Fairway Mortgage Review 2024

Some or all of the mortgage lenders featured on our site are advertising partners of NerdWallet, but this does not influence our evaluations, lender star ratings or the order in which lenders are listed on the page. Our opinions are our own. Here is a list of our partners.

- 50+ mortgage lenders reviewed and rated by our team of experts.

- 40+ years of combined experience covering mortgages and financial topics.

- Objective, comprehensive star rating system assessing 120+ categories and 5,000+ data points.

- Governed by NerdWallet's strict guidelines for editorial integrity.

Our Take

3.0

Fairway Independent Mortgage Corporation offers a wide variety of loans and is a top lender by volume for government-backed mortgages. But it doesn't display sample rates online, and its rates and fees are on the higher end compared with other lenders.

Pros

- Offers a robust suite of loan products, including ITIN loans for borrowers without Social Security numbers, renovation loans, government-backed mortgages and loans for self-employed borrowers.

- Receives high marks for customer satisfaction, according to J.D. Power and Zillow.

Cons

- Mortgage rates for different types of loans aren't posted online.

- Origination fees and mortgage rates are on the high side compared with other lenders, according to the latest federal data.

Lender | Min. credit score | Min. down payment | |

|---|---|---|---|

620 | 3.5% | Visit Lenderat NBKC at NBKC | |

620 | 3% | Visit Lenderat Guaranteed Rate at Guaranteed Rate | |

620 | 5% | ||

620 | 3% | ||

620 | 3% |

Full Review

What borrowers say about Fairway mortgages

NerdWallet’s lender star ratings assess objective qualities, including rates, fees and loan offerings. To assess borrowers’ subjective experiences with lenders, NerdWallet has gathered customer satisfaction ratings from J.D. Power and Zillow.

Fairway receives a top-ranking score of 776 out of 1,000 in J.D. Power’s 2023 U.S. Mortgage Origination Satisfaction Study. The industry average for origination is 730. (Mortgage origination covers the initial application through closing day.)

Fairway receives a customer rating of 4.95 out of 5 on Zillow, as of the date of publication. The score reflects more than 34,600 customer reviews.

Fairway's mortgage loan types

4 of 5 stars

Fairway offers a broad selection of mortgages, including some hard-to-find options, such as ITIN loans for consumers without Social Security numbers and a mortgage tailored to physicians. The mortgage for medical professionals has low down payment requirements and doesn't count student loans in an applicant's debt-to-income ratio.

Fairway's website makes it easy to browse through the main types of loans the lender offers. On the day we visited, we saw 11 mortgage types listed on the loan products page, along with brief descriptions of each loan and links to further detail. ITIN loans weren't listed there, but the lender previously told us it offers them.

Fairway's fixed-rate mortgages feature several term options: 10, 15, 20, 25 or 30 years, depending on the loan type. The lender also offers adjustable-rate mortgages, which have interest rates that change after the initial fixed-rate periods.

Mortgage types include conforming and jumbo conventional mortgages, as well as a full slate of government-backed home loans. When shopping for lenders, it's helpful to know how much they focus on certain types of loans, so you can choose one with deep experience in the program you're interested in. Nationally, Fairway was the No. 1 lender by loan volume for USDA mortgages and the No. 3 lender by loan volume for FHA mortgages in 2022. It was in the top 10 lenders by volume for VA loans, according to 2022 Home Mortgage Disclosure Act data.

Renovation loans are also on the menu, including HomeStyle, FHA and VA renovation mortgages. In addition, Fairway offers reverse mortgages for seniors who want to tap into their home equity.

Fairway does not offer home equity loans or lines of credit.

