Carrington Mortgage Review 2024

Some or all of the mortgage lenders featured on our site are advertising partners of NerdWallet, but this does not influence our evaluations, lender star ratings or the order in which lenders are listed on the page. Our opinions are our own. Here is a list of our partners.

- 50+ mortgage lenders reviewed and rated by our team of experts.

- 40+ years of combined experience covering mortgages and financial topics.

- Objective, comprehensive star rating system assessing 120+ categories and 5,000+ data points.

- Governed by NerdWallet's strict guidelines for editorial integrity.

Our Take

3.5

Carrington has options for buyers with credit challenges or nontraditional credit histories, as well as self-employed borrowers. However, the lender was penalized for misleading customers about mortgage payment relief during the pandemic.

Pros

- Offers multiple low-down-payment loans.

- Accepts history of bankruptcy, foreclosure and late payments with flexible loan program.

- Considers borrowers with low credit scores and high debt-to-income ratios.

Cons

- Fined $5.25 million for misleading customers about pandemic-era payment relief.

- Doesn't offer home equity lines of credit.

- Lender fees are on the high side, according to the latest federal data.

Lender | Min. credit score | Min. down payment | |

|---|---|---|---|

620 | 3.5% | Visit Lenderat NBKC at NBKC | |

620 | 3% | Visit Lenderat Guaranteed Rate at Guaranteed Rate | |

620 | 5% | ||

620 | 3% | ||

620 | 3% |

Full Review

What borrowers say about Carrington Mortgage

NerdWallet’s lender star ratings assess objective qualities, including rates, fees and loan offerings. To assess borrowers’ subjective experiences with lenders, NerdWallet has gathered customer satisfaction ratings from J.D. Power and Zillow.

Carrington Mortgage receives a score of 536 out of 1,000 in J.D. Power’s 2023 U.S. Mortgage Servicer Satisfaction Study. The industry average for servicing is 601. (A mortgage servicer handles loan payments.)

Carrington Mortgage receives a customer rating of 4.93 out of 5 from Zillow, as of the date of publication. The score reflects more than 900 customer reviews.

Carrington Mortgage and consumer trust

The Consumer Financial Protection Bureau (CFPB) took action against Carrington in November 2022 for misleading borrowers who sought temporary mortgage payment relief, known as forbearance, during the COVID-19 pandemic. The lender was ordered to repay improperly charged late fees and pay $5.25 million into the CFPB’s victims relief fund.

A lender’s NerdWallet star rating is negatively affected by recent regulatory actions for violations that harmed mortgage customers. When shopping for a mortgage lender, do an online search to see if the company is in the news, and why.

Carrington’s mortgage loan options

4 of 5 stars

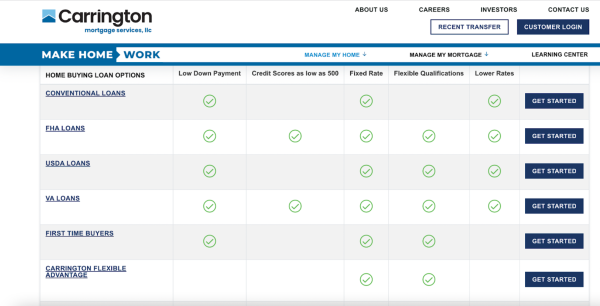

The Carrington Mortgage Services menu offers a standard mix of conventional purchase and refinance loans, as well as government-backed VA loans, FHA loans and USDA loans. FHA and VA loans are also available for manufactured homes, which can be an affordable path to homeownership.

Carrington’s website features an easy-to-read chart where you can compare requirements for different types of loans:

Borrowers who have little credit history or who apply with bank statements (such as self-employed borrowers) can get loans for purchase or refinance through Carrington's Flexible Advantage programs. These loans are also a good fit for borrowers overcoming credit challenges such as bankruptcy, missed payments or foreclosure.

Carrington offers cash-out refinance and high-dollar-limit loan options through the Flexible Advantage programs, too.

Carrington’s home loans are not available in Massachusetts and North Dakota. The cash-out Flexible Advantage loan is not available in Texas.

