MaxMyInterest – smart money management for smart savings

Earn up to 5.36%* interest, fully FDIC-insured

OVERVIEW

Take your savings to the Max

HOW IT WORKS

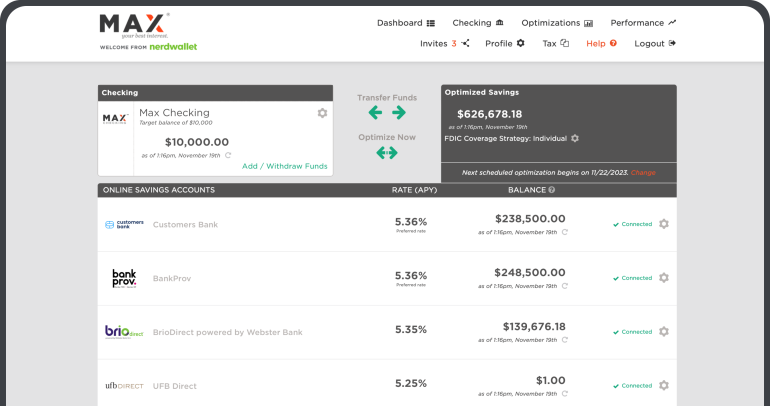

Keep your current bank while earning more with online banks

Fill out one application for all banks

Use the common application to apply once and get access to all MaxMyInterest bank partners.

Smart monthly allocations

Each month, Max helps you allocate your cash to the banks with the highest rates, so you always earn the highest yield, up to 5.36%.*

*current maximum

Simple, flexible, and secure

With Max, you can easily move your cash around to keep your balances below the FDIC insurance limits. Check your balances at any time, all on one screen, and optimize your savings with one click.

TESTIMONIALS

Here’s what our clients say

Very easy to set up. My money feels secure. I feel like I’m getting the best available rate.

Kevin, Minneapolis, MN

Very convenient way to manage cash and earn a high, FDIC insured rate of return.

Gerald, Loomis, CA

Frequently asked questions

What does Max do?

How much can I earn?

Is there a minimum balance required to join Max?

How much does it cost?