Guild Mortgage Review 2024

Some or all of the mortgage lenders featured on our site are advertising partners of NerdWallet, but this does not influence our evaluations, lender star ratings or the order in which lenders are listed on the page. Our opinions are our own. Here is a list of our partners.

- 50+ mortgage lenders reviewed and rated by our team of experts.

- 40+ years of combined experience covering mortgages and financial topics.

- Objective, comprehensive star rating system assessing 120+ categories and 5,000+ data points.

- Governed by NerdWallet's strict guidelines for editorial integrity.

Our Take

3.0

Guild Mortgage has a generous selection of loan programs, including government-backed FHA and VA mortgages, but tends to have higher origination fees and mortgage rates than other lenders, according to federal data.

Pros

- Offers a wide variety of loan options, including home improvement loans and mortgages for manufactured homes.

- Has branches in most states.

Cons

- Origination fees and mortgage rates tend to be on the high side, according to the latest federal data.

- Mortgage rates are not published online.

- Mobile app receives mostly negative reviews from users.

Lender | Min. credit score | Min. down payment | |

|---|---|---|---|

620 | 3.5% | Visit Lenderat NBKC at NBKC | |

620 | 3% | Visit Lenderat Guaranteed Rate at Guaranteed Rate | |

620 | 5% | ||

620 | 3% | ||

620 | 3% |

Full Review

Guild mortgage loan options

5 of 5 stars

Guild Mortgage is proficient in the government-backed mortgages that are ideal for first-time home buyers, including FHA, VA and USDA loans. In 2022, nearly 30% of Guild’s mortgages were FHA and VA loans, federal data shows.

Other purchase and refinance mortgage options include loans for manufactured homes, 203(k) renovation loans, jumbo loans and energy-efficient mortgages. Guild offers a 0% down payment mortgage, up to $2 million, designed for qualified medical professionals.

Home buyers without Social Security numbers can apply for loans up to $1.25 million with the lender’s ITIN mortgage program. There’s even a reverse mortgage option for homeowners at least 62 years old.

Guild also offers options you won’t find at many other lenders, including:

1% Down Payment Advantage allows qualified first-time and repeat buyers the option to put down as little as 1% for a conventional loan. The lender includes a 2% grant that effectively brings your total down payment up to 3%. Income limits apply based on where you plan to buy, and a minimum credit score of 620 is required.

BuyNow Advantage allows qualified buyers in competitive markets to compete with all-cash offers for primary residences, second homes and investment properties. The lender pays cash for the home on the buyer’s behalf, and this option can be added to any conventional Guild loan. Down payment requirements can vary, and a minimum credit score of 680 is required.

GreenSmart Advantage Program allows qualified first-time and repeat buyers the option to roll the expense of energy-efficient upgrades of major appliances into an FHA mortgage. The lender’s partnership with Home Depot allows borrowers to finance up to 5% or the home’s value in upgrades, and a minimum credit score of 580 is required.

A “Mortgage loans” tab at the top of Guild’s website allows borrowers to quickly browse a long list of the lender’s offerings, and each entry links to a page with more details.

» MORE: A guide to government home loans

Guild home equity loan

The lender also offers a home equity loan. These second mortgages are a way for homeowners to access existing home equity without refinancing or selling their home. Funds obtained with a second mortgage can be used for expenses such as home improvements, education costs or debt consolidation.

Guild’s home equity loan is available up to $500,000, and borrowers can tap up to 90% of their home’s value, minus what is still owed on the initial mortgage. Guild also markets a home equity line of credit but explains that it is a brokered product, meaning Guild will help a borrower find an outside HELOC lender or investor.

» MORE: Best home equity loan lenders

What it's like to apply for a Guild mortgage

3.5 of 5 stars

Guild’s digital mortgage platform offers a paperless loan application, along with document upload and the retrieval of income and asset information from many employers and financial institutions. Applicants can also use the portal to keep track of their loan’s status. The company also offers a 17-day closing guarantee to qualifying preapproved borrowers, a faster pace than the traditional closing period of a month or longer.

If you need help with your application, a phone number is available in the “Contact Us” tab at the top of Guild’s website. Advice is available 6:00 a.m. to 5:00 p.m. (PT) Monday through Friday. When we called the lender, we were on hold for about 30 seconds before being directed to a phone menu and then a customer-care associate. Representatives were able to answer our questions quickly and completely, though we did have to repeat a question about the cash-offer program a few times.

