Is the United Quest Card Worth Its Annual Fee?

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

If you fly United Airlines, a new credit card could make your travels more rewarding.

The United Quest℠ Card has a unique roster of benefits that make it a compelling new option among United credit cards. But is it worth the $250 annual fee? A look at the card’s benefits reveals who should get the United Quest℠ Card and will help you decide whether it’s a good choice for you.

Perks of the United Quest℠ Card

The United Quest℠ Card launched in 2021. Chase and United’s co-branded card lineup now offers four options, ranging from the ultra-high-end United Club℠ Infinite Card, whose $525 annual fee includes a United Club membership, to the $0-annual-fee United Gateway℠ Card.

The United Quest℠ Card lands in the middle of United’s card offerings. Among the reasons to get the United Quest℠ Card: It comes with a hefty welcome bonus. Limited-time offer: Earn 70,000 bonus miles and 500 Premier qualifying points after you spend $4,000 on purchases in the first 3 months your account is open.

Cardholders earn:

3 miles per dollar spent on United purchases.

2 miles on travel, dining and select streaming service purchases.

1 mile per dollar on all other purchases.

» Learn more: The complete guide to redeeming United MileagePlus Miles

The United Quest℠ Card annual fee is worth it if you …

Fly with United at least once a year

The United Quest℠ Card comes with up to $125 in statement credit for United purchases. The statement credit works for airfare, in-flight purchases and seat selection fees charged to the card.

Cardholders also get two free checked bags for themselves and two free bags for one companion on each trip, which can equal a huge savings if you — like many of us — can’t decide which shoes go with which outfit each day of your trip.

These two perks together could make the card worthwhile by offsetting part or all of the annual fee.

Use TSA Precheck or Global Entry

The card also offers a credit worth up to $100 once every four years to cover the fee for either Global Entry or TSA Precheck. TSA Precheck is a trusted traveler program that lets you speed through security. It also allows you to keep your shoes on and your liquids in your bags. Global Entry gives you expedited reentry to the U.S. after traveling abroad. Global Entry generally includes TSA Precheck, so if you’re going to go for just one, go for Global Entry.

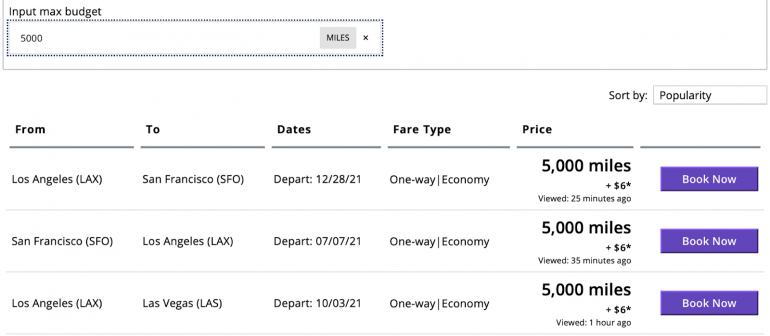

Book award flights on United

A unique perk of this new card: When you redeem miles for flights on United or United Express, you can get 5,000 of those miles rebated to you, up to two award flights per year. This benefit only kicks in after your first anniversary, but can be pretty valuable if you play your cards right.

Because award flights with United start at just 5,000 miles, it’s possible to get two near-free flights each year by taking advantage of this perk.

Want United elite status

If you’re hoping to earn elite status in the MileagePlus program for a chance at cabin upgrades on international flights, this card can help you get there. For every $500 you charge, you’ll earn 25 Premier Qualifying Points toward United elite status. This is good all the way to United’s Premier 1K status — and you can earn up to 6,000 PQPs each calendar year using this method.

Use DoorDash or Caviar

The United Quest℠ Card now offers one-year complimentary DashPass membership, getting you unlimited deliveries with $0 delivery fees and lower service fees from certain restaurants through DoorDash and Caviar. You must activate your membership by Dec. 31, 2024, to take advantage of this benefit. Note that you'll be automatically enrolled in DashPass at the current monthly rate once the free year expires.

The United Quest℠ Card annual fee isn't worth it if you …

Never fly with United. If you’re located near an airport that is predominantly served by Delta or American Airlines, you may find yourself struggling to find a use for the $125 statement credit offered by this card.

Use your miles for upgrades. If you’re more prone to redeeming miles for mileage upgrades rather than flights, you’ll miss out on the 10,000-mile rebate you’d receive after booking two award flights.

» Learn more: The best airline credit cards right now

If you’re considering the United Quest℠ Card

The United Quest℠ Card is an excellent mid-tier option for travelers who will fly with United at least once a year. The $125 statement credit effectively lowers the annual fee to $125 each year, making this an reasonable card to hold and plenty of value to be had beyond the statement credit.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card