Priceline: Everything You Need To Know

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Priceline.com is an online travel agency known for its discount rates on travel purchases including hotels, airfare, rental cars and cruises — oh, and maybe those William Shatner ads.

Priceline claims that it saves customers more than $1 billion every year through its many deal campaigns, which include Express Deals, Tonight-Only Deals and Pricebreakers. Priceline VIP loyalty members can get even more discounts.

But have Priceline deals really gone where no man (or online travel agency) has gone before? Here’s what you need to know about booking with and saving money through Priceline.

How does Priceline work?

Priceline is a part of the world’s largest travel company, Booking Holdings, which also operates other big travel players including Kayak, Rentalcars.com and OpenTable.

Accessible via priceline.com or its mobile app, Priceline delivers personalized recommendations for travelers, including nontraditional accommodations like private homes, boats and yurts. Travelers can bundle lodging, flights and rental cars together in one transaction — and often for a deal.

» Learn more: Pros and cons of booking hotels with Priceline

You enter in your dates and destination, and Priceline lists flights, hotels, and rental cars that can get you there. As an OTA, Priceline facilitates the booking. Meanwhile, the actual travel services are provided by someone else — whether it’s a massive hotel chain or a small, family-owned bed and breakfast.

Priceline offers fairly robust booking tools, especially for travelers who like to book all their trip components — flight, hotel and rental car — in one go, rather than separately.

Priceline’s Trip Builder platform lets users bundle those purchases together into one transaction, while also unlocking privately negotiated rates that are otherwise unavailable. Priceline claims its bundled deals save travelers an average of $240 per transaction.

And the Trip Builder tool is fairly flexible. Bundling features on other websites can be limiting. Sometimes, they force you to book a flight (even if you would have preferred a road trip), or don’t allow for stopovers in multiple cities.

In contrast, Trip Builder accounts for individual travel circumstances and removes many restrictions found elsewhere. Your trip can include a mix of stays between private homes and hotels. You can also opt to bundle a trip that doesn’t involve a flight.

» Learn more: Plan your next redemption with our airline points tool

Priceline deals

Priceline's most famous deal, Name Your Own Price, has been retired. The Name Your Own Price deal was a bidding tool where you could negotiate hotel rates up to 60% off retail, and airfare up to 40% off retail rates.

There are still plenty of other Priceline promos to be had.

Express Deals

Express Deals launched in 2012 with a promise to offer the same savings as bidding, but with an instant-booking component. Perhaps the most standout aspect of Express Deals: You don’t know the actual name of the hotel or flight when you book, but it could save you as much as 50%.

With the flight version of the Express Deals function, you won’t receive your exact departure and arrival times until after you purchase tickets. Instead, you’re given only an approximate arrival or departure time, such as in the early morning.

Ahead of booking hotels through Express Deals, you get some information, such as star rating, customer rating, the neighborhood and the amenities. The actual hotel is revealed only once the booking is made.

There are a few tricks for how to uncover the identity of your Priceline hotels before purchasing. But ultimately, it can often turn out to be exactly what it’s advertised as — a mystery until after you buy.

Pricebreakers

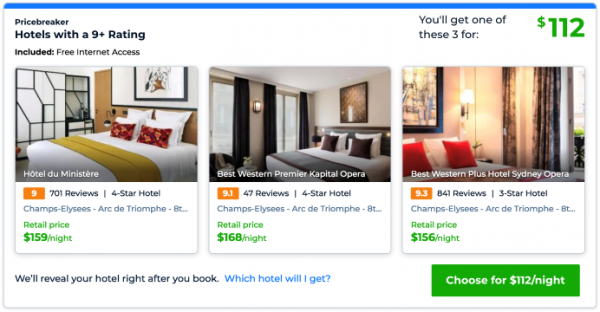

If you like having a somewhat better idea of the hotel you’ll get but still like the gamble, turn to the Pricebreakers deal, which launched in 2020. Consider it a bit of hotel roulette, but this time, you get one of three known options.

With Pricebreakers, three separate (but similar) hotels are displayed, each listed under a single price. Upon booking that Pricebreakers deal, you’ll get a reservation for one of those specific hotels — though the exact one is chosen by Priceline.

Priceline promises that every hotel booked through Pricebreakers has a customer rating above 7 out of 10 and is offered at up to half off published rates you can find elsewhere.

» Learn more: The quick-start guide to points and miles travel

Tonight-Only Deals

Available only through its app, the Tonight-Only Deals promotion offers last-minute hotel deals in most major cities including Atlanta, Boston, Chicago, Dallas, Denver, Honolulu, Houston, Las Vegas, Los Angeles, Miami, New Orleans, New York, Phoenix, San Antonio, San Diego and San Francisco.

