Stock Market Outlook: May 2024

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Warmer weather is returning to much of the U.S. this month, and many investors may be tempted to close their laptops, head for the beach, and stop thinking about stocks for a while. “Sell in May and go away,” as the old saying goes.

But is selling in May actually a good idea?

And if not, can you just dump your money in an AI-powered ETF for the summer and come back in the fall?

Below, we’re also looking at the blue-chip stock earnings and economic data releases that could move markets in May.

In this issue

AI-assisted investing: a good idea or no?

The last month has been a busy one for artificial intelligence (AI) launches.

OpenAI and Anthropic aren’t the only AI games in town anymore. Several large tech companies, such as Microsoft (MSFT), Snowflake (SNOW) and Meta (META), have announced new AI products in recent weeks.

At the moment, there are two main ways in which investors can leverage the rise of AI. One is by investing in AI companies, through AI stocks and AI ETFs. The other is by investing with AI by using an AI assistant to help with stock research, or by investing in an ETF run by AI.

What are some of AI’s best applications for investors?

Thorough investment research can involve a lot of reading, and AI assistants like OpenAI’s ChatGPT and Anthropic’s Claude can be useful for summarizing long tracts of text so long as those tracts were on the internet during their training period.

For example, say you’re considering investing in an actively managed mutual fund, but you want to take a deep dive into its holdings, fee structure, track record and so on before investing.

The fund prospectus (which you can find with a Google search or on the fund’s website) probably contains much of that information. But it also may be more than 100 pages long.

As long as a fund prospectus was published before December 2023 (for GPT-4) or August 2023 (for Claude 3 Opus), the premium versions of ChatGPT and Claude should be capable of summarizing specific parts of it.

AI assistants can also be useful for brainstorming. If stock screeners aren’t your thing (they involve a lot of buttons), and you’re looking for, say, clean energy ETFs that also pay dividends, you can ask ChatGPT or Claude to list some for you.

For some people, “investing with AI” means using an AI assistant to help with investment research or brainstorming. But for others, it means letting an AI actually pick stocks for them. This is the magic behind AI-powered ETFs.

NerdWallet rating 4.9 /5 | NerdWallet rating 5.0 /5 | NerdWallet rating 4.1 /5 |

Fees $0 per online equity trade | Fees $0 per trade | Fees $0 per trade |

Account minimum $0 | Account minimum $0 | Account minimum $0 |

Promotion None no promotion available at this time | Promotion None no promotion available at this time | Promotion Get up to $700 when you open and fund a J.P. Morgan Self-Directed Investing account with qualifying new money. |

What is an AI-powered ETF?

An AI-powered ETF is an exchange-traded fund that uses AI to select and trade stocks. The AI actively manages the fund’s portfolio, often with some degree of human oversight.

Some AI-powered ETFs, such as the Amplify AI Powered Equity ETF (AIEQ), give their AI freedom to pick a variety of stocks. Others, such as the WisdomTree U.S. AI Enhanced Value Fund (AIVL), specialize in a specific kind of stock — undervalued stocks, in the case of AIVL.

Top 9 best-performing AI-powered ETFs as of May 2024

Below is a list of the nine top U.S.-listed AI-powered ETFs on VettaFi, ranked by year-to-date performance.

Symbol | Fund name | Performance (YTD) |

|---|---|---|

DIP | BTD Capital Fund | 10.65% |

AMOM | QRAFT AI Enhanced U.S. Large Cap Momentum ETF | 9.91% |

BUZZ | VanEck Social Sentiment ETF | 5.08% |

AIVL | WisdomTree U.S. AI Enhanced Value Fund | 1.96% |

NEWZ | Stocksnips AI-Powered Sentiment US ALL Cap ETF | -0.10% |

AIVI | WisdomTree International AI Enhanced Value Fund | -1.32% |

OAIA | Teucrium AiLA Long-Short Agriculture Strategy ETF | -1.70% |

AIEQ | Amplify AI Powered Equity ETF | -3.42% |

OAIB | Teucrium AiLA Long/Short Base Metals Strategy ETF | -4.74% |

Sources: VettaFi and Finviz. Data is current as of April 30, 2024, and for informational purposes only. | ||

AI’s weaknesses when it comes to investing

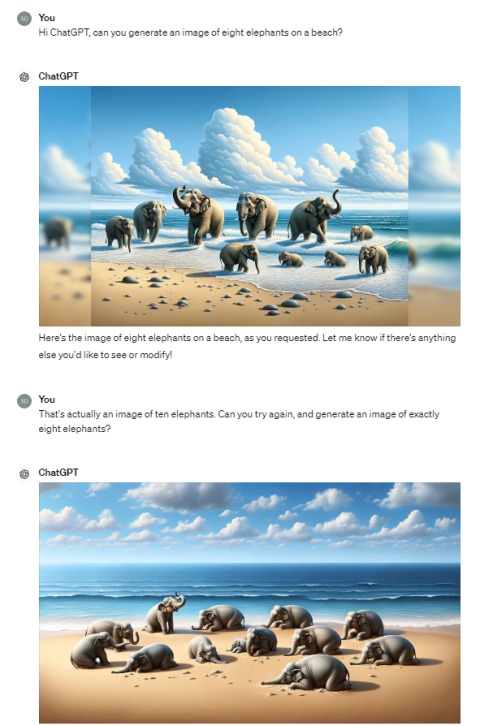

If you’ve played with chatbots like ChatGPT or Claude for a while, you may have noticed that they struggle with any kind of mathematics, including tasks as simple as counting.