Carrington Mortgage home equity loan

Carrington Mortgage offers home equity loans. These second mortgages are a way for homeowners to access existing home equity without refinancing or selling their home. Funds obtained with a second mortgage can be used for expenses such as home improvements, education costs or debt consolidation.

Carrington Mortgage home equity loans are only available to current Carrington borrowers. These loans are available for primary residences or second homes, with a wide range of term options. The lender does not offer home equity lines of credit.

» MORE: Best home equity loan lenders

What it’s like to apply for a Carrington mortgage

3 of 5 stars

On the Carrington website, you can fill out a contact form that begins the mortgage application process. However, in our research, we couldn’t identify a start-to-finish path to complete a fully online application.

The website provides a phone number for customer service but does not indicate an option to apply for a mortgage in person at a branch.

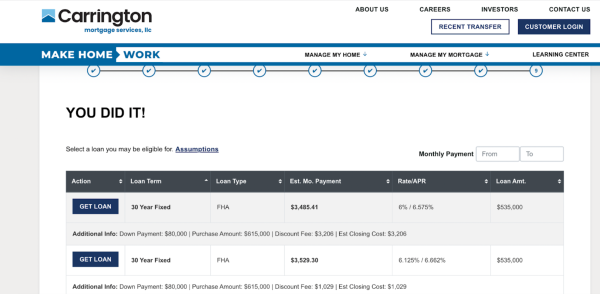

The “get started” or “get loan” buttons lead you to a flow to provide straightforward information. After filling out the desired loan amount, location and financial details, you’re presented with a list of loans you may qualify for:

From there, you are prompted to enter personal information and move further into the mortgage pre-approval process.

Carrington does not offer a chatbot or online chat function on its website. While it does offer a mobile app for iPhone and Android, the average rating falls below 2.9. Recent reviews indicate customer frustrations with limited app functionality and technical difficulties.

Customer service is available by phone. When we called with a question, we experienced a long hold time while waiting on a transfer from a customer service advocate to the mortgage team. There was no option to hang up and receive a call back. After being told we would be on hold for 10 minutes, we hung up after a 55-minute wait.

» MORE: How to apply for a mortgage

Carrington Mortgage rates and fees

2.5 of 5 stars

Carrington Mortgage earns 2 of 5 stars for average origination fee.

Carrington Mortgage earns 3 of 5 stars for average mortgage interest rates.

NerdWallet analyzes federal data to compare mortgage lenders’ origination fees and offered mortgage rates. We measure annual averages across all loan types, as reported by the lenders. Carrington’s origination fee is slightly higher than most lenders, while its interest rates are about average. Loans considered higher risk often have higher interest rates and fees.

Borrowers should consider the balance between lender fees and mortgage rates. While it's not always the case, paying upfront fees can lower your mortgage interest rate. Some lenders will charge higher upfront fees to lower their advertised interest rate and make it more attractive. Some lenders just charge higher upfront fees.

Carrington’s mortgage rate transparency

5 of 5 stars

You'll find extensive information about product offerings and requirements on the Carrington website, as well as the ability to view customized mortgage rates. For purchase loan rates, select the “purchase options” button on Carrington’s homepage. If you aren’t an existing customer, choose “no” to be taken to a form that asks for some basic information. After filling out the form, you’ll see personalized rates that take credit score and location into account.

Alternatives to a home loan from Carrington Mortgage

Here are some comparable lenders we review that borrowers can consider.

New American Funding offers non-qualified mortgages, also called non-QM loans, with flexible income and credit requirements. Caliber offers loans for self-employed borrowers looking to qualify with bank statements.

Explore mortgages today and get started on your homeownership goals

Get personalized rates. Your lender matches are just a few questions away.

Bella Angelos contributed to this review.

More from NerdWallet

NerdWallet’s overall ratings for mortgage lenders are evaluated based on four major categories: variety of loan types (purchase, refinance, fixed and adjustable, for example), ease of application, rates and fees and rate transparency. Among the factors we consider when scoring these categories are options to apply for and track loans online, the level of detail about mortgage rates on lender websites and our analysis of the rates and fees lenders reported in the latest available Home Mortgage Disclosure Act data. These scores generate ratings from 1 star (poor) to 5 stars (excellent).