What it's like to apply for a Fairway mortgage

2.5 of 5 stars

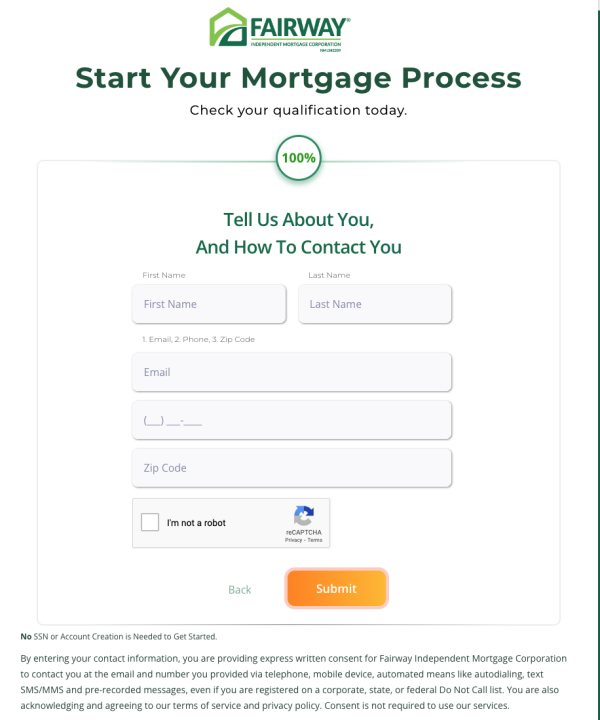

Fairway provides a few ways to apply. You can use the FairwayNOW mobile app, apply through the Fairway website or call or visit a branch.

But if you're in the early shopping stages, navigating your way to ask questions without providing your name and contact information is a little challenging. The website does not feature online chat or prominently post a phone number. A phone number for mortgage servicing and loans is included at the bottom of the home page and on a "contact corporate" page. But on the day we called the corporate number, we were told to contact a branch directly to ask questions about new loans.

Finding a branch is pretty intuitive. The website's "Locations" page features a list of states. Clicking on one brings up a list of branch offices by city and a map showing their locations. When you click on a branch, you can access a list of loan officers with their phone numbers and email addresses and see their photos, profiles and customer reviews.

If you don't mind providing your contact information, the website provides a number of places to ask for a response. The contact page features a form you can fill out with your name, email, phone number, message and how you want someone to contact you. There are also "Find a loan officer" and "Have someone contact me" buttons near the bottom of the home page.

From the home page you can click "Get pre-approved" or "Get started" to begin the application process. From there you're taken through a series of questions and then asked to provide information for a loan officer to get in touch with you.

Once you've made contact with a loan officer, the digital application lets you upload documents, track the progress of your loan and electronically sign documents. A digital closing process lets buyers and sellers preview and approve documents electronically before settlement to save time at the final closing.

» MORE: How to apply for a mortgage

Fairway's mortgage rates and fees

2 of 5 stars

Fairway mortgage earns 2 of 5 stars for average origination fee.

Fairway mortgage earns 2 of 5 stars for average mortgage interest rates.

NerdWallet analyzes federal data to compare mortgage lenders’ origination fees and offered mortgage rates. We measure annual averages across all loan types, as reported by the lenders. Fairway's rates and fees were on the higher side compared with other lenders. Loans considered higher risk often have higher interest rates and fees.

Borrowers should consider the balance between lender fees and mortgage rates. While it's not always the case, paying upfront fees can lower your mortgage interest rate. Some lenders will charge higher upfront fees to lower their advertised interest rate and make it more attractive. Some lenders just charge higher upfront fees.

Fairway's mortgage rate transparency

1 of 5 stars

Fairway does not publish mortgage rates on its website. Borrowers wanting to see mortgage rates based on credit score or other factors will need to contact a Fairway loan officer or begin an application online.

NerdWallet’s transparency ratings are higher for lenders that post sample rates on their sites, making it easier for home buyers to comparison shop, and highest for sites with self-serve tools that allow shoppers to see what rates might be like for their particular loan.

Alternatives to a home loan from Fairway

Here are some comparable lenders we review that borrowers can consider.

LoanDepot offers renovation loans, and Rocket Mortgage originates a high volume of FHA mortgages.

» MORE: Best lenders for FHA loans

Explore mortgages today and get started on your homeownership goals

Get personalized rates. Your lender matches are just a few questions away.

John Buzbee contributed to this review.

More from NerdWallet

NerdWallet’s overall ratings for mortgage lenders are evaluated based on four major categories: variety of loan types (purchase, refinance, fixed and adjustable, for example), ease of application, rates and fees and rate transparency. Among the factors we consider when scoring these categories are options to apply for and track loans online, the level of detail about mortgage rates on lender websites and our analysis of the rates and fees lenders reported in the latest available Home Mortgage Disclosure Act data. These scores generate ratings from 1 star (poor) to 5 stars (excellent).