Ally Mortgage Review 2024

Some or all of the mortgage lenders featured on our site are advertising partners of NerdWallet, but this does not influence our evaluations, lender star ratings or the order in which lenders are listed on the page. Our opinions are our own. Here is a list of our partners.

- 50+ mortgage lenders reviewed and rated by our team of experts.

- 40+ years of combined experience covering mortgages and financial topics.

- Objective, comprehensive star rating system assessing 120+ categories and 5,000+ data points.

- Governed by NerdWallet's strict guidelines for editorial integrity.

Our Take

4.0

Borrowers looking for a conventional mortgage may be satisfied with Ally’s relatively low interest rates and low down payment requirements. However, those looking to explore a wide range of potential mortgage options — such as government-backed loans or second mortgages — won’t find them at Ally. Borrowers looking for a fast application experience may also want to look elsewhere, as customers must be preapproved before applying for a loan.

Pros

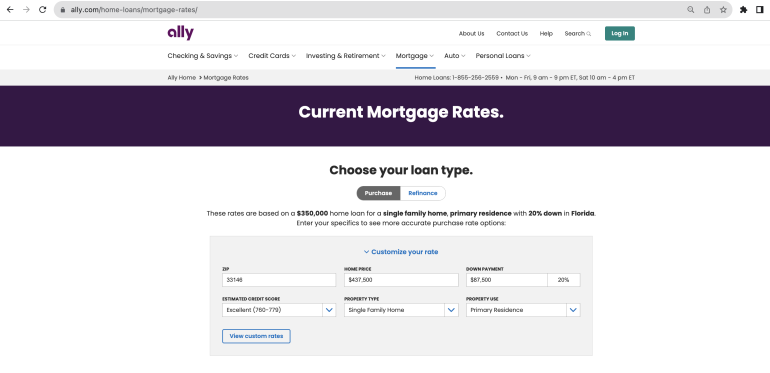

- Borrowers can receive a customized rate quote by entering their information (home price, credit score, etc.) into a tool on Ally’s website.

- Offers Fannie Mae’s HomeReady loan, which has flexible lending requirements and requires just 3% down.

- Interest rates are on the low side relative to competitors, according to the latest federal data.

Cons

- Borrowers must be preapproved before applying for a loan.

- Doesn't offer FHA, VA or USDA loans.

- Origination fees are on the high side, according to the latest federal data.

Lender | Min. credit score | Min. down payment | |

|---|---|---|---|

620 | 3.5% | Visit Lenderat NBKC at NBKC | |

620 | 3% | Visit Lenderat Guaranteed Rate at Guaranteed Rate | |

620 | 5% | ||

620 | 3% | ||

620 | 3% |

Full Review

Ally’s mortgage loan options

2 of 5 stars

Ally offers conventional loans, including the Fannie Mae HomeReady loan, which requires a minimum down payment of 3% and allows for a debt-to-income ratio of 50%. Borrowers may qualify if they earn up to 80% of the median income in the area where they’re buying a home. The lender also offers jumbo loans.

Ally doesn't offer any government-backed mortgages, unlike many national lenders. Borrowers may be interested in one of these loans — USDA, VA or FHA loans — because they can have looser lending qualifications than conventional mortgages. Borrowers who purchase or refinance their mortgage through Ally will need to meet the qualifications for a conventional loan or jumbo loan.

What it’s like to apply for an Ally mortgage

4 of 5 stars

Ally requires borrowers to apply for preapproval before applying for a mortgage. With no physical branch locations, Ally may be a good fit for borrowers who are comfortable with an online banking experience.

Ally’s mobile app has an average rating of 4.7 in the App Store and has been rated over 63,000 times. The lender also has a customer support line, which is available from 9 a.m. to 9 p.m. Monday through Friday and from 10 a.m. to 4 p.m. on Saturday. When we called, we had to navigate through a phone tree for a few minutes to connect with a live agent. However, the representative picked up quickly and was able to answer all of our questions. Ally’s website also has a chat feature, but it’s only available to current customers who are logged into their account.

Its website offers educational resources for customers, including an FAQ section and a roadmap that helps customers prepare for the home buying process. Ally is also affiliated with SpringFour, which connects customers with financial assistance programs.

» MORE: How to apply for a mortgage

Ally’s mortgage rates and fees

3 of 5 stars

Ally earns 2 of 5 stars for average origination fee.

Ally earns 4 of 5 stars for average mortgage interest rates.

NerdWallet analyzes federal data to compare mortgage lenders’ origination fees and offered mortgage rates. We measure annual averages across all loan types, as reported by lenders. Ally’s average mortgage rates are on the lower end compared with competitors, while its average origination fees were on the higher side.

Borrowers should consider the balance between lender fees and mortgage rates. While it's not always the case, paying upfront fees can lower your mortgage interest rate. Some lenders will charge higher upfront fees to lower their advertised interest rate and make it more attractive. Some lenders just charge higher upfront fees.

Ally’s mortgage rate transparency

5 of 5 stars

Borrowers can enter their ZIP code, home price, down payment, credit score range, property type (single family, townhouse, etc.) and property use (primary home, secondary residence or investment property) to get customized rates. For borrowers doing a cash-out refinance, they can also enter this additional amount and see how this changes their rate estimates.

Estimated rates don’t include taxes or insurance costs, so actual APRs will likely be higher.

What borrowers say about Ally mortgages

NerdWallet’s lender star ratings assess objective qualities, including rates, fees and loan offerings. To assess borrowers’ subjective experiences with lenders, NerdWallet has gathered customer satisfaction ratings from J.D. Power and Zillow.

Ally received a score of 731 out of 1,000 in J.D. Power’s 2022 U.S. Mortgage Origination Satisfaction Study. The industry average for origination was 716. (Mortgage origination covers the initial application through closing day.) Ally was not included in J.D. Power's 2023 Mortgage Origination Satisfaction Study.

Ally receives a customer rating of 4.44 out of 5 on Zillow, as of the date of publication. The rating reflects 315 customer reviews.

Alternatives to a home loan from Ally

Borrowers who are looking for a primarily online lender experience may be interested in Guaranteed Rate for a variety of loan types or Pennymac for a government-backed loan.

» MORE: Best mortgage lenders

Explore mortgages today and get started on your homeownership goals

Get personalized rates. Your lender matches are just a few questions away.

John Buzbee contributed to this review.

More from NerdWallet

NerdWallet’s overall ratings for mortgage lenders are evaluated based on four major categories: variety of loan types (purchase, refinance, fixed and adjustable, for example), ease of application, rates and fees and rate transparency. Among the factors we consider when scoring these categories are options to apply for and track loans online, the level of detail about mortgage rates on lender websites and our analysis of the rates and fees lenders reported in the latest available Home Mortgage Disclosure Act data. These scores generate ratings from 1 star (poor) to 5 stars (excellent).