None

no promotion available at this time

Pros

- Large investment selection.

- Strong research and tools.

- Over 19,000 no-transaction-fee mutual funds.

- High order execution quality.

Cons

- High minimum to earn interest on uninvested cash.

Is Interactive Brokers right for you?

Interactive Brokers has always been a great choice for active traders, especially those who can move into the broker's cheaper volume-pricing setup. With the availability of free trades through IBKR Lite, even casual traders might find Interactive Brokers a strong contender. But beginner investors might prefer a broker that offers a bit more hand-holding.

How do we review brokers?

NerdWallet’s comprehensive review process evaluates and ranks the largest U.S. brokers by assets under management, along with emerging industry players. Our aim is to provide an independent assessment of providers to help arm you with information to make sound, informed judgments on which ones will best meet your needs. We adhere to strict guidelines for editorial integrity.

We collect data directly from providers through detailed questionnaires, and conduct first-hand testing and observation through provider demonstrations. The questionnaire answers, combined with demonstrations, interviews of personnel at the providers and our specialists’ hands-on research, fuel our proprietary assessment process that scores each provider’s performance across more than 20 factors. The final output produces star ratings from poor (one star) to excellent (five stars).

For more details about the categories considered when rating brokers and our process, read our full methodology.

on Interactive Brokers' website