Pennymac Mortgage Review 2024

Some or all of the mortgage lenders featured on our site are advertising partners of NerdWallet, but this does not influence our evaluations, lender star ratings or the order in which lenders are listed on the page. Our opinions are our own. Here is a list of our partners.

- 50+ mortgage lenders reviewed and rated by our team of experts.

- 40+ years of combined experience covering mortgages and financial topics.

- Objective, comprehensive star rating system assessing 120+ categories and 5,000+ data points.

- Governed by NerdWallet's strict guidelines for editorial integrity.

Our Take

4.5

Pennymac excels in government-backed mortgages, including FHA loans, and makes it easy to shop for customized mortgage rates online. But average origination fees are higher than most lenders’, and it does not offer home equity lines of credit.

Pros

- Rates are on the low side, according to the latest federal data.

- An online tool makes it easy to customize a rate quote online, with no contact information required.

- “Lock & Shop” lets you secure a rate for up to 90 days while you house-hunt, and switch to a lower one if rates drop while you shop.

Cons

- Origination fees are on the higher end, according to the latest federal data.

- Doesn't offer home equity lines of credit or renovation loans.

- Online chat is available only in the logged-in experience.

Lender | Min. credit score | Min. down payment | |

|---|---|---|---|

620 | 3.5% | Visit Lenderat NBKC at NBKC | |

620 | 3% | Visit Lenderat Guaranteed Rate at Guaranteed Rate | |

620 | 5% | ||

620 | 3% | ||

620 | 3% |

Full Review

What borrowers say about Pennymac mortgages

NerdWallet’s lender star ratings assess objective qualities, including rates, fees and loan offerings. To assess borrowers’ subjective experiences with lenders, NerdWallet has gathered customer satisfaction ratings from J.D. Power and Zillow.

Pennymac receives a score of 706 out of 1,000 in J.D. Power’s 2023 U.S. Mortgage Origination Satisfaction Study. The industry average for origination is 730. (Mortgage origination covers the initial application through closing day.)

Pennymac receives a score of 592 out of 1,000 in J.D. Power’s 2023 U.S. Mortgage Servicer Satisfaction Study. The industry average for servicing is 601. (A mortgage servicer handles loan payments.)

Pennymac receives a customer rating of 4.37 out of 5 on Zillow, as of the date of publication. The rating reflects 325 customer reviews.

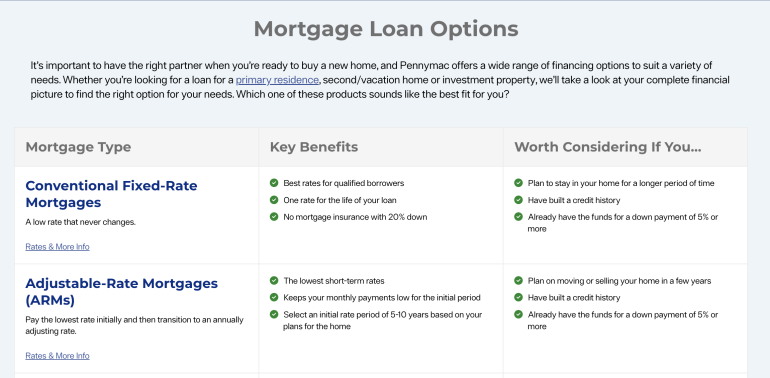

Pennymac’s mortgage loan options

4 of 5 stars

Pennymac is a large lender that offers a wide range of conventional and government-backed mortgages. That amount of choice can be helpful when you’re weighing your options, such as deciding between an FHA vs. conventional loan. We found it easy to navigate the website and understand all available mortgage options.

Pennymac specializes in mortgages backed by the Department of Veterans Affairs, but also offers loans from the Federal Housing Administration and the U.S. Department of Agriculture. In 2022, 27% of new Pennymac mortgages were VA loans and 19% were FHA loans, according to Home Mortgage Disclosure Act data. For USDA loan borrowers who have Pennymac as their servicer, a streamlined assist refinance loan is available to lower their monthly payment without additional appraisals or inspections. VA borrowers can apply for interest rate reduction refinance loans, known as VA IRRRLs.

For conventional purchase mortgages, Pennymac offers fixed-rate loans with 15-, 20- and 30-year terms, as well as adjustable-rate mortgages. The lender also offers HomeReady, HomePossible and HomeOne loans, which provide low-down-payment options and are often a good fit for first-time home buyers. Jumbo loans and loans for second homes and investment properties are also available. However, Pennymac does not offer renovation or construction-to-permanent loans.

Pennymac has numerous refinance options, including conventional and government-backed cash-out refinances. Flexible-term refinances give borrowers the option to customize their term length. The lender also offers home equity loans, but not home equity lines of credit.

Pennymac home equity loan

The lender also offers a home equity loan. These second mortgages are a way for homeowners to access existing home equity without refinancing or selling their home. Funds obtained with a second mortgage can be used for expenses such as home improvements, education costs or debt consolidation.

