ADVERTISEMENT: PRODUCTS FROM OUR PARTNERS

Pay 0% intro interest for up to 21 months

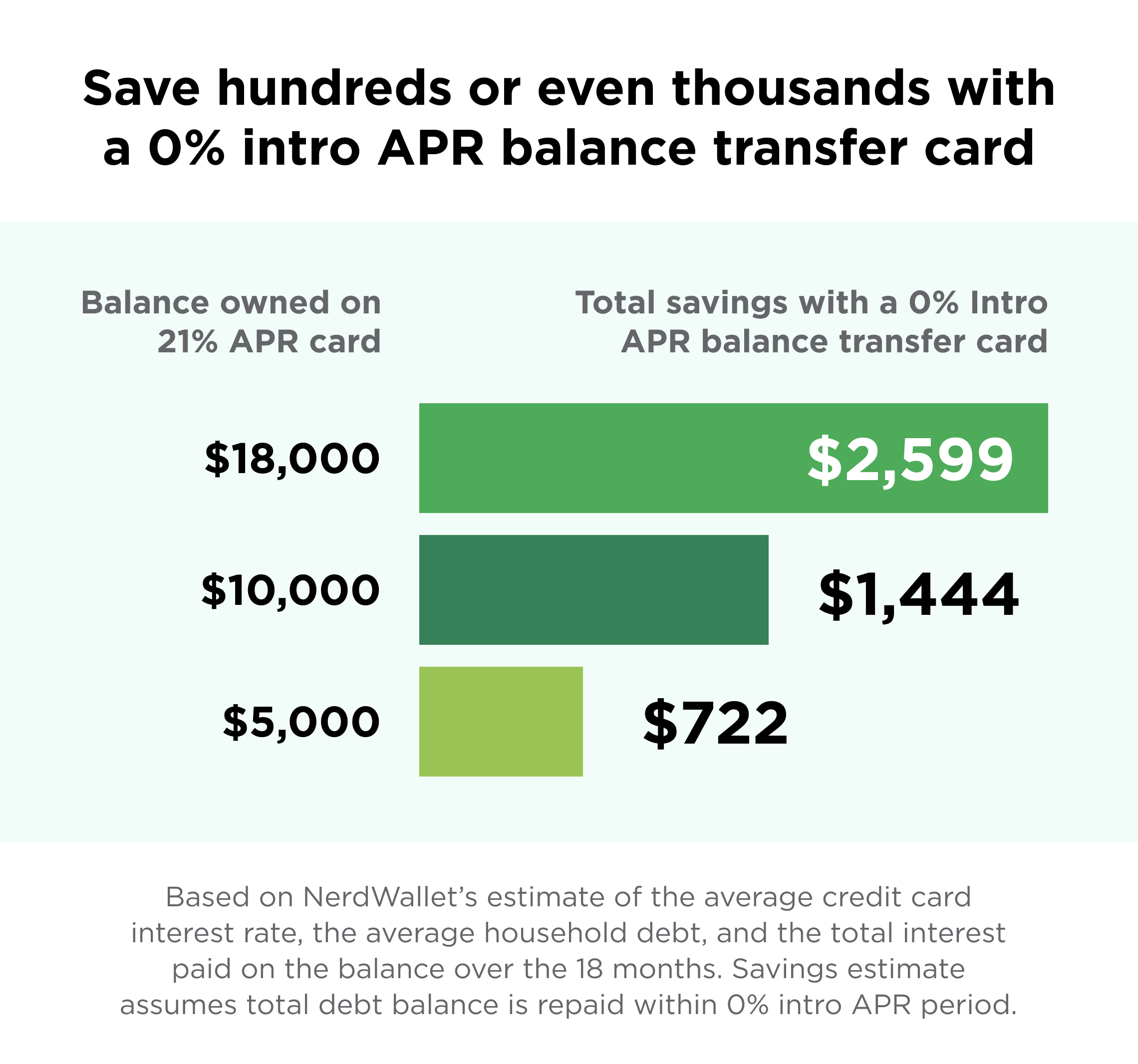

Transferring your credit card balance to a balance transfer card with a 0% introductory rate can save you hundreds, or even thousands, of dollars in interest and help you get out of debt sooner.

Use the right tools for the job

Credit card debt stings. The good news, however, is there’s a way to pay it down with less money in a shorter time. How? By moving your debt to a balance transfer card, which is a credit card that offers a lengthy 0% interest period. Unlike an everyday credit card (which charges interest on balances you carry from month to month), balance transfer cards give you time to pay down debt while preventing interest charges from stacking up.

Take advantage of introductory 0% APRs

When you’re paying down debt, interest rates matter – a lot. For example, compare the difference between paying down an $18,000 debt on a 21% APR card and a 0% balance transfer card. The latter will typically charge you a one-time fee of 3 to 5% on the balance transferred (or a $5 minimum fee, whichever is greater). Then, you won’t be charged any interest on your transferred balance for the duration of the 0% intro APR period. Using the balance transfer card could save you around $2,599, even after paying a 3% transfer fee of $540, assuming the debt is repaid in full within the 0% intro interest period (in this example case, 18 months). As a heads up, the amount you may qualify to transfer and save depends on a variety of factors including your credit worthiness.

Earn more on your savings with a high-yield savings account!