With Tonight-Only Deals, Priceline’s app displays 3-star and 4-star hotel rooms that can be booked for check-in that same night (with a maximum four-night stay) at discounts of up to 35% off published prices found elsewhere. Room reservations can be instantly booked up until 11 p.m. local time, or until they sell out.

Recurring annual sales

Like many travel booking sites, Priceline also runs periodic sales during certain times of year. Cyber Monday and Black Friday are big deal-nabbing opportunities on Priceline.

For example, during the 2021 Black Friday weekend, 2,000 lucky customers received a coupon code that offered 99% off Express Deal hotels. For everyone else, Priceline sent out Black Friday coupons for up to an additional 30% off of Express Deals on top of everyday savings of up to 60% off.

Priceline VIP loyalty program

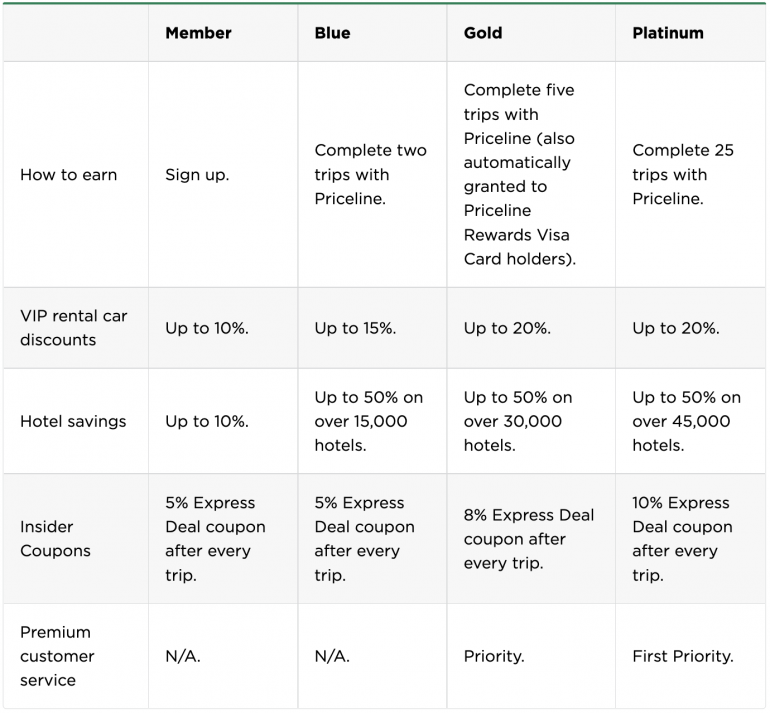

All those deals aren’t the only way you can save when booking with Priceline. Priceline VIP is the OTA’s loyalty program that includes access to extra discounts, coupons, premium customer service and more.

There are four tiers of elite status in the Priceline VIP program: Member, Blue, Gold and Platinum. Joining the program is free — you just have to create an account with Priceline.

Here’s how to earn Priceline elite status, and what each tier entails:

Member | Blue | Gold | Platinum | |

|---|---|---|---|---|

How to earn | Sign up. | Complete two trips with Priceline. | Complete five trips with Priceline (also automatically granted to Priceline Rewards Visa Card holders). | Complete 25 trips with Priceline. |

VIP rental car discounts | Up to 10%. | Up to 15%. | Up to 20%. | Up to 20%. |

Hotel savings | Up to 10%. | Up to 50% on over 15,000 hotels. | Up to 50% on over 30,000 hotels. | Up to 50% on over 45,000 hotels. |

Insider Coupons | 5% Express Deal coupon after every trip. | 5% Express Deal coupon after every trip. | 8% Express Deal coupon after every trip. | 10% Express Deal coupon after every trip. |

