What’s Your Money Personality? Take Our Quiz to Find Out

There are four common money approaches: worship, avoidance, vigilance and status.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Recognizing your money personality is the first step toward financial health, according to some financial planners, credit counselors and psychologists.

Take our money personality quiz — based on a Kansas State University study led by Dr. Brad Klontz — to help identify your money beliefs.

Researchers identified four common attitudes toward money: Money Worship, Money Avoidance, Money Vigilance and Money Status.

Do you worry about money even though you have a steady income and a healthy retirement fund? You may be “money vigilant.”

Do you believe money can solve all your problems? You could be a “money worshipper.”

Knowing what drives your financial decisions, experts say, can help you reach smart money goals, whether that’s spending less on impulse purchases or saving more for retirement.

“We have these beliefs clunking around in our heads, and for many of us it’s been passed down from our parents,” says Klontz, a financial psychologist and associate professor at Creighton University.

Those internal beliefs are formed by your childhood experiences, the community you grew up in and the habits of those around you.

Money Worship

Money worshippers believe that more money will solve their problems and they can never have enough money. They are more likely to overspend on themselves or others and carry credit card debt. Money worship is the most common belief among Americans, according to research by Klontz.

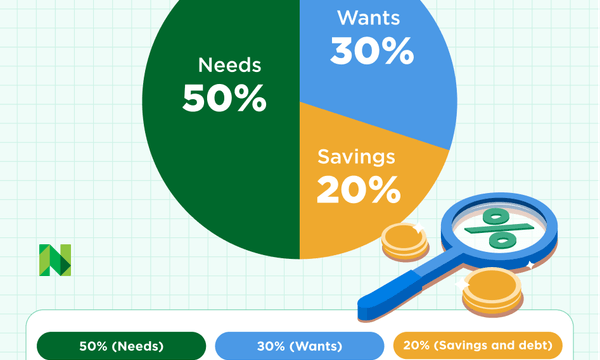

Take action: If you’re a money worshipper, you can take control of your spending by creating a budget and learning about the different ways to pay off credit card debt.

Money Avoidance

Avoiders believe that money is bad and they do not deserve it. They may ignore their finances and avoid thinking about money. They may also give away money to others in order not to have it.

Take action: One option if you’re an avoider is to automate your finances to avoid thinking about them — setting up automatic 401(k) contributions or sending money to a separate savings account, for example. Loved ones can help hold you accountable to those tasks.

Meet MoneyNerd, your weekly news decoder

So much news. So little time. NerdWallet's new weekly newsletter makes sense of the headlines that affect your wallet.

Money Vigilance

Those who are vigilant believe that being frugal and saving is important. They may be secretive about their finances and uncomfortable discussing money with others.

Take action: Secrecy should not stand in the way of better money habits. If you’re uncomfortable talking to family or friends but have money questions, use NerdWallet to find the best savings accounts for an emergency fund, research investment options or get the right credit card to match your spending.

Money Status

People who hold this belief see money as a means to achieving a higher status. They believe self-worth is equal to net worth and may be driven to earn more money than their peers. They may also take risks to make money quickly and buy expensive things.

Take action: If you hold this belief, give yourself a cooling-off period before making a purchase. You can also make a budget — and stick to it — to avoid overspending.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Related articles