Flagstar Bank Mortgage Review 2024

Some or all of the mortgage lenders featured on our site are advertising partners of NerdWallet, but this does not influence our evaluations, lender star ratings or the order in which lenders are listed on the page. Our opinions are our own. Here is a list of our partners.

- 50+ mortgage lenders reviewed and rated by our team of experts.

- 40+ years of combined experience covering mortgages and financial topics.

- Objective, comprehensive star rating system assessing 120+ categories and 5,000+ data points.

- Governed by NerdWallet's strict guidelines for editorial integrity.

Our Take

5.0

Flagstar Bank excels in most areas, such as its application options, customizable interest rate tool and range of mortgage types. Its unique and diverse product offerings include special financing for underserved borrowers and borrowers who are in the early years of a high-income career, as well as for buyers who are renovating or building a home. Interest rates are on the lower side relative to competitors, and borrowers who want to upgrade their home can take advantage of home equity products.

Pros

- Multiple loans for those who are renovating or building a home, including loans with interest-only payments during construction.

- Offers home equity loans and lines of credit.

- Offers down payment assistance and loans for underserved borrowers, including ITIN loans and loans with flexible qualifications in certain communities.

- Interest rates are on the low side relative to other lenders, according to the latest federal data.

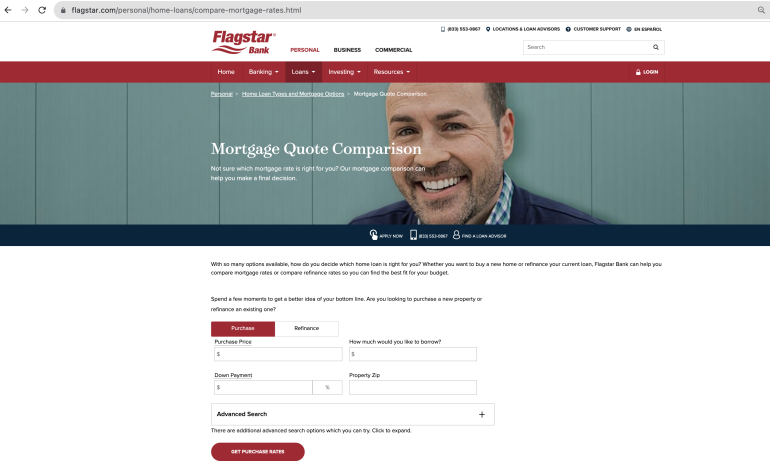

- Borrowers can enter their information (including their desired loan amount, down payment and ZIP code) into the lender’s Mortgage Quote Comparison tool and receive a customized rate quote.

Cons

- Home equity loans aren't available in all locations served by Flagstar.

- In 2022, the lender was fined for violating laws regarding properties in flood zones.

Lender | Min. credit score | Min. down payment | |

|---|---|---|---|

620 | 3.5% | Visit Lenderat NBKC at NBKC | |

620 | 3% | Visit Lenderat Guaranteed Rate at Guaranteed Rate | |

620 | 5% | ||

620 | 3% | ||

620 | 3% |

Full Review

What borrowers say about Flagstar Bank mortgages

NerdWallet’s lender star ratings assess objective qualities, including rates, fees and loan offerings. To assess borrowers’ subjective experiences with lenders, NerdWallet has gathered customer satisfaction ratings from J.D. Power and Zillow.

Flagstar Bank receives a score of 591 out of 1,000 in J.D. Power’s 2023 U.S. Mortgage Servicer Satisfaction Study. The industry average for servicing is 601. (A mortgage servicer handles loan payments.)

Flagstar Bank receives a customer rating of 4.97 out of 5 on Zillow, as of the date of publication. The rating reflects more than 2,900 customer reviews.

Flagstar Bank’s mortgage loan options

5 of 5 stars

Flagstar Bank offers a wide variety of purchase and refinance loans, as well as home equity loans and home equity lines of credit (HELOCs). Browsing the lender’s site quickly reveals many specialty loans such as:

Purchase loans for multiple properties.

Mortgages tailored to borrowers who are early in high-income careers, such as medical professionals and attorneys.

Loans with flexible requirements, including for borrowers in Detroit and Pontiac, Michigan, two communities that Flagstar has designated as benefitting from reinvestment.

Loans for borrowers without Social Security numbers.

Construction and renovation loans, including loans that require interest-only payments during the building period.

Flagstar Bank also offers standard loan options, including:

Conventional loans.

VA loans, including fixed-rate, adjustable-rate and refinance (IRRRL) loans.

FHA loans, including fixed-rate, adjustable-rate, and FHA 203(K) loans for renovation.

USDA loans.

State Housing Finance Agency (known as HFA) loans, which have flexible lending requirements and help get buyers into affordable housing.

Flagstar Bank and consumer trust

In 2022, Flagstar Bank was ordered to pay out $3.62 million in civil penalties for violating the Flood Disaster Protection Act. This involved improper management of loans that backed properties in flood zones, failure to notify borrowers who had inadequate flood insurance and taking too long to fund flood insurance premiums through escrow accounts.

The lender has since been acquired by a new parent company, New York Community Bank.

