How to Read a Mortgage Closing Disclosure

The Closing Disclosure gives the final terms and costs of a mortgage as you near the financing finish line.

Some or all of the mortgage lenders featured on our site are advertising partners of NerdWallet, but this does not influence our evaluations, lender star ratings or the order in which lenders are listed on the page. Our opinions are our own. Here is a list of our partners.

A few days before you're scheduled to close on a mortgage, the lender will provide a Closing Disclosure. Review this document carefully and ask questions if there's anything that you don't understand.

What is a Closing Disclosure?

The Closing Disclosure is a five-page form that spells out the final terms and closing costs of a home loan.

Your lender must provide the Closing Disclosure at least three business days before the scheduled loan closing. This gives you time to review everything and ask questions before signing forms at the closing table.

Reviewing the Closing Disclosure

Go through the Closing Disclosure line by line. Compare the information on the Closing Disclosure with that on the Loan Estimate — the document the lender provided shortly after you applied for the mortgage.

The Loan Estimate is a document that gives estimated costs of a home loan. You should receive a Loan Estimate from the lender within three business days of applying for a mortgage.

If any information looks different from what you expected, contact the lender or settlement agent right away.

The first page of the Closing Disclosure gives the loan amount, interest rate, closing costs and the amount of cash needed at closing. The second page spells out the closing cost details.

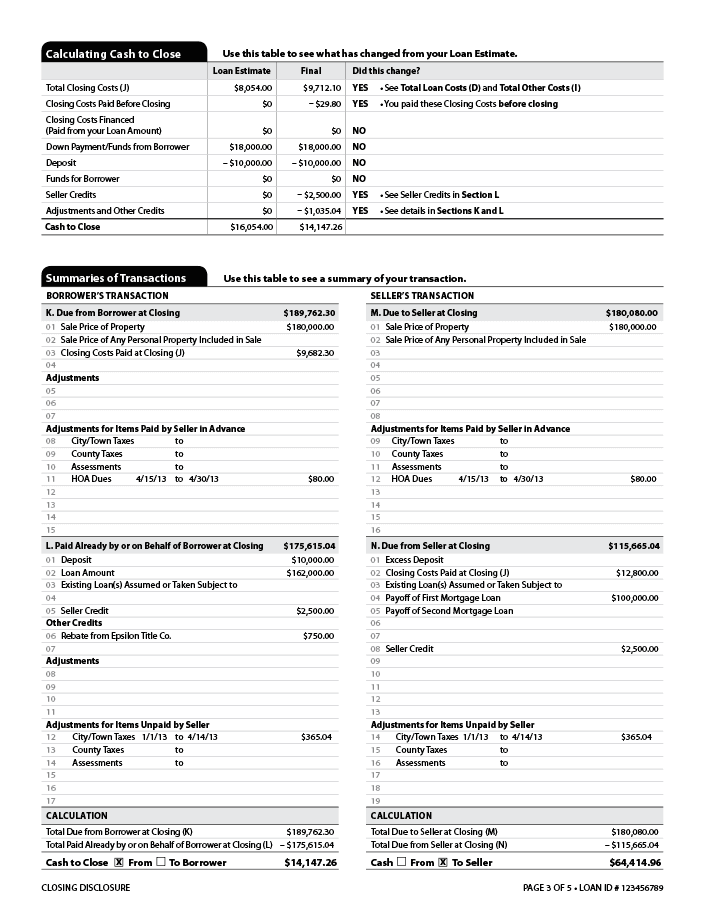

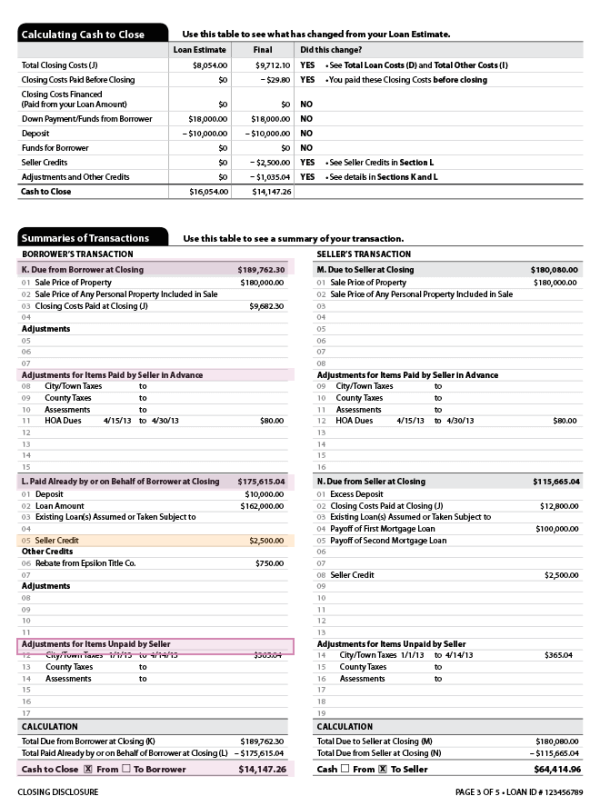

Pay special attention to the third page, which features a comparison table showing the costs as reported by the Loan Estimate and the actual charges to be applied at closing. This section clearly shows whether the costs have changed since receiving your Loan Estimate.

At the bottom is the literal bottom line — the total amount you, as the borrower, will owe at closing. The image below is from a sample Closing Disclosure on the Consumer Financial Protection Bureau's website, where you can click through each page of the form for more detail.

Page 3 of a sample Closing Disclosure on the Consumer Financial Protection Bureau's website

The fourth page shows how the cash-to-close is calculated and the summary of the transaction, and the fifth page provides additional information about the loan, such as escrow account details.

What can cause a 3-day closing delay?

Any substantial revision to the loan’s terms triggers a new three-day review. Minor changes such as modifications to the escrow or adjustments to prorated payments for taxes, utilities and the like don’t qualify.

These three things can reset the 72-hour clock:

The APR increases by more than one-eighth of a percentage point for fixed-rate loans or more than one-quarter of a percentage point for adjustable-rate mortgages.

A prepayment penalty is added to the loan terms.

The loan product changes, such as moving from a fixed-rate to an adjustable-rate loan or to an interest-only mortgage.

Report errors or ask questions ASAP

The Closing Disclosure may look official — and maybe a little intimidating at first. But don't assume the document is correct, advises the Consumer Financial Protection Bureau. Mistakes can happen, which is why it's critical that you review closing documents carefully and contact your lender or settlement agent if anything seems awry.