Pennymac offers home equity loans in a range of lengths, including 10-, 15-, 20- and 30-year terms. There is no prepayment penalty, and the lender tells us that most applications close within 30 days. Pennymac does not offer a home equity line of credit (HELOC).

» MORE: Best home equity loan lenders

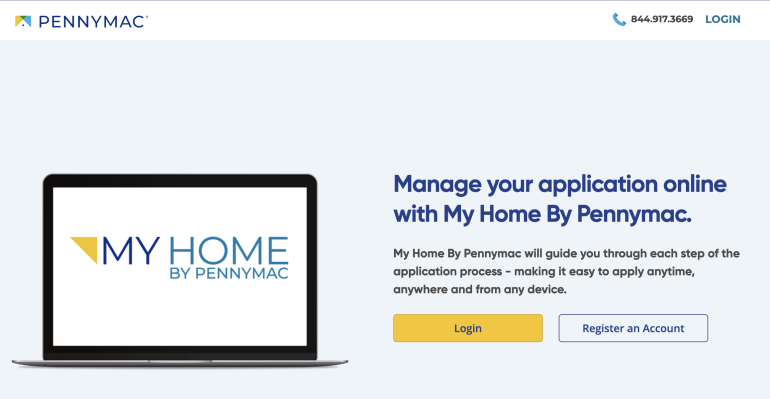

What it’s like to apply for a Pennymac mortgage

4 of 5 stars

A self-service mortgage application is available on Pennymac’s website. This makes it easy to apply for a mortgage on your own time, as opposed to waiting for a loan officer to call you back.

Once you register through the Pennymac website, you can apply for a mortgage, upload documents and track the progress of your application fully online. If you prefer to talk to someone along the way, dedicated support for active loan applications is available by phone during extended business hours, Monday through Friday.

The phones are also staffed on Saturdays for general questions, including starting a new application or making a payment by phone. Online chat is available, but only for users who are logged in to their Pennymac account.

We called the Pennymac customer service line during our research and experienced minimal hold time of less than a minute. After we navigated through a brief phone menu, a live agent answered our questions efficiently.

Pennymac also has a highly rated mobile app for Apple and Android devices. The app doesn’t offer the option to apply for a mortgage, but has plenty of convenience for existing Pennymac customers. Through the app, you can make or schedule payments, view and download documents and calculate ways to save.

» MORE: How to apply for a mortgage

Pennymac’s mortgage rates and fees

2.5 of 5 stars

Pennymac earns 1 of 5 stars for average origination fee.

Pennymac earns 4 of 5 stars for average mortgage interest rates.

NerdWallet analyzes federal data to compare mortgage lenders’ origination fees and offered mortgage rates. We measure annual averages across all loan types, as reported by the lenders. Pennymac’s interest rates are on the low side compared with other lenders reviewed by NerdWallet; however, its origination fee is among the highest of that group.

Borrowers should consider the balance between lender fees and mortgage rates. While it's not always the case, paying upfront fees can lower your mortgage interest rate. Some lenders will charge higher upfront fees to lower their advertised interest rate and make it more attractive. Some lenders just charge higher upfront fees.

Pennymac’s mortgage rate transparency

5 of 5 stars

Pennymac stands out for how easy the lender makes it to shop and compare mortgage rates.

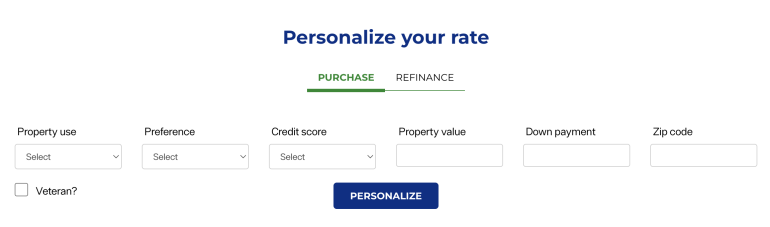

The website displays rate and fee estimates for many available loan types, including conventional, government-backed and jumbo purchase and refinance mortgages. Customized estimates are available online through an instant quote widget, a convenience not offered by all mortgage lenders.

You don’t have to enter any contact information to use the rate tool, either. Just answer some simple questions and you can see a personalized rate and fee estimate. The rate tool is available for purchase or refinance loans.

Alternatives to a home loan from Pennymac

Here are some comparable lenders we review that borrowers can consider.

NBKC offers a wide selection of loans and ample online conveniences. USAA, which uses a membership-based model and serves the military community, specializes in VA loans.

» MORE: Best VA mortgage lenders

Explore mortgages today and get started on your homeownership goals

Get personalized rates. Your lender matches are just a few questions away.

John Buzbee contributed to this review.

More from NerdWallet

NerdWallet’s overall ratings for mortgage lenders are evaluated based on four major categories: variety of loan types (purchase, refinance, fixed and adjustable, for example), ease of application, rates and fees and rate transparency. Among the factors we consider when scoring these categories are options to apply for and track loans online, the level of detail about mortgage rates on lender websites and our analysis of the rates and fees lenders reported in the latest available Home Mortgage Disclosure Act data. These scores generate ratings from 1 star (poor) to 5 stars (excellent).