How to Survive a Strike

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Screenwriters have been on strike for more than 100 days. In a country where the majority of people live paycheck to paycheck, voluntarily going so long without a steady income requires conviction — and planning.

Similar to a layoff, a worker on strike has to grapple with a loss of income and benefits for an indefinite period. Unlike a layoff, most striking workers can't collect unemployment. The risk of strikers depleting their savings or getting behind on bills has made long strikes, such as the one by the Writers Guild of America, rare.

But strikes have a long history of securing higher wages and better conditions for workers because of their financial impact on the employer. That makes striking a valuable tool for today's workforce, which faces high inflation and concerns over new technology such as artificial intelligence (AI).

If it's possible you'd be part of a strike, start treating it as inevitable. The more savings you can set aside, the better you'll feel about supporting the cause when the time comes.

Leverage your union's strike fund

Once you're on strike, your pay will stop. Unions typically set up a strike fund to help members cope with the loss of income during a strike. Union member dues support the strike fund, and each union has rules about how much members can draw from it.

The United Auto Workers (UAW), representing 150,000 workers at GM, Ford and Stellantis, went on strike just before midnight on Sept. 15 when its contract expired. Currently about 13,000 members are striking at three plant locations. Eligible union members are eligible to receive $100 per weekday from the strike fund, according to the UAW website. UAW strike pay kicks in after the eighth strike day.

Your union may also be equipped to help you keep your health insurance coverage if your employer stops paying its share of premiums. Striking workers can elect to continue their health coverage on their own dime under COBRA, a federal law that temporarily requires employers to extend coverage after employment ends. Some unions help members cover these added costs.

Other health insurance options may be available, as well. For example, the United Steelworkers encourages members who need coverage for serious medical conditions or ongoing care to use COBRA, according to the union's website. Then it enrolls everyone else, including members and their dependents, in the USW Emergency Medical Program, which provides limited insurance coverage.

No union to help? Plan ahead

If you're not part of a formal union, or your union strike fund won't fully replace your income, you'll likely rely on savings to get you through the strike. So now is the time to prepare and be ready.

Most U.S. private sector workers have the right to strike regardless of whether they're part of a union. Nonunionized workers strike for the same reasons unionized workers do. Here's a modern example: Fight for $15, a national campaign started by fast-food workers without a union, organizes strikes to demand a higher minimum wage.

An emergency fund could help you keep up on essential bills while you're out of a paycheck. That includes your rent or mortgage, food and utilities. You may also need to keep up with transportation costs, child care and cell phone service so you can be involved in strike activities. Your emergency fund would ideally contain enough cash to cover basic expenses for three to six months. That can feel like a lot. But starting with a small savings goal is OK because most strikes are short.

In fact, the majority of work stoppages lasted less than five days in 2022, according to the Labor Action Tracker. This annual report, from the Cornell University School of Industrial and Labor Relations, documents strikes and labor protest activity across the United States.

As you prepare, research your local laws governing who is eligible for unemployment benefits. While rare, some states allow striking workers to collect unemployment, depending on the circumstances.

In New York, for example, striking workers can begin collecting unemployment if the strike lasts longer than 14 days, according to the New York Department of Labor. Other states have exceptions for workers if the employer has violated a collective bargaining agreement or initiated a lockout (when an employer bars employees from the job site until they agree to certain terms).

If you lose health care insurance and don't have options through a union, you could elect to extend your coverage under COBRA or shop for a health care plan using an online marketplace.

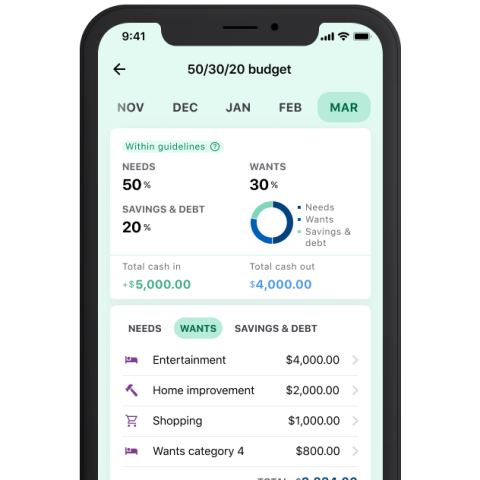

Get control of your personal finances

Regardless of whether you're tapping emergency savings or living off of strike pay, a strike could require you to reconsider your financial priorities, such as:

Cutting back on discretionary spending. Explore cutting streaming services, subscriptions, memberships and other expenses you can live without. It's understandable if you want to keep one or two little indulgences. But make sure it's something you really use.

Finding new ways to get paid. Sell stuff you don't need. Pick up a seasonal job or find an app-based gig. Your days could be filled with picketing, but working a few hours on the side could be enough to pay some bills.

Seeking community assistance. Spend some time researching community resources that could help you stay afloat. Some community organizations can help with bills, or accessing food and mental health services. If you need a place to start, visit 211.org.

Paying the minimum. With interest rates as high as they are, it's not a good time to go into credit card debt. But when your cash flow is severely restricted, using a credit card to buy necessities may be your best option. At the very least, make minimum payments, since not making any could damage your credit score.

Juggling bills as a last resort. If you are struggling to pay utility bills, call your provider's customer service line. You may be able to start a payment plan or otherwise adjust what you owe. Online resources can also help you determine how much time you have on each bill before facing the consequences of nonpayments.

Share resources with other strikers

When on strike, surrounding yourself with other strikers could help you stay motivated and save money. For instance, carpooling, grocery shopping together so you can buy in bulk, or exchanging child care are all practical methods to cut costs. The beauty of collective action is that you're not alone.

Photo by Mario Tama/ Getty Images