Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Allegiant Air is unique when it comes to earning and redeeming miles. Specifically, you can’t accrue miles by flying, and there’s only one way to rack up points for reward travel: the Allways Rewards Visa® credit card. So how are you supposed to navigate their system and use it to your advantage? We’ll break it down in this guide to Allegiant Air’s award chart.

How much are Allegiant points worth?

Each myAllegiant point is worth 1 cent toward airfare or other travel, which you can search for on Allegiant.com. That means the more expensive the flight, the more points will be required to book it. If a flight costs $100, you’ll need 10,000 points to book it.

Keep in mind you won’t be searching for specific award travel; you simply select your preferred flights and choose to pay with points on the payment screen at checkout.

Award types

There is no business or first class on Allegiant flights, just economy. The airline also doesn’t offer multiple award types like some other airlines. Your only upgrade options is for a seat with more legroom. There are no blackout dates or destination restrictions on award bookings.

But flights aren’t all you can book with points. You can also redeem points for hotel packages and car rentals booked through Allegiant.com.

Elite status

Allegiant Air doesn’t offer any sort of elite status for frequent flyers, but they do offer a Buy One Get One airfare for myAllegiant members who have the Allways Rewards Visa® credit card. Basically, the perk allows you to claim one free companion airfare when you book a vacation package through Allegiant with four or more hotel nights or seven or more rental car days on the same itinerary. The following criteria must also be met:

The Member’s full itinerary must be purchased with the member’s Allways Rewards Visa® credit card through Allegiant, and the member must be a passenger on the itinerary.

The free airfare itinerary must match the itinerary of the member/Allways Rewards Visa® credit card holder.

Itineraries for both tickets must be booked, purchased and ticketed at the same time through Allegiant.

As you can see, it’s a whole travel package that must be purchased through the airline in order to claim a BOGO fare, not just a flight. You also have to be an Allegiant credit card holder in order to take advantage of the offer, and it’s not bookable online: You’ll have to contact myAllegiant Member Services.

While you will earn points on a BOGO booking, you can’t redeem them for this type of award.

Earn points with the Allways Rewards Visa® credit card

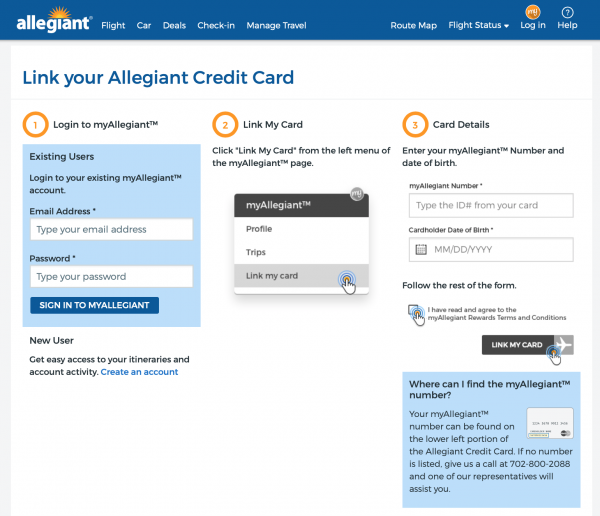

As we’ve established, there’s only one way to earn myAllegiant points: With the Allways Rewards Visa® credit card. Once your card has been linked with your myAllegiant account, you can redeem points online. Simply proceed to the payment page of Allegiant.com after you’ve searched for the booking you want.

If you fly with the airline often, you may want to consider the benefits. There's usually a sign-up bonus offered, and the card earns 3 points per $1 spent on Allegiant purchases, 2 points per $1 on dining and 1 point per $1 on everything else. Cardholders also have the ability to book those Buy One Get One fares.

Other perks of having the Allways Rewards Visa® credit card include priority boarding and a free drink when you fly (just make sure to show your card to the flight attendant when you order).

Points don’t expire, but if you cancel your credit card, you’ll lose them all. And keep in mind that the airline says the points you’ve earned could take up to 6 weeks to show up in your myAllegiant account after each billing cycle.

» Learn More: Find the best airline credit card for you

The bottom line

Allegiant is a budget airline, which means you’ll pay extra for everything, from luggage to in-flight drinks to seat selection. So unless you fly with the airline frequently and eschew the typical upgrades and fees, myAllegiant may not be worth your time and effort. If, however, you like to book entire travel packages a few times a year and travel with a companion, the points you’ll earn with the card, together with the Buy One Get One fare option, can save you the cost of a ticket. That could well be worth it for fans of the airline.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card