State Employees’ Credit Union Mortgage Review 2024

Some or all of the mortgage lenders featured on our site are advertising partners of NerdWallet, but this does not influence our evaluations, lender star ratings or the order in which lenders are listed on the page. Our opinions are our own. Here is a list of our partners.

- 50+ mortgage lenders reviewed and rated by our team of experts.

- 40+ years of combined experience covering mortgages and financial topics.

- Objective, comprehensive star rating system assessing 120+ categories and 5,000+ data points.

- Governed by NerdWallet's strict guidelines for editorial integrity.

Our Take

4.0

State Employees' Credit Union in North Carolina offers a wide selection of conventional loans for members and displays online mortgage rates, but government-backed loans aren't available.

Pros

- No private mortgage insurance required, even with a down payment less than 20%.

- 100% financing available.

- Participates in mortgage credit certificate and down payment assistance programs.

Cons

- Does not have government-backed loan options.

- Membership eligibility is limited, and loans are available only for properties in Georgia, North Carolina, South Carolina, Tennessee and Virginia.

Lender | Min. credit score | Min. down payment | |

|---|---|---|---|

620 | 3.5% | Visit Lenderat NBKC at NBKC | |

620 | 3% | Visit Lenderat Guaranteed Rate at Guaranteed Rate | |

620 | 5% | ||

620 | 3% | ||

620 | 3% |

Full Review

SECU's mortgage loan options

4 of 5 stars

SECU is North Carolina's top mortgage lender by loan volume as of 2022, according to the latest federal data available.

SECU offers conventional fixed-rate and adjustable-rate mortgages — including a special option for first-time home buyers — historic preservation mortgages and manufactured home mortgages, but it does not offer government-backed home loans, like FHA, VA and USDA loans. Mortgages are available for properties in Georgia, North Carolina, South Carolina, Tennessee and Virginia.

SECU HELOC

The lender also offers a home equity line of credit (HELOC). These second mortgages are a way for homeowners to access existing home equity without refinancing or selling their home. Funds obtained with a second mortgage can be used for expenses such as home improvements, education costs or debt consolidation.

SECU’s HELOC can be used for primary residences, second homes and rental properties. SECU offers a special repayment option for borrowers who work as educators, allowing them to skip HELOC payments during the summer months when they may have less income available.

» MORE: Best HELOC lenders

What it's like to apply for a mortgage from SECU

4 of 5 stars

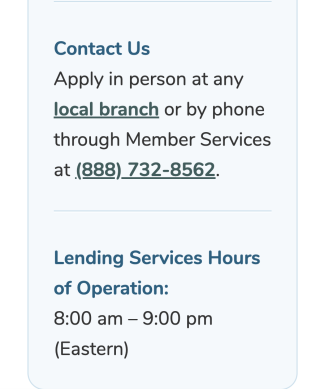

SECU, whose membership primarily includes North Carolina state and public school employees and their families, has more than 250 branches and offers 24/7 member service via a toll-free support line. The website does not offer an online chat feature.

When we called to ask basic loan questions, an automated attendant answered quickly, and we were placed on hold after going through a series of choices. After five minutes, we were given the option to have a mortgage loan specialist call us back. We continued to hold, and after 25 minutes, a loan officer in North Carolina answered our questions.

The website makes it easy to find straightforward answers to FAQs, branch hours and contact information:

SECU's online privacy policy clearly outlines how it will use your information when you interact with the site.

An online mortgage application is available once you're granted member access. Additional online conveniences — like document upload and automated loan tracking, plus a highly rated mobile app — are available, too.

» MORE: How to apply for a mortgage

SECU's mortgage rates and fees

3.5 of 5 stars

State Employees' Credit Union earns 3 of 5 stars for average origination fee.

State Employees' Credit Union earns 4 of 5 stars for average mortgage rates.

NerdWallet analyzes federal data to compare mortgage lenders’ origination fees and offered mortgage rates. We measure annual averages across all loan types, as reported by the lenders. SECU scores better than average for mortgage rates and about average for origination fees.

As part of a strategic plan published in December 2022, SECU said it would move toward "tier-based pricing" for its loan products. The change will mean that borrowers with lower credit ratings will pay higher interest rates than borrowers with stronger credit ratings. That's standard practice in the mortgage industry, but previously SECU didn't base pricing on credit ratings.

The credit union said the new pricing would allow it to offer more competitive rates to many of its members.

Borrowers should consider the balance between lender fees and mortgage rates. Though it's not always the case, paying upfront fees can lower your mortgage interest rate. Some lenders will charge higher upfront fees to lower their advertised interest rate and make it more attractive. Some lenders just charge higher upfront fees.

SECU's mortgage rate transparency

4 of 5 stars

SECU posts current interest rates online for its loan products and lets you calculate the monthly payment.

A rate table for loans with different down payments is accessible from the homepage, but the navigation may not be obvious. When we checked, we found the rates by clicking on the "loan products" tab at the top and then clicking on "lending rates" under the "related links" header. From the table, you can click on a loan and go to a page with more details, where you can calculate a monthly payment and mortgage annual percentage rate (APR).

What borrowers say about SECU mortgages

NerdWallet’s lender star ratings assess objective qualities, including rates, fees and loan offerings. NerdWallet assesses borrowers’ subjective experiences with lenders using customer satisfaction scores from J.D. Power and Zillow. SECU of North Carolina didn’t have sufficient data from either source for NerdWallet to share.

Alternatives to a home loan from SECU

Here are some comparable lenders we review that borrowers can consider.

CrossCountry offers a broad selection of mortgages, including government-backed home loans, and PNC Bank offers low-down-payment mortgages and programs for first-time home buyers.

Explore mortgages today and get started on your homeownership goals

Get personalized rates. Your lender matches are just a few questions away.

Bella Angelos contributed to this review.

More from NerdWallet

NerdWallet’s overall ratings for mortgage lenders are evaluated based on four major categories: variety of loan types (purchase, refinance, fixed and adjustable, for example), ease of application, rates and fees and rate transparency. Among the factors we consider when scoring these categories are options to apply for and track loans online, the level of detail about mortgage rates on lender websites and our analysis of the rates and fees lenders reported in the latest available Home Mortgage Disclosure Act data. These scores generate ratings from 1 star (poor) to 5 stars (excellent).