Premium customer service | N/A. | N/A. | Priority. | First Priority. |

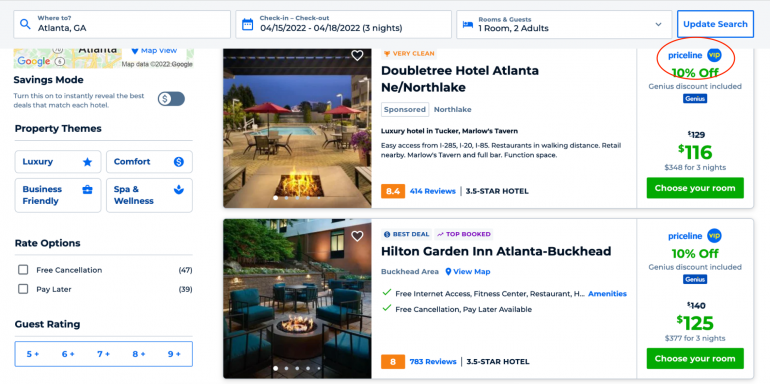

Unlike other elite status programs, there are no special seat upgrades or free goodies like Champagne in your hotel room with Priceline VIP. But for no-frills travelers who value saving money over amenities, the discounts might be the most valuable perk anyway. Properties eligible for VIP discounts are designated by a Priceline VIP logo in the search results.

Look for this Priceline VIP logo on listings to indicate extra discounts for members.

Something that sets Priceline VIP apart from other loyalty programs is that your Priceline elite status does not expire. Instead, you keep your same tier level from year to year until you advance.

To reach the next level, though, you’ll have to have completed new qualifying trips after Jan. 1 of that year (so trips completed in previous years do not count toward earning elite status).

» Learn more: How do hotel points work?

The best credit cards for Priceline bookings

You can earn bonus points and perks when booking with certain travel credit cards that pair well with online travel agencies, like Expedia, Hotels.com or Priceline. Here are the best cards specifically for Priceline users:

Priceline VIP Rewards™ Visa® Card

While not necessarily the best credit card to use for general everyday spending, the Priceline VIP Rewards™ Visa® Card is one of the best cards to use for purchases on Priceline itself. It earns 5 points for every $1 spent on purchases, bookings and reservations made at Priceline. It also earns 2 points on restaurant and gas purchases, and 1 point for everything else.

Priceline points are worth 1 cent, so you’re looking at a 5% return for all your Priceline purchases on this card. What’s also nice is that you can redeem your rewards as statement credits, so you’re not necessarily suckered into earning points in a loyalty program you might not regularly use.

Other benefits of card ownership include automatic Priceline VIP Gold status. And if you spend $10,000 on the card within each card membership year, you’re eligible to receive a statement credit for the $100 Global Entry application fee or the $78 TSA PreCheck application fee.

Considering the Priceline VIP Rewards™ Visa® Card has a $0 annual fee, it’s hard to be too harsh on this card. Plus, the extra benefits can be quite a money-saver.

This card is convenient not just for spending on Priceline, but all sorts of travel purchases.

For all your non-Priceline bookings, use this card to earn 5 points per dollar on travel booked through Chase. You’ll also earn 3 points per dollar on dining at restaurants, streaming services and online grocery purchases; 2 points per dollar on other travel spending (including online travel websites like Expedia); and 1 point per dollar spent on everything else.

The card, which has an annual fee of $95, also features an introductory offer: Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

» Learn more: Review of the Chase Sapphire Preferred® Card

Canceling travel booked on Priceline

Priceline has an abundance of deals, particularly for travelers who are flexible about where they stay and when they travel. But for all the delights of booking on Priceline, there are pitfalls too — and cancellations rank among the biggest.

Many of the deepest discounts cannot be changed or canceled, period. That includes Express Deals (the deals where the full itinerary is revealed only after you book), which are non-changeable and nonrefundable.

For other bookings outside of Priceline’s mystery deals, change and cancellation policies vary. Often, whether your travel can be refunded is up to the provider’s policy, not Priceline’s. A basic economy flight might not qualify for a refund, but an upgraded ticket might.

And in some cases, you might be able to change your reservation — but only for a fee. Again, fees vary by provider, but can be reviewed within your online itinerary.

How to cancel a Priceline booking

If your reservation is eligible for cancellation, you can use Priceline’s self-service cancellation tool. From a logged-in Priceline account, click the My Trips button and select View/Cancel Itinerary next to the reservation you want to cancel.

Be sure to read the individual policy for each cancellation, as they can vary in terms of how much money you’ll actually get back.

You can also cancel flights by calling Priceline’s Customer Care number at 800-774-2354.

How to contact Priceline

Use the Priceline Help Center for help with situations like changing and canceling your trip, getting a refund or filing a complaint. If you’re unable to get help from Priceline’s self-service tools, there are a few other ways to get in touch with support:

Text Priceline’s customer care team at 33296.

Launch Priceline’s chatbot on the Help Center.

Call and speak to a human. Priceline’s general contact number is 877-477-5807.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-5x

Points60,000

Pointson Chase's website

1.5%-5%

CashbackUp to $300

2x-5x

Miles75,000

Miles