Because of the timing of the civil violation and Flagstar’s subsequent merger with New York Community Bank, its NerdWallet star rating was not impacted by these actions. When shopping for a mortgage lender, do an online search to see if the company is in the news, and why.

Flagstar Bank’s HELOCs and home equity loans

The lender also offers a home equity line of credit, or HELOC, and a home equity loan. These second mortgages are a way for homeowners to access existing home equity without refinancing or selling their home. Funds obtained with a second mortgage can be used for expenses such as home improvements, education costs or debt consolidation.

The lender provides sample rates for their equity products on its website.

Both HELOCs and home equity loans have a minimum balance of $10,000 and a 0.25% rate discount for enrolling in automatic payments. Borrowers who want to tap less than $10,000 of their equity will be better served by a lender with no minimum balance.

HELOCs have a maximum loan-to-value ratio (the amount of the loan relative to the value of the property) of 85%, which is slightly higher than the industry standard of 80%. There is also an annual fee of $75.

Home equity loans have a choice of 10, 15, or 20-year terms and are limited by geographic location.

» MORE: Best HELOC lenders

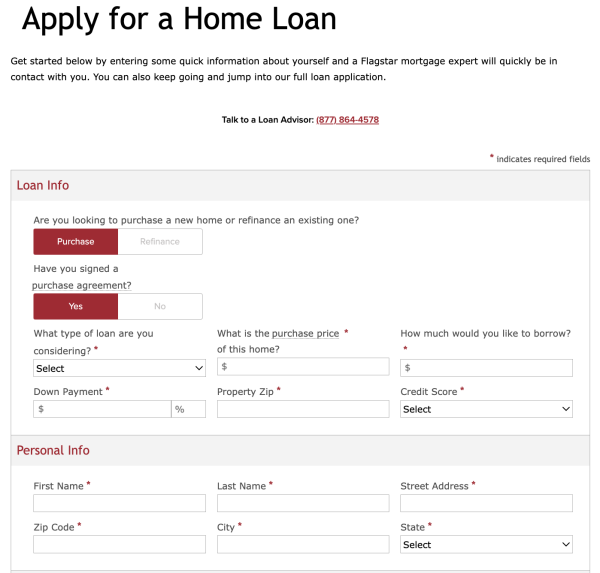

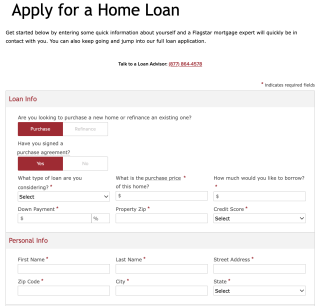

What it’s like to apply for a Flagstar Bank mortgage

5 of 5 stars

Borrowers can apply online, over the phone, by mail or at a home loan center. Note that only some branch locations are home loan centers, and many are accessible by appointment only.

Online customers can use the live chat feature for assistance. However, when we tested this feature, the agent couldn't answer our questions and instead directed us to a help page.

Borrowers who choose to apply over the phone can reach the lender’s mortgage lending department Monday through Thursday from 8 a.m. to 9 p.m. ET, Friday from 8 a.m. to 7 p.m. ET, or Saturday from 10 a.m. to 4 p.m. ET. When we called their line, we were connected with a knowledgeable representative after three minutes of holding. This time, the agent was able to answer all of our questions.

The lender also has a mobile app, which has a rating of 4.6 in the App Store at the time of writing.

» MORE: How to apply for a mortgage

Flagstar Bank’s mortgage rates and fees

3 of 5 stars

Flagstar Bank earns 2 of 5 stars for average origination fee.

Flagstar Bank earns 4 of 5 stars for average mortgage interest rates.

NerdWallet analyzes federal data to compare mortgage lenders’ origination fees and offered mortgage rates. We measure annual averages across all loan types, as reported by the lenders.

Flagstar Bank had lower-than-average mortgage interest rates relative to other lenders that NerdWallet researched, though its origination fees were on the higher side.

Borrowers should consider the balance between lender fees and mortgage rates. While it's not always the case, paying upfront fees can lower your mortgage interest rate. Some lenders will charge higher upfront fees to lower their advertised interest rate and make it more attractive. Some lenders just charge higher upfront fees.

Flagstar Bank’s mortgage rate transparency

5 of 5 stars

Borrowers can use the mortgage quote comparison tool on the lender’s site to get a sample rate that is tailored to their qualifications.

Alternatives to a home loan from Flagstar Bank

Borrowers looking to choose from a wide array of options (including borrowers from underserved communities) may be interested in a mortgage from New American Funding, while borrowers looking to tap their home equity may want to consider PNC Bank for a HELOC.

Explore mortgages today and get started on your homeownership goals

Get personalized rates. Your lender matches are just a few questions away.

Bella Angelos contributed to this review.

More from NerdWallet

NerdWallet’s overall ratings for mortgage lenders are evaluated based on four major categories: variety of loan types (purchase, refinance, fixed and adjustable, for example), ease of application, rates and fees and rate transparency. Among the factors we consider when scoring these categories are options to apply for and track loans online, the level of detail about mortgage rates on lender websites and our analysis of the rates and fees lenders reported in the latest available Home Mortgage Disclosure Act data. These scores generate ratings from 1 star (poor) to 5 stars (excellent).