ADVERTISEMENT: PRODUCTS FROM OUR PARTNERS

How Much Should You Have Saved in Retirement by Age?

Wondering if you’ve saved enough for retirement? This guide breaks it down by age.

ADVERTISEMENT: PRODUCTS FROM OUR PARTNERS

How Much Should You Have Saved in Retirement by Age?

Wondering if you’ve saved enough for retirement? This guide breaks it down by age.

As you’re planning for retirement, understanding how much you should have saved by your age bracket can be key to securing a comfortable and worry-free future.

While everyone’s financial needs vary, income-based benchmarks can offer helpful guidance. Read on to learn more.

Don’t Rely Solely on Home Equity

For many Americans, a significant portion of their net worth is tied up in their home. While home equity can be a valuable asset, it's not easily accessible for everyday living costs or emergencies. As you approach retirement, it’s important to have liquid savings—money you can easily access without having to sell or borrow against your home. Relying too heavily on home equity may compromise your financial flexibility and stability during retirement.

Retirement Savings Benchmarks

According to research from NerdWallet2, here’s what you should aim for in retirement savings by age, based on the national averages.

Ages 45-54

Target savings of

$313,220

Ages 55-64

Target savings of

$537,560

Ages 65-74

Target savings of

$609,230

Keep in mind, these figures don’t account for inflation, healthcare expenses, or market fluctuations—factors that can significantly impact your retirement budget. Thoughtful investing and planning for future costs, especially healthcare, are essential to protecting your financial health over the long term. Working with a financial advisor can provide clarity and guidance and is a good option to explore.