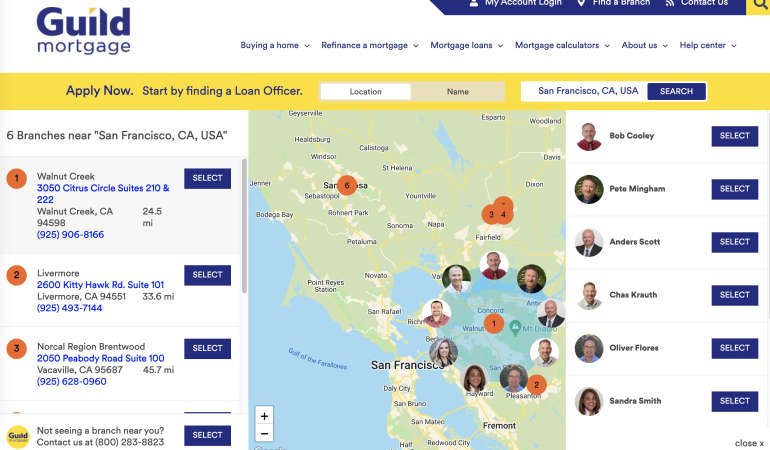

With branches in 44 states, Guild can accommodate borrowers who want to apply in person, and a tool on the lender’s website can help identify locations and loan officers near you.

The lender has a mobile app, but users give it low marks for functionality.

No live chat option appears on the lender’s website to help answer questions.

» MORE: How to apply for a mortgage

Guild's mortgage rates and fees

2 of 5 stars

Guild Mortgage earns 2 of 5 stars for average origination fee.

Guild Mortgage earns 2 of 5 stars for average mortgage interest rates.

NerdWallet analyzes federal data to compare mortgage lenders’ origination fees and offered mortgage rates. We measure annual averages across all loan types, as reported by the lenders. Overall, Guild had origination fees and mortgage rates that were higher than average in the industry.

Borrowers should consider the balance between lender fees and mortgage rates. While it's not always the case, paying upfront fees can lower your mortgage interest rate. Some lenders will charge higher upfront fees to lower their advertised interest rate and make it more attractive. Some lenders just charge higher upfront fees.

Guild's mortgage rate transparency

1 of 5 stars

You won’t find mortgage rates on the Guild Mortgage website; you’ll need to speak with a loan officer for those.

NerdWallet’s transparency ratings are higher for lenders that post sample rates on their sites, making it easier for home buyers to comparison shop, and highest for sites with self-serve tools that allow shoppers to see what rates might be like for their particular loan.

What borrowers say about Guild mortgages

NerdWallet’s lender star ratings assess objective qualities, including rates, fees and loan offerings. To assess borrowers’ subjective experiences with lenders, NerdWallet has gathered customer satisfaction ratings from J.D. Power and Zillow.

Guild receives a score of 702 out of 1,000 in J.D. Power’s 2023 U.S. Mortgage Origination Satisfaction Study. The industry average for origination is 730. (Mortgage origination covers the initial application through closing day.)

Guild receives a score of 668 out of 1,000 in J.D. Power’s 2023 U.S. Mortgage Servicer Satisfaction Study. The industry average for servicing is 601. (A mortgage servicer handles loan payments.)

Guild receives a customer rating of 4.96 out of 5 on Zillow, as of the date of publication. The rating reflects more than 8,540 customer reviews.

Alternatives to a home loan from Guild Mortgage

Here are some comparable lenders we review that borrowers can consider.

New American Funding also offers FHA 203(k) mortgages, and Northpointe Bank offers mortgages with low down payments.

Explore mortgages today and get started on your homeownership goals

Get personalized rates. Your lender matches are just a few questions away.

John Buzbee contributed to this review.

More from NerdWallet

NerdWallet’s overall ratings for mortgage lenders are evaluated based on four major categories: variety of loan types (purchase, refinance, fixed and adjustable, for example), ease of application, rates and fees and rate transparency. Among the factors we consider when scoring these categories are options to apply for and track loans online, the level of detail about mortgage rates on lender websites and our analysis of the rates and fees lenders reported in the latest available Home Mortgage Disclosure Act data. These scores generate ratings from 1 star (poor) to 5 stars (excellent).