AmEx Pay It Plan It: What It Is and How It Works

Pay off smaller purchases one at a time or set up payment plans for larger ones, saving money on interest.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

American Express's Pay It Plan It® feature lets you pay for purchases one at a time with your smartphone — and might help you save money on interest in the process.

Pay It Plan It® gives cardholders the option to pay off small purchase amounts right away (Pay It®) or pay down large balances over time by setting up an interest-free payment plan for a monthly fee (Plan It®). For those who carry balances, the latter option could potentially add up to big savings.

How it works

Log in to your AmEx Mobile app. If you don’t already have it, you can download it for free on your iPhone or Android device. You can also access the Plan It® feature by visiting the American Express website.

See what purchases are eligible. In your app, you’ll see icons that say “Pay It®” for purchases under $100 and “Plan It®” next to purchases over $100. Some transactions can’t be paid with this feature. More on that later.

For Pay It® transactions: Click on the Pay It icon. If you have multiple banking accounts on file, you can decide which one to use. Press “Pay” to complete the transaction. At that point, you’ll see a pending payment notification on your balances. The payment will take up to 48 hours to be reflected in your outstanding balances. (There is no application requirement for this feature.)

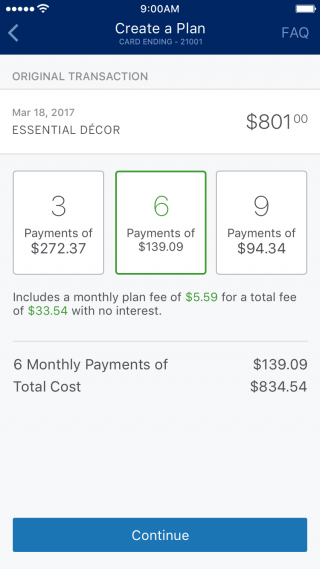

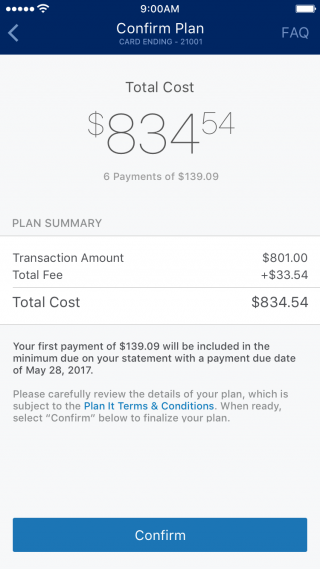

For Plan It® transactions: Click the Plan It icon, then click “Create a Plan.” From there, you can choose from up to three plan options, which can vary by customer. (See images below.) In lieu of interest, you’ll have to pay a small monthly fee which varies based on your credit card's APR. If your card has an APR of 14.99%, for example, you'd pay a monthly fee of up to 0.66% of each purchase. This would generally save you money compared with paying the regular APR. (There is no application requirement for this feature.)

Once you confirm your plan option, your next payment on the plan will be added to your "minimum due" payment on your next bill.

Keep in mind, you can still pay your bill all the usual ways — such as online with autopay or by mailing in a check. This feature just gives you additional options.

What's the catch?

Before you use this feature, you should know that it comes with some limitations:

The feature is not available for all American Express cards. Pay It Plan It® is an option on most of AmEx's consumer credit cards, but it isn't available on AmEx small-business credit cards.

Certain transactions are excluded from Plan It®. Some transactions that aren’t eligible for Plan It® include purchases subject to foreign transaction fees, purchases of cash equivalents (say, cash advances) and fees charged by American Express, such as annual fees on your credit card.

There's a limit on how many Plan It® plans you can have. You can have up to 10 payment plans active at any one time.

There’s a daily limit to how many Pay It® payments you can make. You can make up to five payments per day, including payments from every device, according to American Express. If you want to pay off more than those five purchases in a day, consider making one larger payment instead of several small ones.

American Express has a FAQ page with more specific details.

How it can help

Here's how you can use Pay It Plan It® to your advantage.

Use Plan It® if you’re expecting to incur interest on a major purchase. Plan It® is almost always going to be cheaper than paying interest on a major purchase, despite the monthly fees. If you pay your balance off early, you won’t have to pay future monthly fees. However, if you have an active 0% purchase APR offer, paying down your balances over time without Plan It® would likely be cheaper.

Use Pay It® if you’re trying to keep balances low. If you’re flying too close to your limit, using Pay It® regularly for small purchase amounts — or, alternatively, just making additional payments throughout the billing cycle — can help you keep your balances low. Bringing those balances down could have a positive effect on your credit score.

Images courtesy of American Express.

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.