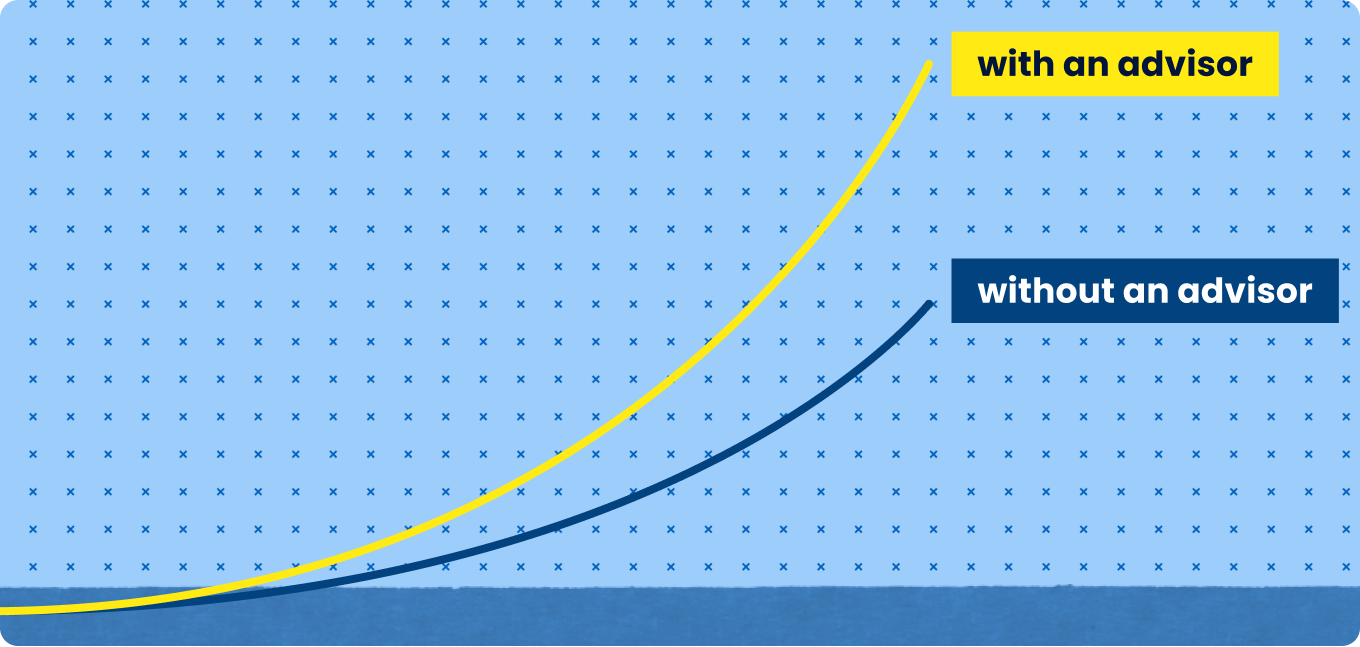

An advisor may boost your retirement by 4x.

Disclaimer:

People with financial advisors have better financial outcomes. Working on a financial plan now can potentially increase your retirement savings by 4x in the future based on this 2024 T. Rowe Price Study

If You're Not Where You Want to Be

Falling short of your retirement savings goal isn’t the end of the road. You still have options to improve your financial outlook:

Max out catch-up contributions

If you’re 50 or older, you can contribute an extra $7,500 to your 401(k) and $1,000 to your IRA annually.

Tighten your budget

Cut back on discretionary spending to redirect more toward savings.

Delay retirement

Working a few more years or taking on part-time work can let you delay claiming Social Security, which increases your benefits by 8% each year after full retirement age.

A financial professional can ensure that you have a comprehensive plan to get back on track.

Take An Important Step Towards Retirement Confidence

Ready to start focusing on your retirement plan? Answer simple questions on NerdWallet Advisors Match and get matched with up to three financial advisors—within minutes. These professionals can help you plan for the retirement you envision, offering guidance based on your financial goals and needs.

Answer a few questions: it only takes a few minutes.

Get matched with an advisor: We'll match you with up to three financial advisors.

Work toward your money goals: Connect with your advisor and start making progress.

ON NERDWALLET ADVISORS MATCH

How NerdWallet Advisors Match works

Tell us a bit about your financial situation — it only takes a few minutes.

We'll match you with one or more financial advisors.

Connect with your advisor and start making progress.

ON NERDWALLET ADVISORS MATCH

Take the First Step Toward Retirement Confidence

Ready to get started on your retirement plan? Answer a few simple questions through NerdWallet Advisors Match and get matched with up to three financial advisors—within minutes.

These professionals can help you plan for the retirement you envision, offering guidance based on your financial goals and needs.

ON NERDWALLET ADVISORS MATCH

Disclaimer: This information is for general informational purposes only and does not constitute personalized investment advice. The benchmarks discussed are general guidelines and may not reflect your individual circumstances. Your actual retirement needs can vary significantly based on factors such as lifestyle, health, inflation, and market conditions. All investments involve risk, including possible loss of principal, and there is no guarantee that any particular investment strategy will be suitable or profitable. Converting a traditional retirement account to a Roth IRA may help reduce your tax burden in retirement, but the converted amount is subject to income tax in the year of conversion, which could place you in a higher tax bracket. Withdrawals from a Roth IRA also have specific rules: converted funds generally must remain in the account for at least five years to be withdrawn tax-free, and early withdrawals may incur taxes and penalties. Consult a qualified tax professional to understand how a Roth conversion could affect your individual situation. While tax-advantaged accounts such as Health Savings Accounts (HSAs) can offer valuable benefits, they have eligibility requirements and annual contribution limits. HSAs require enrollment in a high-deductible health plan and may result in higher out-of-pocket costs. Withdrawals for non-qualified expenses are subject to taxes and penalties. HSA investments involve risk, and account fees or legislative changes may affect their benefits. Consult a financial or tax professional to determine whether an HSA is appropriate for you. NerdWallet Advisory is not a law firm or accounting firm, and this information should not be construed as legal or tax advice. For advice specific to your needs, consult a qualified financial, tax, or legal professional.

1 "Average Retirement Savings by Age" — NerdWallet

2 "Social Security and Your Retirement Plan" — ssa.gov