These AIs are highly specialized at interpreting and generating text and images, not calculations. As an example, the screenshot below shows my attempts to get ChatGPT to generate a picture of exactly eight elephants on a beach:

Source: OpenAI and author.

The innumeracy of AI chatbots is something to keep in mind if you’re using them to streamline your investing process. It’s always worth double-checking any numbers they spit out. Investors should probably avoid asking AI chatbots to do any math, and they certainly shouldn’t ask them to predict where the stock market will go next.

With that in mind, the track record of AI-powered ETFs might give some investors pause. Less than half of the funds listed above are outperforming the S&P 500 index this year.

Granted, AI technology is improving rapidly. ChatGPT may not be able to generate a picture of exactly eight elephants on a beach, but it can generate some very realistic pictures of elephants on a beach. By contrast, AI-generated images from just two or three years ago were often too garbled to be recognizable at all.

AI-powered ETFs may also improve substantially in the years ahead or they may continue to underperform cheap index funds. Only time will tell.

Term of the month: 'Sell in May and go away'

You’ve probably heard of the “summer slump” before — the loss of productivity caused by warm, beautiful weather.

Teachers report that students often forget much of their coursework over summer vacation, and some managers say that employees become less reliable during the warm months, too.

Some people say the stock market also experiences a summer slump, an effect known as “sell in May and go away.”

What does 'sell in May and go away' mean?

“Sell in May and go away” is an adage that average stock market returns tend to be lower during the period from May to October than during the period from November to April due to various summer-related economic slowdown factors such as vacation season in the Northern Hemisphere.

This phenomenon is sometimes also called the “Halloween indicator,” as Halloween marks the end of the six-month period of alleged seasonal underperformance.

The implication of the saying is that you should sell in May — that investors can increase their returns by reducing their exposure to stocks in May, and buying stocks in November.

But is that actually true?

Is 'sell in May and go away' supported by research?

Historical data does support the idea that, on average, market returns are higher from November to April than from May to October. A 2013 study by the CFA Institute looked at stock returns from 37 countries between 1970 and 2012 and found that returns were 10 percentage points higher on average during the November-April period.

But does this mean it’s actually a good idea to try to time the market, by selling stocks in May and buying them in November? Researchers are more skeptical of that proposition.

A 2023 study by Manulife Investment Management looked at the returns of a hypothetical investor who used the “sell in May and go away” strategy (moving from stocks to cash in May, and from cash to stocks in November) on the S&P 500 index for 50 years.

It compared those “sell in May and go away” returns with the returns of a hypothetical investor who simply bought and held an S&P 500 index fund for 50 years and found that the buy-and-hold investor came out ahead.

Should you try to time the market?

Research indicates that although “sell in May and go away” is a real statistical phenomenon, investors are not very good at profiting from it. This is one example of a broader principle of investment management: Trying to time the market is very risky, and many financial advisors recommend a more consistent investment strategy such as dollar-cost averaging instead.

However, if you want to try to take advantage of the “sell in May and go away” effect while sticking to a buy-and-hold strategy, there may be a way to do both.

Investors are often encouraged to rebalance their portfolios at least once a year. That means selling off portions of their best-performing investments and buying a little more of their worst-performing investments to bring the portfolio back to its target investment mix.

Some investors may find it convenient to do their annual portfolio rebalance in April around tax day when many of us are reviewing our financial situations anyway. Rebalancing in April means that you’ll likely be cashing out some of your most profitable investments just before the summer stock market slump that could potentially start in May.

Dates that could move markets this month

Economic events

May 1, Federal Reserve interest rate decision. The Fed concluded its meeting and left the federal funds rate unchanged at the current range of 5.25% to 5.50%.

May 3, Bureau of Labor Statistics (BLS) monthly employment report. A report showing hiring levels and various measures of the unemployment rate.

May 15, BLS monthly consumer price index (CPI) report. A key inflation gauge. The employment and CPI reports could give investors hints about what the Federal Reserve will do with interest rates in future meetings; unexpectedly high unemployment or low inflation could indicate that a rate cut is on the way.

May 24, Michigan Consumer Survey preliminary data for May. The University of Michigan will release its final data for last month’s survey on May 10, and its preliminary data for this month’s survey on May 24. The survey has become a closely watched indicator of ordinary Americans’ perceptions of the economy, which have been improving recently after a long period of negativity.

May 31, Federal Reserve Bank of New York R-star estimate. The “natural rate of interest,” or R-star, is an important indicator of the future trajectory of interest rates.

Earnings

Below is a table of blue-chip stocks that are reporting earnings per share in May, with the dates and analyst estimates for their upcoming earnings reports.

We’ve filtered the list for companies with a market capitalization of at least $200 billion — high-volume stocks whose earnings reports are often major trading events for options traders and day traders.

Company name & symbol | Earnings date | Consensus EPS forecast |

|---|---|---|

Mastercard Inc. (MA) | May 1 | $3.22 |

? | ? | ? |

? | ? | ? |

? | ? | ? |

? | ? | ? |

? | ? | ? |

? | ? | ? |

? | ? | ? |

? | ? | ? |

? | ? | ? |

? | ? | ? |

? | ? | ? |

? | ? | ? |

Neither the author nor editor owned positions in the aforementioned investments at the time of publication.

On a similar note...